More Bangladeshis are joining the financial system as mobile financial service (MFS) providers have kept onboarding them through easy account-opening processes, lower charges and many other benefits, official records say.

The year 2021 began with 99.3 million MFS account-holders and the number reached 108.1 million as of October, according to the latest data available with the central bank.

The amount transacted through more than a dozen MFS providers was Tk 565.56 billion in December, 2020, but rose to Tk 675.89 billion in October this year.

The mobile money operators have accelerated financial inclusion in Bangladesh as their services have made financial services easily accessible and affordable, said a news release on Tuesday.

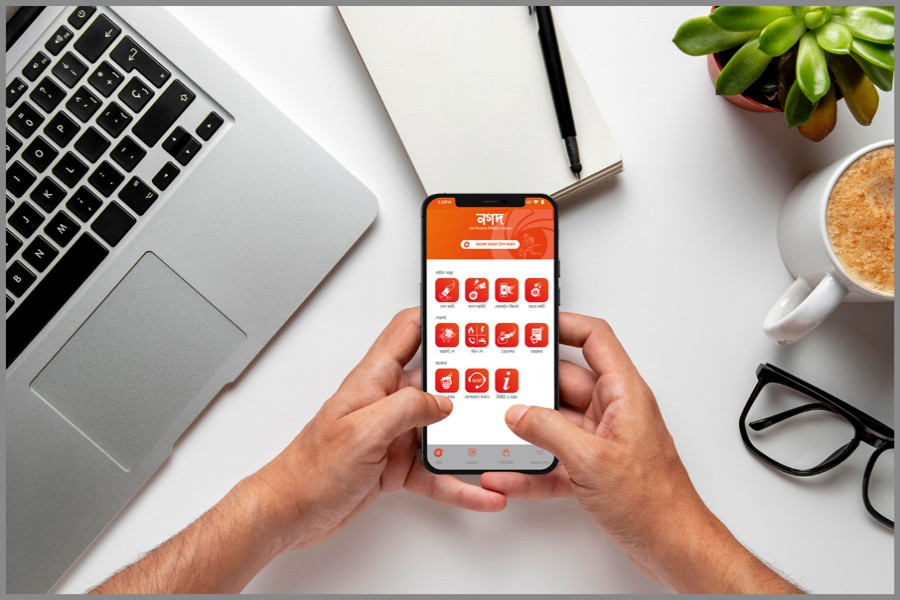

It added that Nagad, the mobile financial arm of the Post office, has played a tremendous role through sustainable innovations and customer-centric services.

Users of Nagad, the disruptive mobile money service carrier, can enjoy the lowest cash-out charge and easy payment service from any part of the country, according to the company.

One of the best innovations of Nagad is said to be the method of opening an account by dialing *167#, which has changed the entire mobile financial sector in the last one year. Because of the innovation, any individual can now connect with the network of Nagad by simply dialing *167# from any mobile phone operator and setting a four-digit PIN, said the release.

Nagad has created 350 million new account-holders in 2021, thanks to the innovative account-opening process, an unprecedented feat for any company in Bangladesh.

Many low-income people use Nagad. Taking into account their financial condition, which has worsened because of the coronavirus pandemic, Nagad has brought down the cash-out charge to Tk 9.99 per Tk 1,000 withdrawal, giving a huge relief to the people, the company said.

Besides, the government’s mobile financial service operator has played an important role in distributing government allowances, including the allowances of the social safety net programmes.

Nagadis said to have played a key role in ensuring transparency in disbursement of allowances among the marginalised beneficiaries.

The government was able to provide allowances to 350 million people, thanks to Nagad. The government has disbursed Tk 5,065 crore under the social safety net programmes in the last financial year through MFS operators. Nagad alone disbursed 75 per cent of the amount.

It has offered up to 16 per cent discount and cash back on 126 brands on the occasion of Victory Day. By using Nagad wallet, customers can avail the offers from more than 2,500 outlets of different brands throughout the country.

“Nagad has brought about revolution to the mobile financial service in the country since its inception,” Nagad Managing Director Tanvir A Mishuk said while narrating its successful journey.

“Nagad became the best mobile financial service in the country three years ago for ensuring digital services for customers and thanks to its customer-friendly, easy and affordable service” he said adding, “We promise that Nagad will amaze everyone with many more new services in the future.”

Nagad, which began its journey in 2019, has 580 million registered customers. Daily transactions through its network hovers around Tk 7.0 billion.

The year 2021 saw the entry of a new MFS provider, Trust Axiata Pay. Trust Bank owns a 51 per cent stake in the company while Axiata Digital Services SdnBhd, Malaysia the rest.

In March this year, upay, a subsidiary of United Commercial Bank, launched its operation aiming to provide mobile financial services to people of all walks of life.

MFS brands of Bangladesh include Rocket, bKash, MYCash, Islami Bank mCash, First Pay SureCash, OK Banking, Rupali Bank SureCash, TeleCash, Islamic Wallet, Spot Cash, and Meghna Bank Tap n Pay.