Speakers at a webinar Sunday demanded specific imposition of tax on all tobacco products to make it unaffordable for the sake of public health.

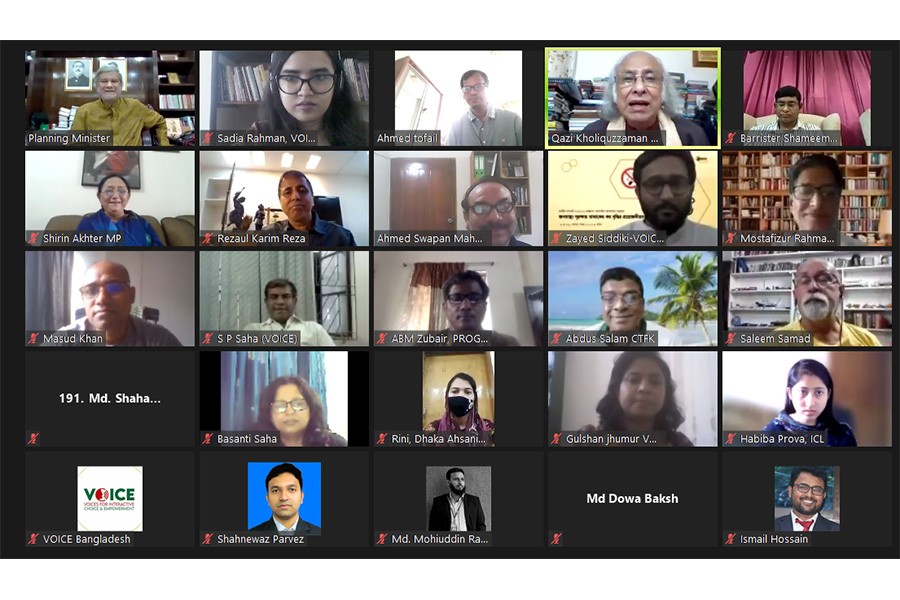

They made the demand at a webinar titled “The necessity of increasing tobacco tax to save public health prior to budget”, organised by human rights and research organisation VOICE.

Planning Minister MA Mannan was the chief guest at the seminar and economist and the Chairman of PKSF Dr Qazi Kholiquzzaman Ahmad attended the programme as the chairperson.

MA Mannan applauded the organisers for arranging the webinar. He made his position clear against tobacco and was optimistic about the imposition of specific tax on tobacco products for the sake of public health.

He asked everyone to be focused on the issue.

Economist Kazi Khaliquzzaman suggested imposing 1.0 per cent additional surcharge to create awareness against tobacco.

“Our prime minister has declared to make our country tobacco free by 2040. But she cannot do everything alone,” he said.

The webinar was moderated by Executive Director of VOICE Ahmed Swapan Mahmud.

Parliament members Aroma Dutta, Shirin Akhter, MP, Ashim Kumar Ukil, MP, Shamim Haider Patwary and and Mustafizur Rahman, Lead Policy Advisor of Campaign for Tobacco free Kids, were the special guests.

Zayed Siddiki, the project coordinator of VOICE, presented a keynote paper.

The presentation focused on the current complicated tobacco tax structure of Bangladesh where different amount of tax is imposed on different tiers.

According to Bangladesh Bureau of Statistics, the per capita income of people in Bangladesh grew by 25.4 per cent in 2017-2018 fiscal year compared to 2015-16.

But the prices of tobacco products remained almost the same or increased insignificantly.

Specially the prices of lower tier cigarettes have remained cheap and affordable that is accelerating tobacco consumption among poor people.

Bangladesh is one of the largest tobacco consuming countries in the world with 35.3 per cent of her grown-up people are addicted to tobacco. Because of the cheaper rate of bidi, cigarette and other tobacco products, it remains extremely challenging to contain the fatality rate.

However, controlling the prices of tobacco by imposing tax has proved to be an effective way to reduce tobacco consumption. This is why a number of suggestions to reform tax structure were raised in the webinar. Around 57 per cent tax is imposed on lower tier cigarette while 65 per cent on the rest by introducing equal amount of tax on all tiers.

It suggested introducing a tiered-specific excise with uniform tax burden where excise share will be 65 per cent of final retail price across all cigarette brands.

In addition, 15 per cent VAT and 1.0 per cent health development surcharge will be applied to the final retail price.

In case of non-filter bidi specific tax should be 45 per cent of the retail price

In case of smokeless tobacco (jarda, gul), specific tax would be 66 per cent of the final retail price.

Parliament Member barrister Shamim Haider Patwary said, “There is no other country in the world that has multi-tiered tax structure imposed on tobaccolike it is in Bangladesh. In fact, this is a fundamental reason we cannot benefit from tax increase in our country.”

Editor-in-chief of TV Today Monjurul Ahsan Bulbul, Executive Director of PROGGA ABM Zubair, Country Coordinator of Road Safety Programme, Global Health Advocacy Incubator Dr Shariful Alam were present at the webinar.