Bangladesh's automobile industry is set to get a boost with the beginning of production of Hyundai passenger vehicles in a local assembling plant, which is also expected to further cut car imports.

Sources say two popular brands of motorcars of the Korean automobile giant -- Creta and Alcazer -- will be manufactured from next month in the US$ 100-million assembling plant set up by Fair Group at the Bangabandhu Hi-Tech Park in Gazipur.

Officials of the Fair Group, which has tied up with Hyundai, told the Financial Express that they were planning to manufacture 200 units of vehicles in the first lot of production.

The six-acre plant has a capacity to make 4,000 units annually, but if need be, it can be enhanced to 5,000 units.

The Fair Group of industries has also been assembling mobile phones of another iconic Korean group - Samsung - for the last three years, helping reduce import-dependence of this electronics sector.

The officials also said success of the Samsung phone assembling encouraged them to tie up with the Korean automobile giant to assemble their four-wheeler brands.

Managing Director of Fair Technology Ruhul Alam Al Mahbub says the company is using Hyundai's technology and expertise and will ensure that Hyundai's world-class cars can be enjoyed at affordable prices by Bangladeshi customers.

Narrating their business plan, the company officials stated that they would bank on price advantage and brand value as the locally assembled Hyundai automobiles would be much cheaper than the imported ones.

For example, one unit of latest model of Creta currently sells at Tk 4.7 million, but the locally assembled ones would sell at around Tk 4.0 million each.

So, the customers would get huge price advantage for the same-quality automobiles, Asfaq Ovee, a senior official of the company, told the FE.

On the other hand, one unit of the imported Alcazer sells at around Tk 5.0 million, but the local manufactures might be available for Tk 4.5 million each.

"We think that due to the price advantage, customers will prefer locally assembled vehicles of Hyundai brand instead of its imported ones."

Moreover, the banks prefer brand-new cars to reconditioned cars in sanctioning loans to customers, he notes about car-financing advantage.

Economists also hail the assembling of four-wheelers in the country, as it would save huge foreign exchange, especially at a time when the dollar price is skyrocketing.

Encouraged by the latest automobile policy, a number of foreign brands have rolled out plans to start automobile assembling in Bangladesh in collaboration with local partners.

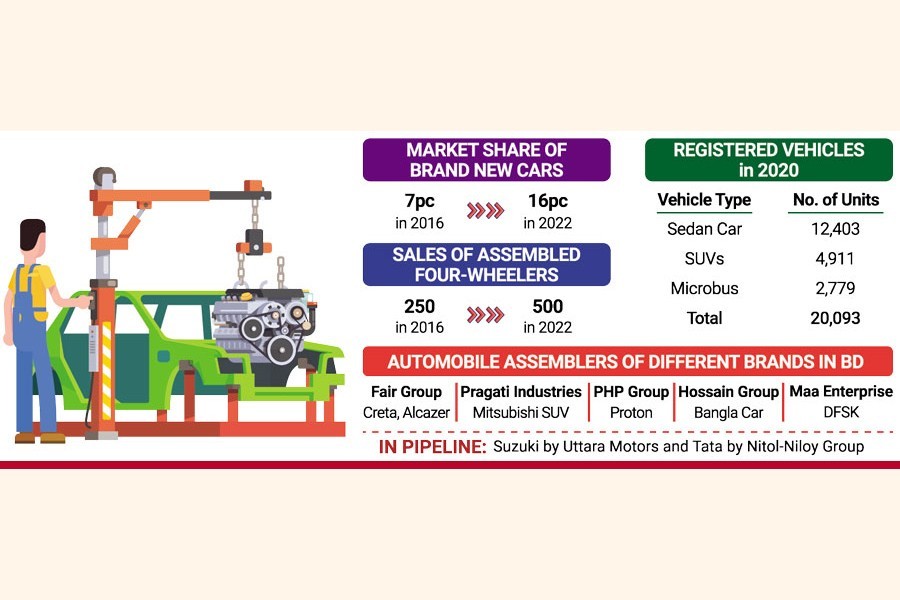

Presently, Mitsubishi SUV is being assembled by the state-owned Pragoti Industries, Malaysian-brand Proton by PHP Group, electric vehicle Bangla Car by Hossain Group, and Chinese DFSK brand by Maa Enterprise.

Some other brands, which are in the pipelines, are Japanese Suzuki by Uttara Motors, and Indian Tata brand by Nitol-Niloy Group.

Starting off in 1966, Pragoti Industries is among the oldest and largest automobile assemblers in Bangladesh. It was out of operation for a long time, but made a fresh start in 2011 assembling Mitsubishi's Pajero Sports (CR 45).

PHP is assembling vehicles of three models -- Proton Preve, Proton Saga and Proton Exora -- in its Chittagong plant.

Chinese vehicle-manufacturer Foton Motors also plans to set up a plant in Bangladesh in joint venture with ACI Group to assemble commercial vehicles.

According to reports, the share of brand-new and-locally assembled cars on the market has more than doubled in the last five years. The share of brand-new cars was 7.0 per cent in 2016, but now it is over 16 per cent.

Although the share of assembled cars is still nominal, it has also doubled in the last five years, industry-insiders said.

Roughly 500 assembled four-wheelers are being sold here annually at present, whereas it was around 250 in 2016, local car distributors noted.

Severely hit by the Covid pandemic, the local auto industry was gradually getting a rebound, but the Russia-Ukraine war and the surge in dollar prices dealt a fresh blow.

In total, 20,093 passenger vehicles were registered in 2020, of which the share of sedan cars was 55 per cent with 12,403 units. The number of registered SUVs was 4,911 and microbus 2,779.

According to Bangladesh Investment Development Authority (BIDA), the local four-wheeler automobile industry is attracting investments, as is reflected in the recent entry of several global brands.

"Bangladesh's automobile ecosystem offers huge opportunities for investment with a stimulating growth in the demand for passenger and commercial vehicles, favourable economic policies, and attractive fiscal incentives," it claims.

The new automobile policy offers huge benefits for the four-wheeler industry. The investors get the opportunity to import capital machinery and equipment at zero-rated duty to produce vehicles. Besides, it offers one-time cent-percent duty and tax waiver for import of machinery to set up completely knocked down (CKD) vehicle factories. A 10-year tax holiday is provided to electrical vehicle assemblers or manufacturers.

The facilities a carmaker will get until June 2030 also include exemption from value-added tax (VAT), supplementary duties, advance tax on imports, and corporate tax. The tax burden for a CKD car will be maximum 45 per cent until 2025.

Industry-insiders say consumer interest in brand-new cars has risen exponentially in recent years -- driven by young buyers and purchase influencers.