Bangladesh's digital and paperless banking has boomed as the number of ATMs, POSs, CDMs, and CRMs has swelled significantly across the country over the last couple of years, insiders said on Friday.

Bankers said the Covid-19 pandemic and addition of young customers had facilitated the digital banking growth across the country, including the rural areas, as the people were avoiding visits to branches for their safety.

The paperless banking has expanded at a higher rate in the rural areas compared to the urban areas, the financial analysts said.

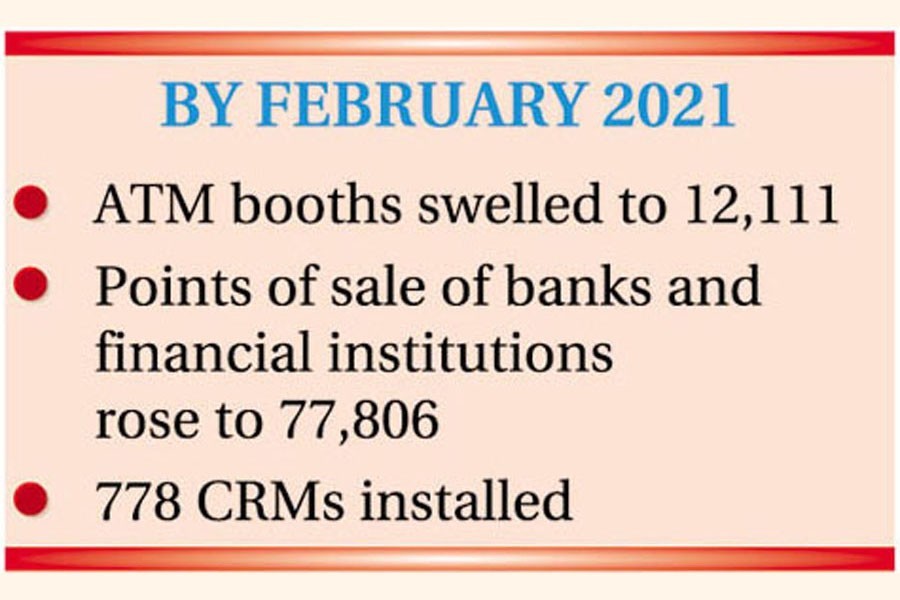

The FE analysis has found that the number of ATM (automated-teller machine) booths swelled to 12,111 in February this year, posting a 10 per cent growth compared to a year ago.

In February 2020, the total number of the ATMs of the commercial banks and financial institution was 11,002, showed the Bangladesh Bank (BB) data.

Two years ago, in February 2019, the number of ATM booths was 10,398.

The analysis has also found that the number of ATM booths in rural areas till February 2021 was 3,582, which is 30 per cent of the total 12,111 booths across the country.

The central bank data showed that the cash transfer at the points of sale (POSs) of the banks and financial institutions had also swelled significantly to 77,806 in February this year, maintaining a 21 per cent growth compared to the same period last year.

POS is a system which is operated by a machine in the shops to tap the banks/financial institutions' debit or credit card for transferring money to make payment for shopping.

In February last year, the number of POSs across the country was 64,339, and two years back, in February 2019, it was recorded at 49,106.

The POSs in the rural areas also rose, as till February this year their number reached 6,518.

A year ago, in February 2020, the POSs in the rural areas were 4,584, and two years ago, in February 2019, the figure was 1,232, the central bank statistics showed.

The Bangladeshi commercial banks also set up 1,574 CDMs (cash deposit machines) across the country till February 2021, BB said.

During the same period last year, the number of CDMs was 1,408 while it was 1,341 in February 2019.

Similarly, the banks and financial institutions had also installed 778 CRMs (cash recycling machines) till February this year.

A year ago, in February 2020, the number of CRMs was 264 across the country, and two years back, in February 2019, it was recorded at 141 only, the central bank statistics showed.

A senior BB official said since the customers had become familiar with the digital banking system during this long-lasting pandemic, the use of paperless banking tools had significantly increased over the last couple of years.

The central bank had also instructed the commercial banks and financial institutions to install the ATMs, CDMs, CRMs and POSs even in the rural areas along with the urban segments for improving the country's digital banking activities.

Tapoch K Das, chief financial officer (CFO) of the Mercantile Bank Limited, told the FE that the coronavirus pandemic had changed the human behaviour over the last one and a half years prompting the customers to use the paperless banking facilities across the country.

Besides, the banks and financial institutions had also come forward with their e-banking services during this pandemic to avoid gathering in the branches, he added.

Mainly those two reasons had increased the installation of the ATM, CDM, CRM and POS across the country, Mr Das said.

The Mercantile Bank CFO said the customers in the meantime had become familiar with the paperless and digital banking devices which also prompted the installation of those tools by the commercial banks and financial institutions.

Touhidul Alam Khan, additional managing director of the Standard Bank Limited, told the FE that the customers prefer to avoid the bank branches for the money transaction and other activities.

"They are favouring the paperless banking for their safety. Besides, a huge number of young people had been added with the banking system over the last few years resulting in upgradation of the paperless banking across the country," Mr Khan said.

If you visit the rural areas, you can see ATM booths even in the villages, Mr Khan added.