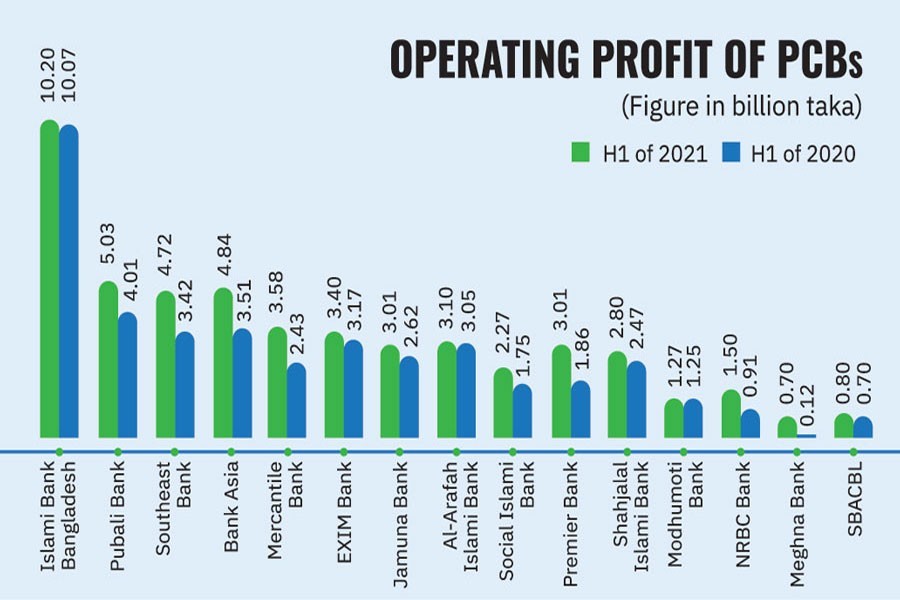

Most of the private commercial banks (PCBs) showed an increased operating profit in the first six months (H1) of this calendar year (2021) despite the extent of overall classified loans in the banking system was on the rising trend, bankers said.

Of the 42 PCBs, the FE obtained provisional data of 15 PCBs that recorded increased operating profits during the period from January to June.

The data of the rest PCBs was not immediately available.

In the final count, the amount of profit would be a little higher or lower, said officials of different commercial banks.

The un-audited operating profit, however, does not reflect the actual financial position of the banks as they have to set aside funds for provisioning bad debts and pay taxes.

The widening trend of interest rate spread has helped the banks to register more operating profit during the period under review compared with the same period of 2020, according to the senior bankers.

The weighted average spread between the lending and deposit rates offered by all the scheduled banks rose to 3.26 per cent in May 2021 from 2.94 per cent in the same period of the last year, according to the central bank's latest statistics.

During the period, the interest rate spread widened as the banks cut their deposit rates deeper than that of the lending rates, the bankers explained.

The weighted average interest rate on deposits fell to 4.14 per cent in May 2021 from 5.24 per cent in the same period of 2020 while such rate on lending came down to 7.40 per cent from 8.18 per cent, the BB data showed.

"Lower cost of funds has pushed up the operating profit of the banks during the period under review," a senior executive of a leading PCB told the FE.

He also said that the banks, which had managed non-performing loans (NPLs) using the BB's relaxed loan classification rules, booked better operating profits during the H1 of 2021.

Meanwhile, the amount of classified loans increased by more than 7.0 per cent to Tk 950.85 billion in the first quarter of 2021 from Tk 887.34 billion in the preceding quarter despite providing policy support by the central bank.

"Upward trend in the capital market has also helped the banks to enhance their operating profits in the first six months of this year," the banker explained.

Between January 01 and June 30 this year, the DSEX, the prime index of the Dhaka Stock Exchange (DSE), rose 748 points or 13.85 per cent to settle at 6,150 on Wednesday.

"The banks were trying to offset the adverse impact of Covid-19 pandemic on their businesses through using the BB's refinancing schemes against the stimulus packages along with the relaxed loan classification rules of the central bank," another senior banker said while replying to a query.

He also said the banks may face more challenges to book similar operating profits by the end of this calendar year if the ongoing Covid-19 pandemic continues.