Bangladesh is destined to experience persistent power-generation shortages as dwindling domestic natural gas production subjects the country to costly fuel import over the years ahead, says London-based Fitch Solutions.

"With the ongoing elevated natural gas prices and global gas-supply strain, Bangladesh's power sector has been facing threats to its energy security," the data-analytics agency says in its latest report, as people in the country already reels from frequent outages.

The government has introduced power-rationing measures, such as limiting school and work hours, and daily load-shedding hours (for up to two hours) since July 2022.

Despite having domestic gas-fields, the Fitch Solutions team on Oil and Gas estimates that natural gas production in Bangladesh only served about 67 per cent of the market's total natural gas consumption.

The remaining gas demand was met by liquefied natural gas (LNG) imports, exposing the market to elevated LNG spot prices and increasing domestic energy prices.

"LNG imports will also increase over the coming years, as domestic natural gas production decreases with depleting gas fields," says the agency.

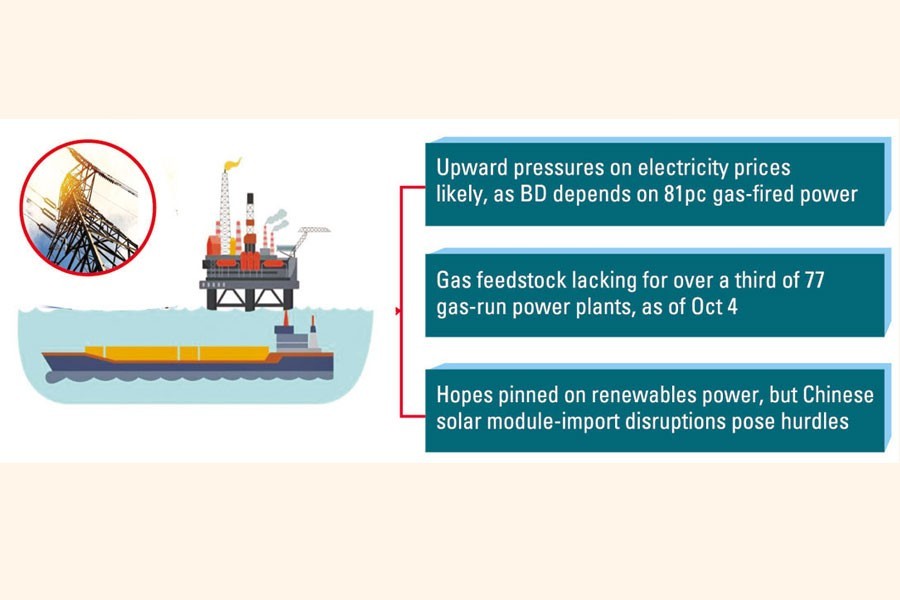

The research organisation forewarns that this will result in upward pressures on electricity prices, as Bangladesh depends on gas-fired power generation for 81 per cent of its electricity needs, as of end-2021.

Additionally, government data as on October 4, 2022 showed natural gas feedstock was lacking for more than a third of the market's 77 gas-fired power plants.

In fact, this has been experienced in the market as LNG prices are "increasing the daily cost of living for Bangladeshis, leading to more protests, which our Country Risk team expects to continue for 2022 and 2023," it notes.

"We maintain our robust forecast for Bangladesh's renewables sector, with non-hydropower renewables capacity to expand more than five times from end-2021 to 2031, supported by existing growth-support mechanisms."

Bangladesh's non-hydropower renewables capacity stood at 551.7MW in end-2021.

This will increase to about 2,688.9MW in 2031, growing at an annual average rate of 19.4 per cent.

"The majority of this growth will come from the solar power sector, which will make up about 87 per cent of the non-hydropower renewables capacity mix over the coming 10 years," says the Fitch Solutions taking a long view over the spectrum of power problem and solutions.

It also notes growth in the solar-power sector has been and will continue to be, mainly from projects supported, developed, and launched by the Bangladesh Power Development Board (BPDB).

However, Fitch Solutions highlights that about 580MW projects in BPDB's solar-project tracker are still in the planning stages.

"This is despite the firm's expectation that they will all come online in 2022. We believe the slowed progress is a result of disruptions in solar module imports from Mainland China. This presents downside risks to our robust forecasts of solar-power capacity and generation for the short term."

The gas-supply issue is urging the government to accelerate the development of renewables, presenting upside risks to the growth of its renewables sector over the forecast period.

The government is revising its Renewable Energy Policy in hopes to accelerate the diversification of the power sector.

"Details of the policy updates have yet to be finalised, but we expect a strengthened focus on solar and then wind power, which presents upside risks to our already robust forecast."

Apart from a potential amendment, the government has been working on an integrated energy and power masterplan with the Japan International Cooperation Agency to chart a plan for energy security and a low-carbon energy transition, it mentions.

"This masterplan, scheduled for launch in November 2022, also places an upside risk on our forecast as it does not indicate accelerated progress in renewables development."

The agency notes that the State Minister for Power, Energy and Mineral Resources also announced that Bangladesh is promoting rooftop and floating solar panels, alongside a net-metering scheme, supporting solar-power growth.