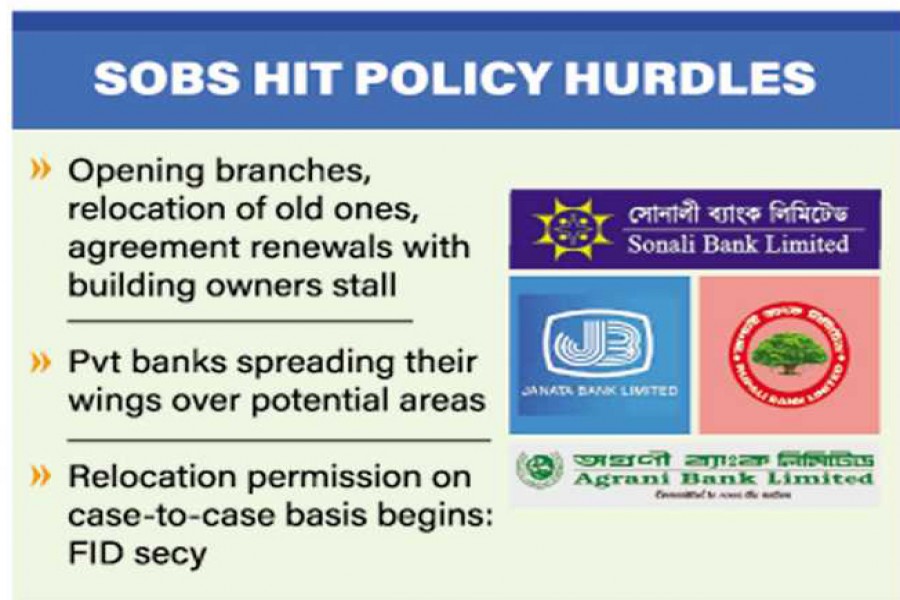

Aspired business expansion of state-owned banks (SoBs) is held back by the introduction of 'dual approval' mandate and a 'go-slow' policy pursued by government authorities, official sources said.

Due to such policy hurdles, the opening of new branches, relocation of existing ones, and extension of agreements with building owners where branches are housed are also being delayed and normal operational activities are hindered, they added.

Usually, the SoBs had relocated and opened new branches with approval from the central bank.

After the virus invaded the country, the Financial Institutions Division (FID) in May last year in a notification asked the SoBs to keep suspended procurement of moveable property, renting office space, and beautification of the branches as part of austerity measures to cope with economic disruptions.

Officials said since the notification was issued, the SoBs need to take permission from the central bank first which later sends the applications to the FID. This diarchy proves "severely time-consuming".

They said following the FID notification the opening of new branches by public-sector banks remained almost suspended while the private-sector banks continuing to spread their wings over areas having business potential.

Even the SoBs are hardly allowed to relocate branches or extend contact with building owners, thus even failing to pay rent, they added.

Managing Director of Sonali Bank Ataur Rahman Prodhan in a recent letter to the FID secretary wrote that in the past they were able to complete works regarding relocation and expansion of branches by taking central bank's approval only. However, the central bank now approves such proposal but tags it with FID concern referring to the notification.

Mr Prodhan wrote that his bank sent proposal to the FID regarding a number of branches but, due to delayed approval, they were failing to relocate branches or furnish new deals with the building owners.

"In some cases, we had to face untoward situation for failing to ink new deals with the building owners, which is creating legal complications," said the bank MD.

"We are obliged to follow government's directives regarding austerity measures during the pandemic period," he wrote, adding that at the same time relocation of branches to lower security-risk places, ensuring customer-friendly environment, and expansion of bank business are also necessary.

Seeking approval for pending applications Mr Prodhan also requested the secretary to exclude the provision of taking mandatory permission from the FID for the branch- relocation and-expansion issues.

FID secretary Sheikh Mohammad Salim Ullah told the FE there are many factors involved in expansion or relocation of SoB branches.

He said relocation of a branch of a public bank is discouraged to places where branches of other state banks have presence.

"However, we are now giving permission on a case-to-case basis taking all the factors into consideration," he added.

Regarding mandatory permission from FID, he said government is the owner of state-run banks, thus the FID needs to keep watch on their activities and business prospects.