Credit flow into Bangladesh's private sector has been on the up and up pushed by rising demand, particularly for trade financing, sources say on a cautious note about a possible side-effect.

The upturn is evident in July findings that also show loan disbursement from the low-cost refinancing schemes, offered by the central bank, have also pushed up credit growth particularly in private sector, officials said Monday.

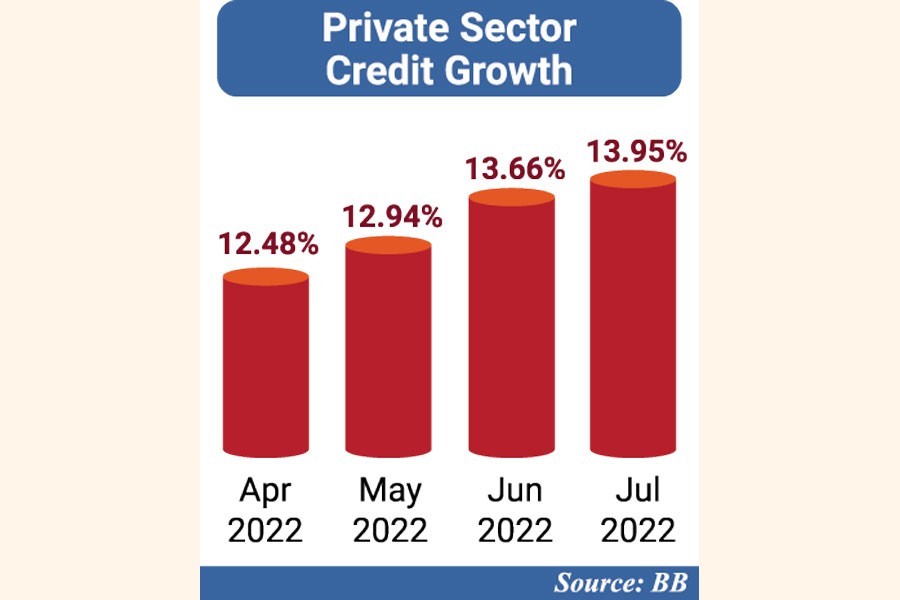

The credit flow rose to 13.95 per cent in July 2022 , year on year, from 13.66 per cent a month before, according to the central bank's latest statistics. It was 12.94 per cent in May this calendar year.

It was 0.35-percentage-point higher than the Bangladesh Bank (BB) target of 13.60 per cent for the first half (H1) of the current fiscal year (FY) 2022-23.

Experts, however, fear that the ongoing upward trend in inflationary pressure on the economy may be fueled further if the existing trend in the private-sector credit growth continues.

"Now the central bank should take appropriate measures to take back the credit growth within the respected level," Toufic Ahmed Choudhury, former director-general of the Bangladesh Institute of Bank Management (BIBM), told the FE while replying to a query.

Dr Choudhury also says the private-sector credit growth increased significantly during the period under review following higher trade financing to settle import-payment obligations.

Talking to the FE, Bangladesh Bank spokesperson Md Serajul Islam said: "We're managing liquidity in the market considering the ongoing inflationary pressure on the economy."

He also said the central bank had already withdrawn around Tk 700 billion from the market through selling the US currency to the banks directly for settling their import-payment obligations.

The private-sector credit growth is likely to decrease during the second quarter (Q2) of the FY'23 if the falling trend in import payments continues, according to another central banker.

The settlement of letters of credit (LC), generally known as actual import, in terms of value, came down to US$6.79 billion in July from $6.80 billion a month before, the BB data showed. It was $6.16 billion in May 2022.

On the other hand, the opening of LCs, generally known as import orders, dropped by more than 38 per cent to $4.78 billion in July 2022 from $6.60 billion a month before. It was $5.43 billion in May 2022.

"We're working continuously to curb unnecessary imports through strengthening our monitoring and supervision," the central banker explains.

The central bank has already taken a series of measures, including imposing cash LC margin for all imports, save some essentials, to ease import-payment pressure on the economy.

Earlier on July 14, the central bank started monitoring LCs worth US$5.0 million and above initially, using its dashboard, to discourage 'unnecessary' imports.

Currently, the watchdog monitors the LCs worth $3.0 million and above on the same grounds.

"Such monitoring of import LCs will be continued until stability comes back on the country's foreign-exchange market," the BB official notes.

Talking to the FE, Syed Mahbubur Rahman, Managing Director (MD) and chief executive officer (CEO) of Mutual Trust Bank Limited, said the private-sector credit growth increased further following higher demand for loans mostly for trade financing.

"Corporate entities now prefer the local-currency loans to foreign ones to avoid possible exchange risk in future," the senior banker said while explaining the upward trend in private- credit growth in recent months.

Meanwhile, outstanding loans with the private sector rose to Tk 13525.66 billion in July 2022 from Tk 11870.11 billion in the same month of 2021.

The amount was Tk 13512.35 billion in June 2022.