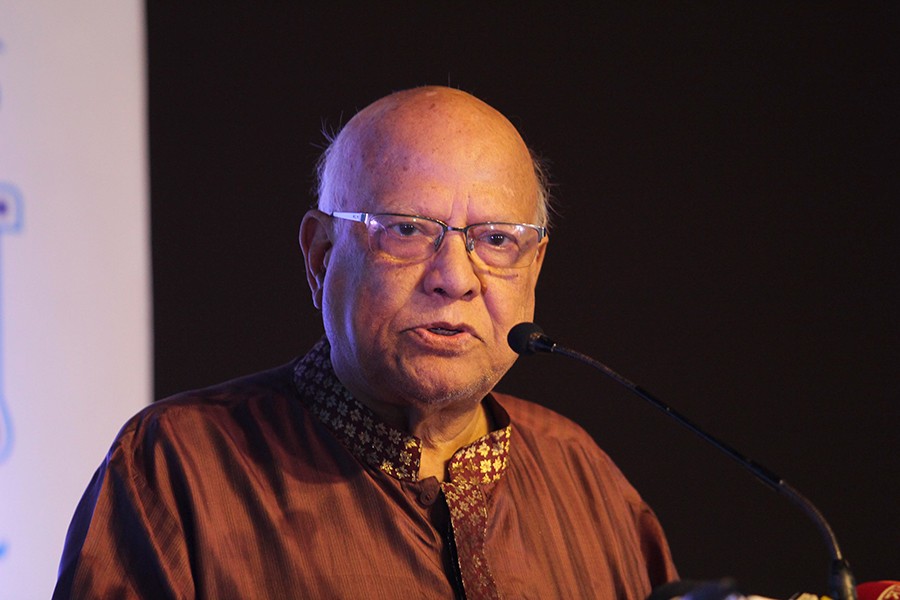

Finance Minister A M A Muhith came down heavily on bankers on Sunday, and blamed their non-co-operative approach for increasing the number of defaulters incessantly.

"I noticed, you people (bankers), after offering one instalment of loan to a party, try to make him a defaulter. You create situation, so that he becomes a defaulter immediately."

Mr Muhith said: "I think it is a weapon you want to use and do use. This is very bad. My advice is, keep yourself away from such philosophy."

The minister said these at the inaugural ceremony of a five-daylong orientation course for directors of the state-owned banks (SoBs) in the capital.

Financial Institutions Division organised the programme with its Secretary Ashadul Islam in the chair.

State Minister for Finance and Planning M A Mannan, Bangladesh Bank Governor Fazle Kabir, and Comptroller and Auditor General of Bangladesh Mohammad Muslim Chowdhury also spoke on the occasion.

The finance minister further said: "Help the borrowers at first, hold their hands. But you do not do that. I am certain about this impression that you never hold hands of entrepreneurs. You need to change you mindset."

He also talked about rescheduling of loans, which takes place for endlessly.

"I don't know what the law suggests about the allowable number of rescheduling. But what is happening here seems to be an unending process. The number of allowable rescheduling needs to be fixed."

The minister identified another thing, winding up troubled business, which needs to be given proper importance.

"In many cases winding up (of a business) is the appropriate solution. (But) this is not considered in most cases.

That means you (bankers) want the entrepreneurs to remain under your control, and reschedule loans again and again."

Mr Muhith said winding up of loans needs to be emphasised. "If a project fails, instead of trying to salvage it, just close it. Ask the entrepreneur for doing new things."

He noted that an impression prevails in the market that Bangladesh's banking sector is very weak. Many try to say that banking sector went out of control, and some consider it as a very week sector, which is not correct.

"These notions exist due to ignorance. Banking sector is not weak at all."

The minister, however, acknowledged the presence of many types of problems in banking sector here. He also said such problems prevail in any banking sector, even in the developed countries, too. "If the problems can be resolved timely, it is alright."

He opined that sometimes a reform initiative needs a long time to be implemented.

"Time-bound plans have to be taken to implement reforms. That will help remove the problems, which arise due to delayed execution of decisions."

Mr Muhith further said capital account convertibility needs to be in place to some extent since the country's foreign exchange reserve has become strong.

"My advice is to allow investment abroad since our economy has already attained a matured position," he added.

The minister also said some people say the number of banks in Bangladesh is more than enough, as there are a total of 63 banks at present, including the state-run ones. This is another criticism about the sector.

"The major criticism is about non-performing loan (NPL), and in this case the entire blame goes to the SoBs. The rate of NPL is very high in the govt banks, while the NPL is non-mentionable in the private sector banks."

But the minister said there are different types of wrongdoings in the private sector banks, where mutual patting of back takes place. Directors of one bank take loan from another bank, and vice versa.

"Controlling the back-patting is very tough. But it needs to be controlled, and we have to find out ways for doing that. Until now we could not find a solution."

He said there was another problem regarding winding up of banks. The problem is solved to some extent, but not at full-scale.

"The provisions of bankruptcy and merger were not in our knowledge. Now law has been enacted (for these). But I think it is weak, and the procedures suggested for salvaging are not appropriate."

"Salvaging doesn't simply mean that the bank has to be saved. Bankruptcy and merger need to be incorporated with salvaging. A reform to this regard will be fantastic," added Mr Muhith.

He requested the bankers to forward to him special ideas by this month, if they have, about salvage operations, particularly for bankruptcy and merger.