The ongoing rebound in economic activities may continue in the current fiscal year, guided by continued expansionary monetary and prudent fiscal policies, as per a latest review, which, however, bears a bellwether.

In its reappraisal of the situation the central bank signaled three downside risks in economic activities from both domestic and global fronts in the near future.

The headwinds the Bangladesh Bank (BB) foresees are a sharp rise in global inflation, tightening monetary conditions in global markets, and the threat of Omicron--a new wave of the latest variant of the coronavirus.

"Going forward, the broad-based recovery of economic activities in the first quarter (Q1) of FY'22 is likely to continue in the coming quarters of FY'22, with continued expansionary monetary and prudent fiscal policies backing up," the central bank says in its latest Bangladesh Bank Quarterly (BBQ) for July-September 2021.

However, the three aforementioned headwinds--a sharp rise in global inflation, tightening monetary conditions in global markets, and the threat of Omicron--may pose downside risks in economic activity on both domestic and global fronts, it forewarns.

"Uncertainty is still prevailing on both internal as well as external fronts," a BB senior official told the FE while explaining the economic outlook.

He also says higher imports along with rising trend in private-sector credit growth indicate that the country's economy is recovering gradually on the back of declining Covid-19 infection rates.

"We've challenges, but still at a manageable level," the central banker noted.

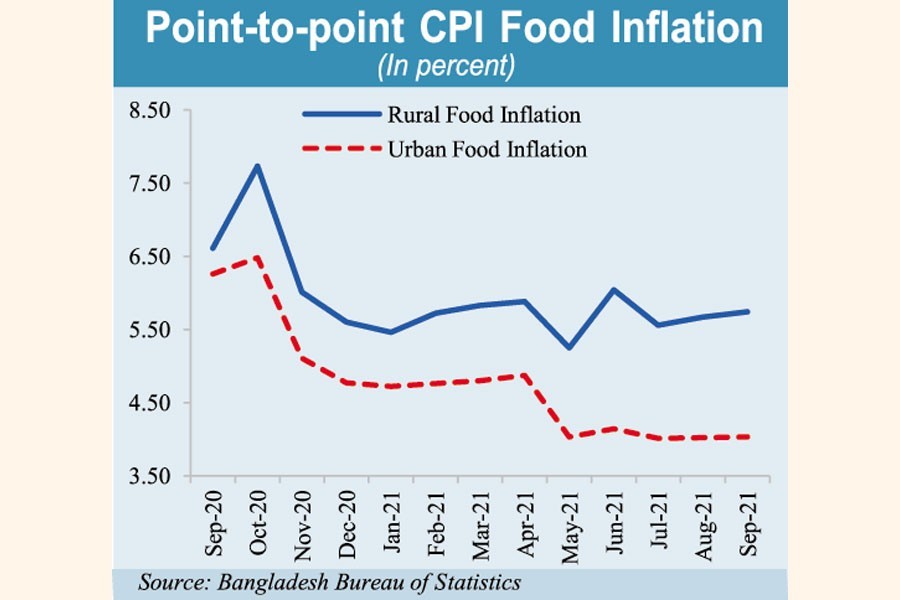

The central bank predicts that headline inflation may pick up in the coming months due to a sharp rise in global energy prices and an upturn in inflation outlook in advanced and emerging-market economies.

"Moreover, supply-side disturbances and the pass-through effect of input cost to output prices on the back of rising domestic demand will remain a concern to the inflation forecast," the BBQ says.

However, supply-side interventions by government along with accommodative monetary policy by the central bank might contain inflation within a tolerable range, it adds.

The latest BB observations came against the backdrop of rising trend in inflationary pressure on the economy in recent months.

The inflation as measured by consumer price index (CPI) rose to 5.70 per cent in October 2021 from 5.53 per cent a month before on a point-to-point basis, according to the latest data of the Bangladesh Bureau of Statistics. It was 5.36 per in July 2021.

"Import planning should be done properly to ensure supply of essential items in the domestic markets smoothly that would help curb inflationary pressure on the economy," Mustafa K. Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), told the FE.

Dr Mujeri, a former chief economist at the BB, also says congenial atmosphere will have to be ensured to encourage entrepreneurs to make fresh investment along with expansionary monetary and fiscal policies for strengthening economic activities across the country.

Talking to the FE, Md. Ahsan Habib, professor and director at Bangladesh Institute of Bank Management (BIBM), urged the policymakers to extend financial support to low-income group as well as micro-and small enterprises to save them from the impact on possible inflationary pressure.

"The government may provide such financial support through announcing separate stimulus package or any other ways," Mr Habib said in reply to a query.

He also said: "Our economy is integrated so we cannot avoid the inflationary pressure."

During the period under review, the overall banking-sector performance exhibited a mixed trend, reflected in a marginal improvement in non-performing loans (NPLs), a moderation in capital-to-risk-weighted asset ratio (CRAR), an increase in the growth of bank advances, a decline in provision maintained against bad loans, a rise in profitability, and maintenance of adequate liquidity, according to the BBQ.

The BB, however, says increased credit to the productive sectors such as cottage, micro, small and medium enterprises (CMSMEs) and the screening of loan for improving NPLs would remain the key challenges in near terms.

"With the reopening of economic activities and economic recovery, it is expected that demand for credit would get further momentum in coming quarters," the BBQ says, adding that currently adequate liquidity exists in the banking system, sufficient enough to absorb credit demand.

Regarding external front, the central bank also predicts that the deficit in current- account balance is likely to widen further, saying that may improve if export earnings continue to rebound on the back of continued global economic recovery in near term.

"With a steep fall in remittance inflows and escalation of import payments for various infrastructure projects of government along with upward trend in global food and oil prices the deficit in current-account balance is likely to increase in the near future," the central bank noted.

Although foreign-exchange-reserve buffer is currently adequate to meet the potential import payments underpinned by strong export earnings together with sizeable financial inflows, downside risks arise from declining remittance inflows and upturn in prices of commodities on the international market, according to the BBQ.

About the GDP (gross domestic product), the central bank says the real GDP rebounded with 5.43-per cent growth in FY'21 from 3.45 per cent in FY'20, and is expected to grow around 7.0 per cent in FY'22 as per recalculated base FY2015-16.