Most banks are about to miss the target of lending from the second tranche of recovery stimulus also to cottage, micro, small and medium enterprises (CMSMEs).

Now close to the December deadline to a bifurcated target, the banks are still in dilemmas over lending to new borrowers under the second stimulus package as many a client is unable to repay their current debts, industry-insiders say.

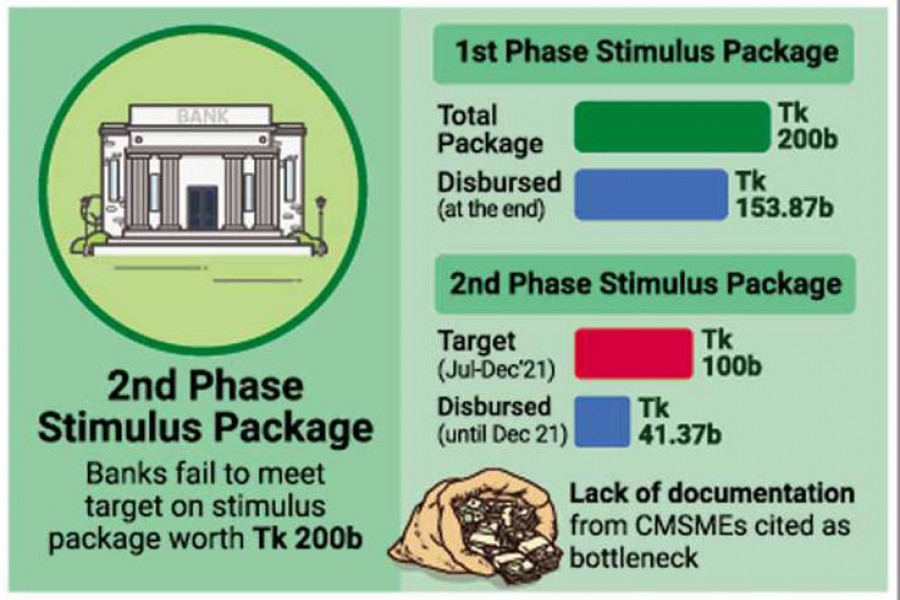

Forty-seven scheduled banks and seven non-banking financial institutions (NBFIs) had disbursed Tk 41.37 billion, nearly 21 per cent of total Tk 200 billion, from the package aid for survival of the CMSMEs until December 21, according to the central bank's latest monitoring report.

Only three banks along with an NBFI could achieve such loan- disbursement target during the period under review, it shows.

The dismal lending scenario came out against 50-per cent disbursement target set by the Bangladesh Bank (BB) for the banks and the NBFIs by this yearend.

Considering first quarter's lower performance, the central bank instructed the banks and NBFIs in October to achieve 50 per cent of the lending target under the package by the first half of the current fiscal year (FY), 2021-22.

The issue will be discussed at an upcoming bankers' meeting scheduled to be held at the central bank headquarters in Dhaka on December 28, according to a BB senior official.

"The central bank may go on hard line against the banks which are missing target continuously under the package," the central banker told the FE on Saturday while replying to a query.

In November 2021, the central bank alerted bankers concerned in Khulna and Rangpur divisions to achieve 50 per cent of the disbursement target under the CMSMEs package by the deadline.

Talking to the FE, Syed Mahbubur Rahman, former chairman of the Association of Bankers, Bangladesh (ABB), said banks' portfolios on CMSMEs are stressed and small.

"Banks had provided loans to their best clients in the first phase of CMSMEs package, but a good number of customers were unable to repay their loans properly," Mr Rahman, also managing director (MD) and chief executive officer (CEO) of Mutual Trust Bank Limited, explained.

In that situation, banks are facing difficulties in selecting fresh clients for sanctioning loans under the package, according to the senior banker.

"In some cases, we cannot provide fresh loans under the package for lack of proper documentation," an executive of a leading private commercial bank told the FE.

Under the package, all types of borrowers will be entitled to enjoy interest subsidy at 5.00 per cent for a period of maximum one year.

During the period, the borrowers will pay the interest rate at 4.00 per cent out of the 9.0 per cent under the package, while the remaining 5.00 per cent will be paid by government as interest subsidy to the banks and NBFIs concerned.

The borrowers who availed assistance from the first phase of the package would not be eligible for the second phase in line with the BB policy.

But loans of the borrowers will be continued in line with the 'bank-customer' relationship, paying 9.0-per cent interest instead of 4.0 per cent earlier, another BB official said.

In the first phase, the banks and NBFIs had disbursed Tk 153.87 billion of the stimulus package until June 30 last, BB data showed.

The disbursed amount was nearly 77 per cent of the total Tk 200-billion funds for the sector.

A total of 97,814 Covid-affected CMSMEs across the country benefited through receiving the low-cost loans under the first tranche of recovery aid.