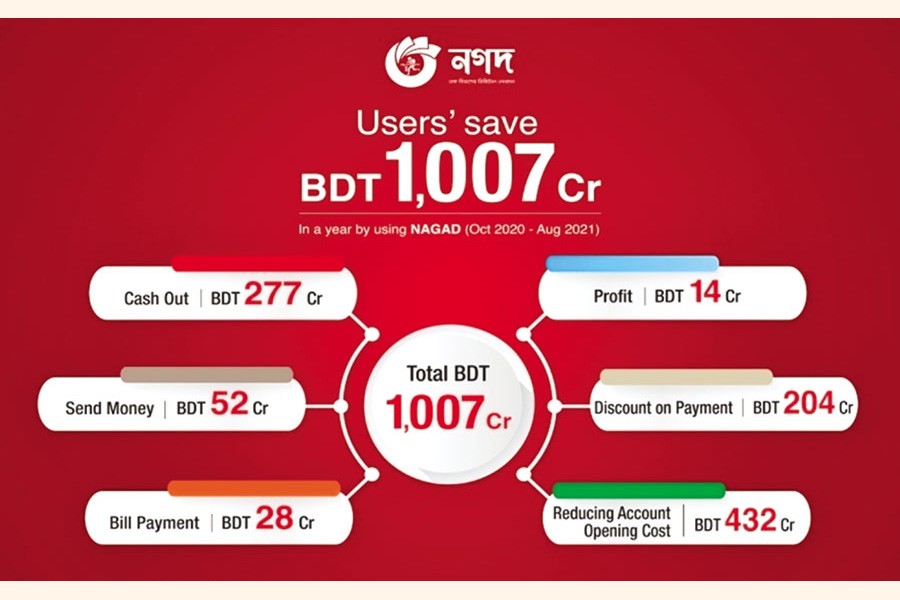

Customers of Nagad have saved and earned more than Tk 10 billion in the past 11 months in various service charges, compared to the amounts charged by other mobile financial service (MFS) operators.

Thus, the Bangladesh Post Office's mobile financial wing says, it has established itself as the most cost-effective MFS for customers for availing any such services.

In the current market, the MFS operators offer various services such as cashout, person-to-person monetary transactions, payment of bills, and interest on savings.

For the cashout service, for example, the charge of Nagad is Tk 11.49 (including VAT) whereas the market standard charges are Tk 18.50 (including VAT).

Nagad explains that out of the amount of cashout its users transacted in the past 11 months (October 2020-August 2021), an amount of Tk 2.77 billion was saved for them.

For 'person to person send money' service, Nagad has zero charges with unlimited number of transactions. Other operators' charges range from Tk 5.0 to Tk 10.

So, Nagad customers have saved Tk 520 million in 'send money' during the given period.

Another major MFS service is payment of various bills, including utility bills, credit card bills, and tuition fees. For Nagad customers, all types of bill payment are completely free of charges. Other operators charge Tk 28 to Tk 45 for such services. Here, Nagad users saved Tk 280 million.

Nagad Managing Director Tanvir A Mishuk has termed such cost-effective service model as a tool to achieve financial inclusion in the economy.

"From the beginning, the goal of Nagad was to bring the marginalised and unbanked people to the structured financing. We've always tried to keep our charges rational. It's a matter of satisfaction that Nagad customers are enjoying the most cost-effective MFS service in the country and can use those saved-up resources to other needs," he says.

Nagad has agreements with a range of companies to provide discount to Nagad users if the payment is made through Nagad wallet. Nagad users have received Tk 2.04 billion worth of discount in various products and services in the past 11 months.

MFS operators not only provide payment services, they also offer savings schemes for customers. The Nagad customers enjoy 6.5 per cent interest on saving schemes and in the existing market, other MFS operators offer 4.6 per cent interest. With 2.0 percentage point leverage, Nagad users have earned a profit worth Tk 140 million during the period.

One of the most important innovations of Nagad is digitisation of MFS registration process with path breaking *167#, the company said. With this, the time and cost of the users declined significantly as previously registration required NID (national identity card) photocopy, two copies of passport size photograph and travel costs to agent points. In the 11 months, Nagad has acquired 25 million customers and due to the automated system they were able to save Tk 4.32 billion.

After its launch on March 26, 2019, Nagad is working to bring an ease in the financial transaction of people on the digital platform. In the past two and a half years, the operator bagged 54 million customers with a daily average transaction of Tk 7.00 billion.