Bangladesh's maiden bid to check tax evasion through cross-border transactions remains stalled for lack of funding to equip a watchdog agency with logistics, while capital flight remains a concern.

Officials say the much-desired transfer pricing cell (TPC) has yet to take off in full gear as it lacks access to data with its international counterparts.

The National Board of Revenue (NBR) framed the transfer-pricing law in 2012 with intent to check tax evasion by multinational companies or MNCs through cross-border financial transactions. The TPC was established in 2014.

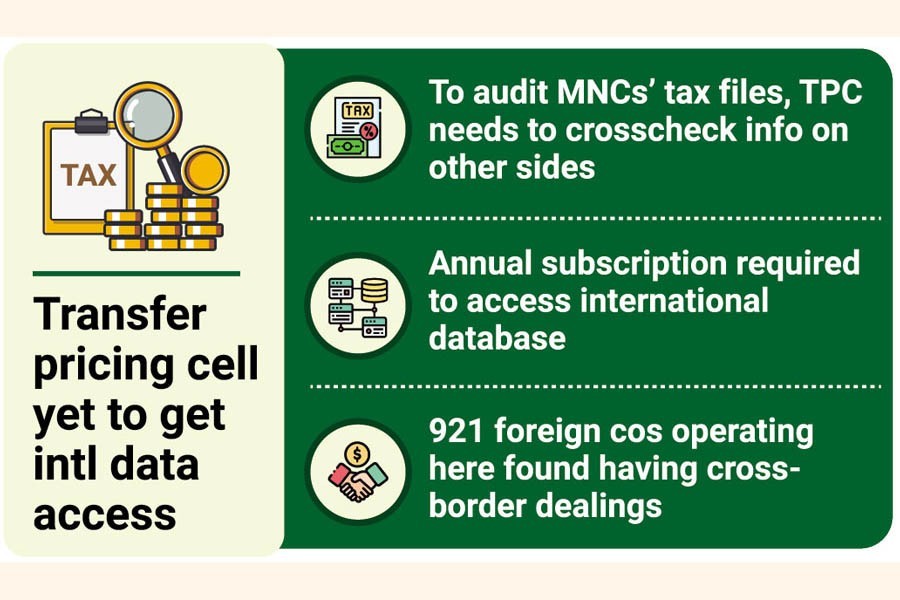

To start auditing tax files of the multinational companies, the cell will have to crosscheck the information of international transactions on other sides too, sources say quoting the Transfer Pricing Law.

The TPC would require paying an annual subscription to get access to the international database. For this funding, the revenue board would need separate allocations dedicated to TPC.

Sources involved with the formation of the TPC said the NBR needs to have proper planning as to whether it wants an active TPC to check tax evasion by MNCs.

An FE analysis finds that the NBR, sometimes, suffers from indecision on few areas of determining working process and designating officials for TPC. It trained officials for TPC and then transferred to other zones, creating dislocation and vacuum in the cell.

During the time lag of eight years, the NBR has reconstituted the TPC more than five times and again a move is on in this regard.

Although the TPC has done a lot of groundwork earlier, including collection of Statement on International Transactions (SIT), data collection from all MNCs and many more, it could not start the task of scrutinizing tax files of MNCs as yet.

International tax experts say the taxmen would need to access data of the other countries to determine arm's-length prices as incorporated into the transfer-pricing law, implemented in 2014.

An arm's-length transaction is one in which the buyers and sellers of a product act independently and do not have any relationship to each other, and it ensures that there is no collusion between the buyers and sellers.

Under the law, the taxmen cannot apply any discretionary power to determine arm's-length prices of the MNCs.

It is not possible to detect transfer mispricing without verifying parent country or other countries' information where TP occurred, the jurists say.

Distinguished Fellow of the Centre for Policy Dialogue (CPD) Prof Mustafizur Rahman, who was involved with the formation of the TPC, says: "We have started the TPC on the basis of research aiming to reduce the tax evasion through cross-border transaction."

"Unfortunately, capacity of the cell has not been developed yet," he adds.

He suggests extending cooperation so that the TPC gets access to real- time data for starting the scrutiny.

When the TPC initially started working, it paid off to the public exchequer Tk 100 million in the fiscal year 2017-19 through voluntary tax re-adjustment of MNCs.

TIM Nurul Kabir, Executive Director of the Foreign Investors Chamber of Commerce and Industry (FICCI), says, "We welcome any law that would not hamper ease of doing business."

TP happens to become a popular tool in South Asia, too, to check cross- border tax evasion.

Transfer-pricing regulations became fully operational in India in 2005-06, followed by Sri Lanka in 2015.

In a functional survey in 2020, the NBR found some 921 foreign companies, operating in Bangladesh in various forms, have some types of cross-border transactions.

Such companies include multinationals and branches, liaison and representation offices of foreign firms.

The TPC prepared business profiles of the companies and sought Statement of International Transactions (SITs) from them. Though submission of an SIT is mandatory for a foreign firm having international transactions, only 16 per cent of them had submitted the SITs.

The TP law has a provision of penal tax, which is 2.0 per cent of international transactions, for not submitting an SIT.

Transfer pricing takes place when an MNC pays or gets payment for purchase or sale or transfer of any tangible or intangible output to any of its associates or subsidiary companies in which it has substantial interests in any form.