Bangladesh's mobile financial service (MFS) has got a boost as its total transaction volume ballooned more than two and half times in four years, bankers and experts said on Friday.

They said the paperless banking and digital advancement in the country have resulted in the remote money transaction, reaching the doorsteps of the people.

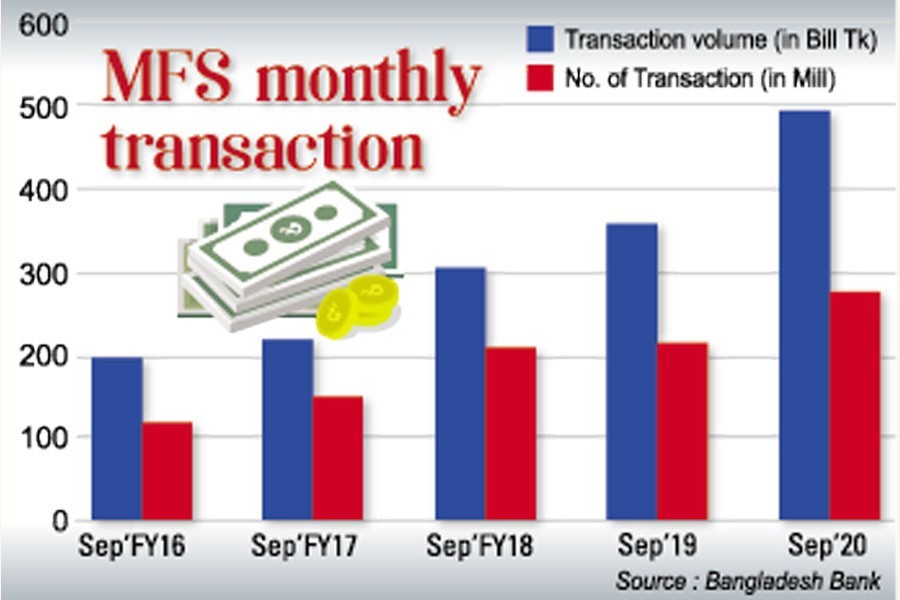

The central bank data showed that the monthly transaction through mobile phones in September this year was recorded at Tk 491.21 billion, 152 per cent higher than the corresponding month of 2016.

In September 2016, the total volume of the transaction through the MFS was Tk 194.71 billion, the Bangladesh Bank (BB) statistics showed.

The number of monthly transactions has also registered a steep rise over the last four years as it has reached Tk 273 million in September 2020, growing by 132 per cent.

A total of 15 private banks and one public sector department is providing the MFS services to their clients over the years.

Among the MFS providers, bKash is the no. 1 player, followed by Rocket, an initiative of the Dutch-Bangla Bank Limited, and Nagad, a service of the Bangladesh Postal Department.

Besides, the UCBL, Mercantile Bank, Rupali Bank, Trust Bank, Islami Bank Bangladesh Limited also have a presence in the MFS market.

Among them, the bKash is the leading player with it nearly 75 per cent of the market share, followed by Rocket and Nagad with 10-12 per cent each, market players said.

Bankers and economists said the peoples' tendency towards the digital platform during the COVID period, paperless banking, simplification of the MFS services, upgrade of digital infrastructure of commercial banks and allowing utility service payments are the main factors for the growth of the MFS in Bangladesh.

Research director of the Centre for Policy Dialogue (CPD) Dr KG Moazzem told the FE that the COVID was blessings for the MFS providers.

The countrywide lockdown for more than three months has become beneficial to digital banking as people became familiar with the online and mobile service payment systems, resulting in the huge growth, he added.

Chief financial officer of Mercantile Bank Limited Tapoch K Das told the FE that the COVID factor and enhancement of the daily transaction limit had boosted the growth of MFS in Bangladesh in this year.

A central bank senior official said the government and the central bank had taken some steps in a bid to simplify the mobile money transfer for the clients, which facilitated the growth in transactions.

In recent days, a lot of new products and fresh services in the MFS, utility bill payment, and salary payment had also increased its growth, Mr Das told the FE.

Sydul H Khandkar, project director of U-Cash, told the FE that the MFS was available even in remote villages where access to banking was not available.

The COVID has expedited the use of the MFS by the clients during this pandemic as they had been familiar with the digital platform more than before, he added.

A regional manager of the "Rocket" told the FE that the coronavirus had become a blessing for their services.

Besides, an increase in corporate clients, salary payments, cash transfer, tuition fee payments in the educational institutions, and shopping payments have boosted their transactions in recent months, he added.

Dr Moazzem said, "Although the MFS is growing, it has some challenges as well. Its security across the country had become a big factor these days. The service providers should ensure the security of the technology as we all of the customers."