Russia wants Bangladesh to repay in ruble the loans taken for building Rooppur nuclear power plant, sources say, as Moscow introduces its currency as an alternative to the US dollar to skirt western sanctions.

However, Bangladesh wouldn't like to pay back the debts in the Russian currency due to complex procedures and conversion-risk factors, officials said Monday.

Bangladesh government has halted loan repayment to Russia following the sanctions imposed by the United States and European Union over the Russian war against Ukraine.

"Bangladesh had been repaying the loans on the disbursed amounts since FY2017. But it has suspended the repayment since July 2021. To date, two installments have not been paid. Now the third installment has also been due," says a senior Ministry of Finance (MoF) official.

Recently, Moscow called Dhaka for repaying the loans in ruble as they had already disbursed the amount for Bangladesh's Rooppur nuclear power-plant (RNPP) project, he adds.

Bangladesh repays outstanding loans to Russia on a half-yearly basis. Two installments for July-December 2021 and January-June period in 2022 calendar year were not paid.

Another installment is knocking at the door as its deadline will expire in December this calendar year, according to the MoF official.

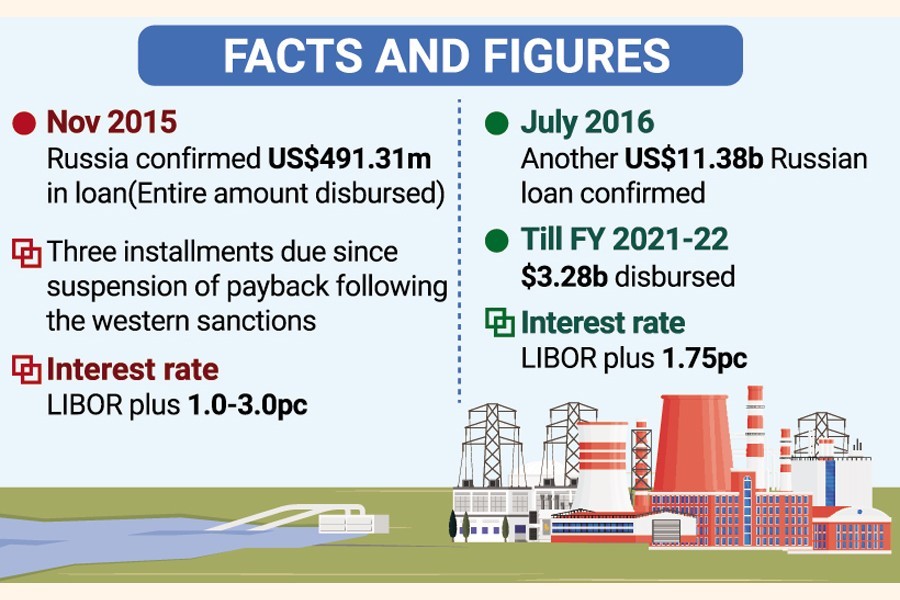

Russia in November 2015 confirmed US$491.31 million worth of loan for the preparatory works of the power plant. The entire amount has already been disbursed to Dhaka.

Official data with ERD showed Bangladesh had repaid the lion's share of the loan with interest and principal for this tranche of the borrowings for the country's maiden nuclear-power plant.

The interest on the loan was charged at LIBOR plus 1.0-3.0 per cent, payable in 10 years with a grace period of 5 years.

According to the Economic Relations Division (ERD), Moscow later in July 2016 confirmed another US$11.38 billion in loans for Bangladesh to construct the 2400-megawatt nuclear plant at Rooppur in Pabna.

Out of the $11.38 billion, Russia till last fiscal year (FY 2021-22) had released $3.28 billion for funding the power plant.

"For the $11.38-billion loan, we have already started payment of the principal amount only against the disbursed amount as the grace period will end in FY2026. Then both the principal and interest will have to be repaid at an interest rate of LIBOR plus 1.75 per cent," says a senior ERD official.

When asked, a science and technology ministry official said since the global payment system with Russia is suspended due to the Ukraine war, Bangladesh is not being able to repay the loans over the years.

"We are scrutinising the Russian proposal for paying back their loans in ruble. But since Bangladesh has not adequate Russian currency in reserve, it will be difficult for us. If we go for buying ruble from the open market, then we have to purchase through USD, which is not possible at this moment due to conversion risks," he notes about the current currency conundrum facing the entire world.

"Now we are discussing with our counterpart Russian lender any further possible available mechanism for the repayment of the outstanding loans," the ministry official says.

Another MoF official said: "Like other countries, Bangladesh has also been struggling with dollar crisis amid shrinking foreign-exchange reserves. So, it is not possible at this moment to go for purchasing ruble to repay the Russian loan."

Seven months ago in February 2022, Russia evaded Ukraine in a 'special operation' reportedly to forestall NATO expansion. In retaliation the US and the EU sanctioned Russia.

Major Russian banks have been removed from the international financial messaging system Swift, which delays payments to Russia for its oil and gas exports and for repayment of its investments against different projects across the globe.

The US has barred Russia from making debt payments using the $600million it holds in US banks, making it harder for Russia to repay its international loans.

Russia's central bank assets have been frozen, to stop it using the $630 billion (£470 billion) of reserves it has in foreign currencies.

The western measures prompted Russia as well as its ally China to try to push their currencies-ruble and RMB-as alternative international trading currencies and also go for currency swaps with trading partners.