Compliance requirements in submission of documents by corporate taxpayers should be reduced in the new income-tax law to make it business-friendly, says a report on overhaul of Bangladesh's 'outmoded' taxation system.

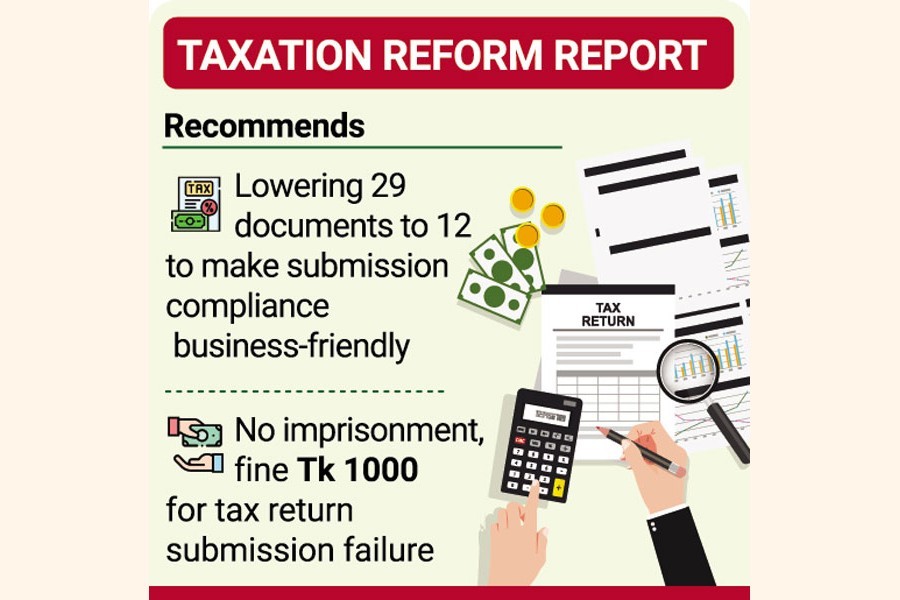

Currently, corporates have to submit 29 returns for 'at-source tax' in a year, which involves volumes of brainstorming paperwork and extra money.

The number of at-source tax returns could be pared down to 12 in a year to make it business-friendly, says the expert recommendation.

The suggestions come in the report of a review committee on the Income Tax Law 2022 (draft), submitted Monday to the National Board of Revenue (NBR).

In the report, the review panel has recommended for the tax authority to scrap the provision of imprisonment in case of failure in submission of tax returns in the draft of new income-tax law.

It says the proposed measure in the draft law may discourage a large number of taxpayers from coming onto tax net, thus resulting in revenue loss.

The 20-member committee, comprising public-and private-sector representatives, submitted the report to NBR chairman Abu Hena Md Rahmatul Muneem.

The committee members include high officials of the National Board of Revenue (NBR), Economic Relations Divisions (ERD), the Ministry of Finance, Ministry of Commerce, the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), Metropolitan Chamber of Commerce and Industry (MCCI), Foreign Investors Chamber of Commerce and Industry (FICCI), Bangladesh Supreme Court, Emerging Credit Rating Limited, Accounting and Information Systems Department Dhaka University, Institute of Chartered Accountants Bangladesh (ICAB), Bangladesh Securities and Exchange Commission, Research and Policy Advocacy.

The all-stakeholder body suggested imposing penalty at the maximum of Tk 1000 in case of failure in submission of tax return by an individual taxpayer without having any valid reason.

Currently, the draft income-tax law has the provision of rigorous imprisonment for one year or penalty or both.

The committee suggests incorporating definition of stock into the new income-tax law to give a clear definition of asset and not to include shares into its purview.

It recommends not including reinvestment unit or cumulative investment- plan unit as dividend if it is issued by open-end mutual fund or exchange- traded fund (ETF).

The committee proposed inclusion of demerger in the new law along with existing merger, amalgamation.

"Due to absence of demerger from the income-tax ordinance, the taxpayers have to seek help of the High Court to resolve the relevant issues, which is time-consuming and complex," the report reads.

It suggests determining tax on the basis of 'Income Year' instead of 'Tax Year.'

Currently, the government proposes the tax rate through Finance Bill for the year that the taxpayers already completed their accounting calculation or about to complete.

The rate of tax and taxpayers' decisions to invest for income-tax rebate, tax planning and other business decisions could be taken prospectively if the taxmen consider 'Income Year' of a taxpayer instead of existing 'Tax Year'.

A senior official of the NBR says the revenue board high-ups will sit with the review-committee report to see which provisions it could include in the draft law.

The draft income-tax law will be placed before the cabinet by December 31.

The NBR published the draft law in October 2021 eliciting public opinion.To finalize the law, the NBR formed the review committee on October 6, 2022.

The review committee recommended incorporating the changes to the Finance Act 2020, 2021 and 2022 in the new law, cut the source-tax rates, expand the lists of allowable expenses in the law, define abuse of the tax system and double taxation, and include the new financially transparent entity.

"We worked based on the TOR set by the NBR. Review Committee reviewed all the proposals received from the stakeholders focusing on the objective of this Tax Act 2022," says Snehasish Barua, a Founding Partner at Snehasish Mahmud & Co, who is a member of the review committee.

It was not a mere conversion of the existing Income Tax Ordinance 1984 into Bangla language but also to create a more business-friendly income-tax system to increase its competitiveness on the international market and attract investment, including FDI, adds Mr Barua, also adviser of the FICCI.

The panel proposed aligning the draft law with international best practices keeping in mind country context, of state revenue management with international best practices.

It also proposed curbs on arbitrary power, reducing the discretionary powers of the field-level officials in collection as much as possible, simplification of tax-refund system so that an assessee can get refund automatically into their bank accounts before the audit, he said.

"The recommendations would help in creating necessary legal provision for online filing, documentation and hearing, simplification of law by usage of simple language and formula," he hopes.