The rising air and sea shipment costs have landed apparel makers in deeper trouble, as they reel under the lingering effects of Covid-19, industry people say.

Freight forwarders attributed the rise in shipment costs to the capacity constraints, lengthy loading and unloading activities due to coronavirus-linked operational suspensions and growing demand.

The new concern for the factories was highlighted in a new study, conducted jointly by the Center for Policy Dialogue (CPD) and the Mapped in Bangladesh (MiB).

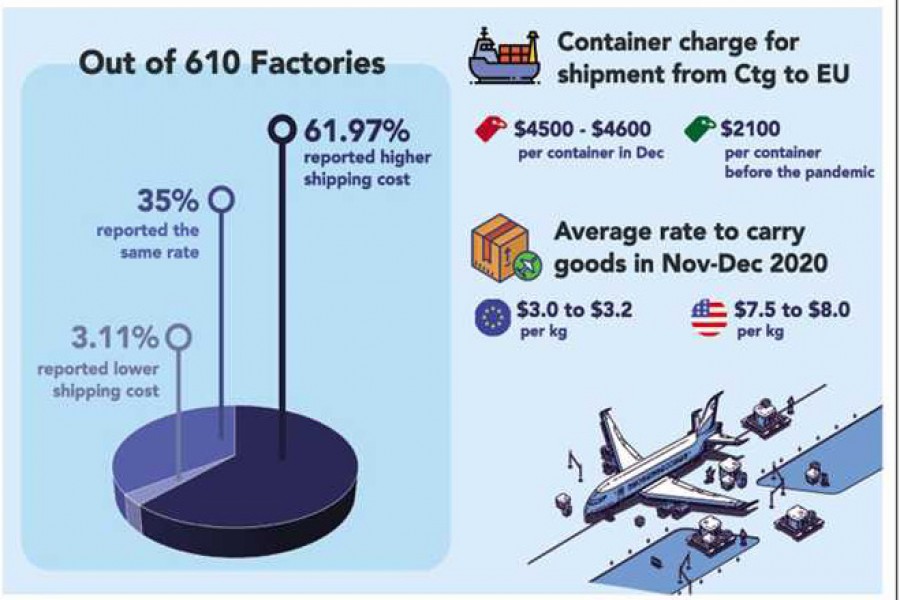

According to the survey, 61.97 per cent out of 610 factories reported that their shipping cost is higher than the pre-pandemic period.

About 35 per cent reported the same rate, while 3.11 per cent said their shipping cost is lower than before.

According to industry people, the average rate to carry goods to the European airports in November and December was $3.0 to $3.20 per kg.

The rate was $7.50-$8.0 per kg for the USA, they said.

Local exporters shipped goods by nearly 40 airlines before the pandemic, but half of them suspended flights or drastically reduced frequency.

On the other hand, the number of containers carrying exportable goods has drastically fallen due to lockdown in major importing countries, longer loading and unloading operations caused by Covid-19 movement restrictions and the growing demand, they added.

Talking to the FE, Fazlul Hoque, managing director of Plummy Fashions Ltd, said the rate of air shipments fluctuates as it is largely depends on the demand and supply.

In recent months, the demands have been growing, but the supply is limited, said Mr Hoque, a former president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), adding the air shipment charge has increased by 50 per cent.

Echoing Mr Hoque, Fazlee Shamim Ehsan, director of the BKMEA, said he had to pay US$ 3.75 for per kg of knitted jacket items shipped by air last week to Paris, which was $2.50 to $2.60 per kg before the pandemic.

The container charge for shipment from Chattogram to European Union ports went up to $4,500 to $4,600 per container in December, which was $2100 before the pandemic, he noted.

Both the leaders said about 5.0 to 10 per cent of the total exports are shipped by air mainly because of the urgency or meeting the lead time.

Almost all samples are sent through air shipments, they added.

"The rising shipment cost has put an additional burden on exporters at a time when global apparel buyers are asking for reduced price and cutting work orders," Mr Hoque said.

Mr Ehsan, however, said factories have to bear the cost burden for not adhering to the appropriate terms of sales while opening the letters of credit.

He said many of the exporters don't use the FCA (free carrier) terms of sale and open L/Cs rather than opting for FoB (free on board). Apparel exporters need not to bear the carrier charge if they use FCA.

When asked, Bangladesh Freight Forwarders Association (BAFFA) senior vice president Amirul Islam said the shipment cost has increased in recent months mainly because of the growing demand against short supply.

The global scenario is that carriers have reduced their space or capacity or the number of containers, he said, forecasting that the situation might improve by the middle of next year.

Carrier operators have reduced their capacity by almost 50 per cent during the pandemic and has not increased the rate since July and August, sources said.