Finance Minister A M A Muhith on Monday said the new VAT law might be fully implemented in fiscal year (FY) 2021-22.

He made the comment just after a day the National Board of Revenue (NBR) chief pledged to implement the new law from next FY.

Implementation of the new law was deferred in FY 2017-18 by two years. As per the government's commitment, it is scheduled to come into force from July 1, 2019.

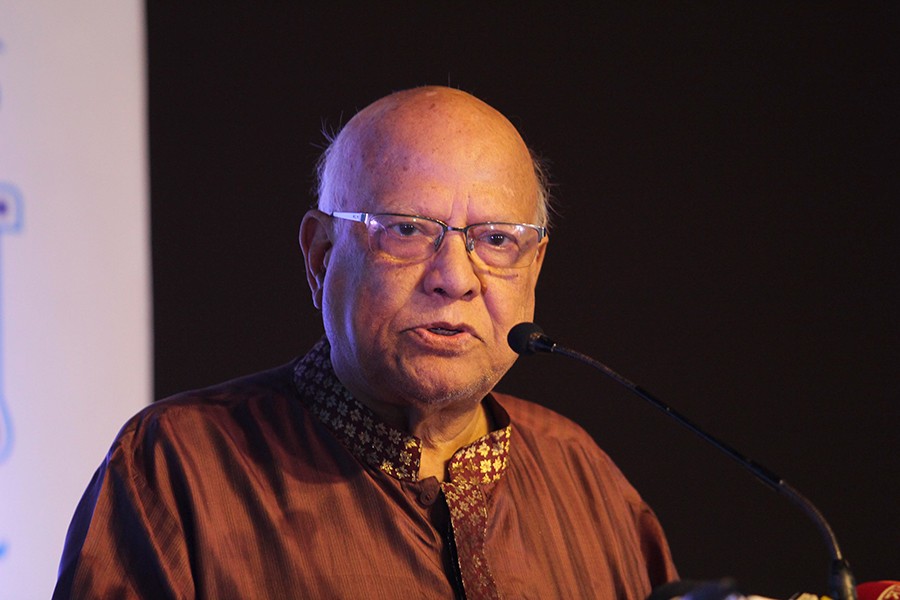

Speaking at a programme to award the highest VAT-payers, the finance minister said the tariff value in the VAT law should be gradually abolished.

"It is a complete distortion, as tax should be imposed on actual value of the products," he also said.

NBR organised the programme at Bangabandhu International Conference Centre in the capital on the occasion of National VAT Day 2018.

The finance minister said the government will keep three rates of VAT in the new law instead of a uniform rate of 15 per cent.

There will be huge VAT exemptions under the new law, and the final decision in this regard will be taken on the year of implementation of the law, he added.

"VAT seems regressive for its cascading effect. It will be ideal to slap VAT only on value addition, if proper accounts are maintained by the businesses."

Electronic Fiscal Devices (EFDs) will be introduced to help the businesses maintain their accounts, he added.

Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) President Shafiul Islam Mohiuddin said the VAT law should focus more on suppliers, rather than end-users.

It can be done by adopting advance technology, he opined, demanding a hassle-free VAT law to stop harassment.

"Some 20 per cent of businesses are paying 80 per cent of the aggregate VAT collection."

Businesses have respective plans and calculations. So, the government should take such measures that may help them to increase operating cost.

The government deferred implementation of the new VAT law following demand of the business community. Law should not be imposed forcefully, he added.

Anti-Corruption Commission (ACC) Chairman Iqbal Mahmud said ACC is not a rival of any entity, rather it wants to cooperate.

"Discretionary power of taxmen and fear factor among taxpayers are the major causes behind tax avoidance."

There are untapped potentials in VAT collection. If (proper) system is developed, VAT collection can be doubled than the current target, he opined.

NBR Chairman Md Mosharraf Hossain Bhuiyan said the tax-GDP ratio will be gradually increased through proper efforts, as the country is moving towards development.

In the programme, some 21 top VAT-payers of Dhaka division received awards from the finance minister.

On the occasion of National VAT Day 2018, NBR awarded a total of 144 highest VAT-depositing businesses across the country.

Zakia Sultana, Commissioner of Dhaka North VAT Commissionarate and Convener of VAT Day Organising Committee, delivered the welcome speech.