The law ministry sees no option for payback of defrauded e-commerce customers’ money stuck up after the online businesses concerned went bust.

As a result, insiders say, a cloud of uncertainty looms large over settlement of the prevailing stalemate over repayment of such stuck-up funds to the clients.

"There is no scope to pay back funds of customers of the e-commerce businesses facing cases or failing to supply commodities to their clients as per their agreement," the Ministry of Law is quoted as saying in its opinion.

According to the ministry, such e-commerce platforms have committed crimes upon their failure to provide their customers with goods in accordance with their deal, it adds.

In this regard, the ministry has suggested that authorities concerned should comply with court orders on unfreezing the accounts of payment gateways concerned.

The law ministry made the opinion as sought by commerce ministry according to a special meeting on the troubled e-commerce sector held at the commerce ministry on October 25, 2021 with Commerce Minister Tipu Munshi in the chair.

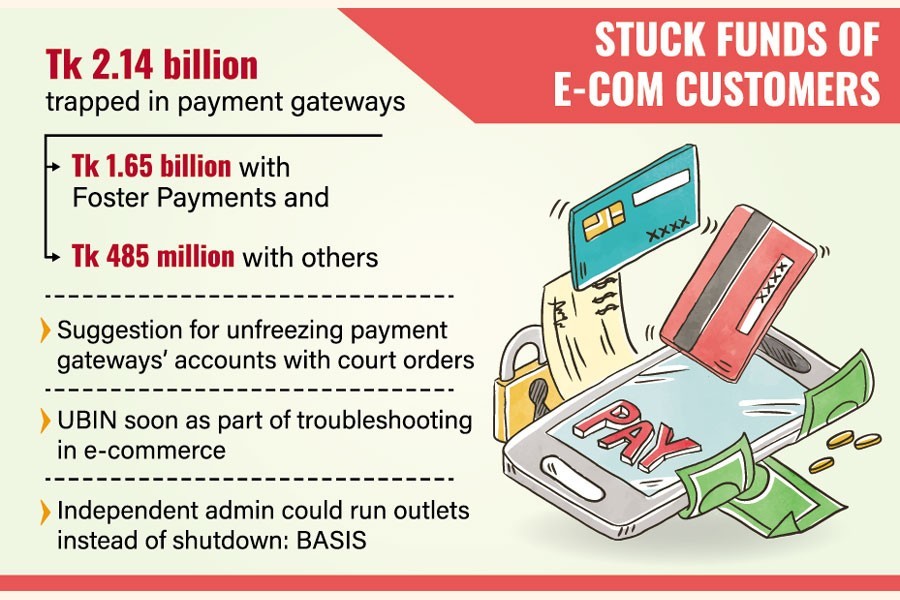

The meeting had decided to take steps to pay back Tk 2.14 billion, stuck in different payment gateways, to e-commerce customers in three months.

Now the payback to the victim e-commerce customers turns uncertain if the law ministry gives the 'no scope' sans court order, a senior e-commerce platform official said.

On December 07, 2021, the commerce ministry sought opinion from the law ministry on legal aspects regarding the repayment.

Currently, over Tk 2.14 billion remains trapped in different payment gateways--this amount was paid in advance by the e-commerce customers against their ordered goods, said a source in the Law and Justice Division.

On November 02, 2021, Bangladesh Bank (BB) requested the commerce ministry to move for the payback. In line with the BB request, the ministry had sought the legal opinion to settle the score.

On June 30, the central bank introduced an escrow service on payments to e-commerce platforms.

Since the issuance of a circular on October 14, 2021 over the botched e-commerce transactions, over Tk 5.05 billion had been paid to the payment gateways by the customers concerned against goods they had ordered. Of the amount, the payment gateways have already settled over Tk 2.91 billion with the online marketplaces.

The remainder, over Tk 2.14 billion, got blocked in the different service-providing firms, including SSL, shurjoMukhi, Foster, bKash, Nagad, and Southeast Bank Ltd.

Of the stuck-up amount, reports say, over Tk 1.65 billion of Qcoom online shopping, paid by its customers against ordered goods, has been stuck up with Foster Payments.

And over Tk 485 million has been stuck in other payment gateways, according to a central bank letter.

Complexities cropped up in payback of the money due to shutdown of operations of such e-commerce platforms concerned, it is mentioned in the central bank letter.

"The e-commerce companies may claim the amount paid to their clients by them if it is proven that they supplied earlier products to the customers concerned," says the letter sent by the Payment Systems Department of BB.

Government agencies concerned are working to pay back the money that was paid in advance by customers from July 01 until October 14, it adds.

The amount of Tk 2.14 billion has been blocked at payment gateways for not delivering goods to customers who paid various platforms for the items, a BB official said.

A recent commerce ministry meeting yielded a positive outcome on refund of online platform Qcoom funds.

Present at the meeting were representatives from the law ministry, the central bank, police and authorities concerned, including Foster.

It has instructed Qcoom and its payment gateway Foster to submit a list of the customers concerned by January 10.

The government authorities concerned have taken multiple steps in the wake of various scandals by dubious e-commerce platforms such as Evaly, E-orange, Dhamaka Shopp-ing, Sirajganj Shop etc.

The cabinet division and the commerce ministry have already formed a high-powered committee to bring discipline in the e-commerce sector and to resolve the problems in the sector.

Top officials of the e-commerce platforms concerned, who are allegedly involved in regularities in the name of online trade with customers, are now in jail.

A process is now at the final stage to introduce unique business identification number (UBIN) in favour of e-commerce platforms soon.

The government has made a move to set up a regulatory authority for the country's e-commerce sector, which, experts say, holds high prospects if not squandered.

Contacted, AHM Shafiquzzaman, chief of Digital Commerce Cell of the commerce ministry, said: "We are expecting to start paying back stuck funds to the e-commerce clients concerned after getting the list from the Qcoom and payment gateway Foster within the current month."

Around 30 e-commerce platforms collected Tk 210 billion from their customers. Of the amount, only Tk 3.87 billion has been deposited into the accounts of such platforms.

Currently, most of the companies' bank accounts have been blocked by the competent authorities.

Experts, however, say if the affected consumers do not get their money back, it will badly affect their confidence level, thus adversely impacting country's emerging e-commerce business.

Talking to the FE, President of Bangladesh Association of Software and Information Services (BASIS) Syed Almas Kabir said confidence of e-commerce consumers had already deteriorated as, after showing a significant rise in 2020, the online transactions already declined in 2021.

He suggests that the government should take necessary steps for restoring client's shaken confidence for the sake of flourishing e-commerce sector in the country.

"For doing so, steps can be taken to strengthen the online consumers' call center like existing state-run '999' so that consumers get their desire services promptly," he says.

When asked, Mr Kabir opinioned that instead of closing down the problem-ridden e-commerce entities, they could have been run through independent administrators so that the affected consumers and merchants can get their money back to some extent.