The insurance density in the country has increased sharply, but its penetration remains stagnant, according to the industry's regulator.

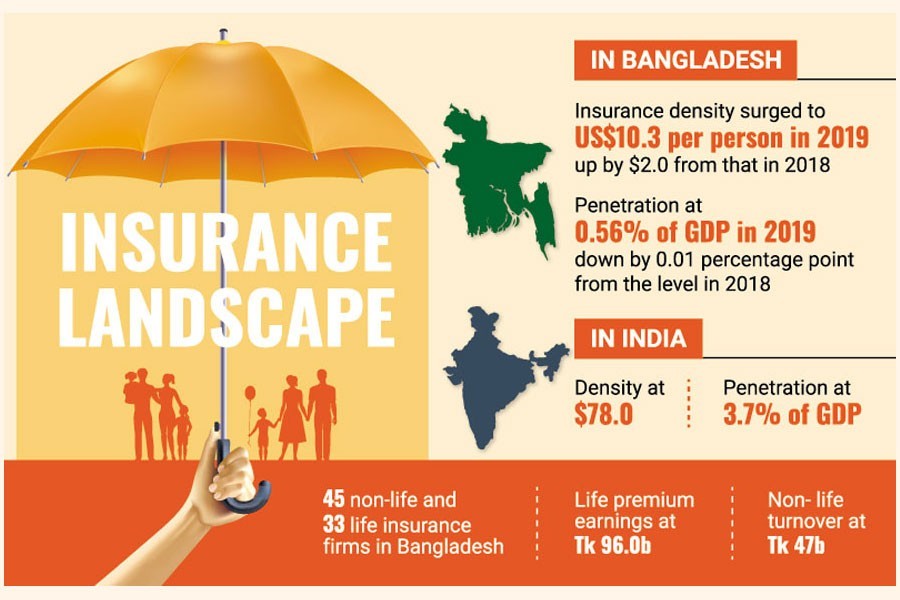

Insurance density has surged to US$10.3 per person (overall) in 2019, up by $2.0 per person in 2018, said Insurance Development and Regulatory Authority (IDRA) data.

In contrast, the penetration stood at 0.56 per cent (overall) of the GDP in 2019, down by 0.01 percentage point from 2018, the IDRA data showed.

The insurance penetration is measured as the percentage of insurance premium to GDP and the density is calculated as the ratio of premium to per person.

The regulatory authority has measured both the key indicators this January by considering official statistics of the premium earrings by local insurers and other macroeconomic indicators.

The insurance penetration and density reflect the level of development of a sector in any country.

The density was buoyed up by increased premium in the non-life insurance sector in 2019.

Insurance penetration, which remained almost the same as the previous year, was lifted more by a higher GDP growth than the insurance growth.

Compared with other neighbouring economies, both the indicators of Bangladesh are much lower.

India has a penetration at 3.7 per cent of the GDP and the density at $78.

Officials at the IDRA insisted that the average size of 'sum assured' has increased in recent years reflecting the rise in density.

They, however, said the introduction of 'bancassurance' in the country may boost both.

Insurance executives said life insurers have been turning towards individual insurance instead of micro-insurance policy resulting in the rise in gross premiums.

Since many large projects in the public sector are being implemented, income from such schemes also helped raise the density, some insurance executives told the FE.

Md Khaled Mamun, managing director and CEO at the non-life insurance firm Reliance Insurance Company told the FE the overall density has increased due to the large projects undertaken by the government.

"In my view, a large number of mega projects are being implemented in the country, which lead to the rise in overall premium earnings," Mr Mamun said.

He also said both density and penetration might have declined in 2020 due to the pandemic.

"I am not sure … but both non-life and life insurance businesses were impacted by the ongoing pandemic," the CEO said referring to the general shutdown from March 26 to May 30 last year amid the pandemic.

MM Monirul Alam Tapan, a former managing director and CEO at privately-owned life insurance company, Guardian Life, told the FE: "All firms are now concentrating on the normal individual insurance policies. It is boosting the premium earnings".

He said many clients are also opting for large-sized policies amounting to Tk. 10 to Tk. 20 million.

Narayan Chandra Rudra, CEO of Meghna Life Insurance Company, said that some regulatory measures have been eased in recent years, which have facilitated premium earnings.

He said the reinsurance firms abroad also encourage large 'sum assured.'

"We can now take an individual insurance up to Tk 7.0 million without obtaining the re-insurer's prior approval", he noted.

Bangladesh has 45 non-life insurance firms and 33 life insurance companies.

Life premium earnings are around Tk 96.0 billion while non- life sector's turnover is around Tk 47 billion.