Phenomenal global price rises and local currency's exchange-rate depreciation drive up Bangladesh's private-sector credit flow, a latest study by the central bank shows, while policymakers now contemplate a restraint.

Generous cash flow through crisis-time stimulus and low-interest credits meant for economic rebound are seen as cardinal cause of incensed inflation worldwide, and central banks of developed countries, including the US, are going for rate raise to press the brake on easy money as a way of taming overheated market.

As per the Bangladesh Bank survey, the current private-sector-credit growth is nearly 14 per cent. But it could stand nearly at 11 per cent had there been no depreciation of the Bangladesh taka against the US dollar.

The chief economist unit of the central bank released Wednesday the research paper styled 'Impact of Exchange Rate and Global Commodity Price Inflation on Private Sector Credit in Bangladesh'. It says the growth in private-sector credits has been improving since September 2021, mainly driven by credit for export-import financing as the export-import growth increased gradually and climbed close to 20 per cent in recent months.

"The export-import financing growth contributed significantly to the recent high private-sector- credit-growth phenomenon," the BB study report reads.

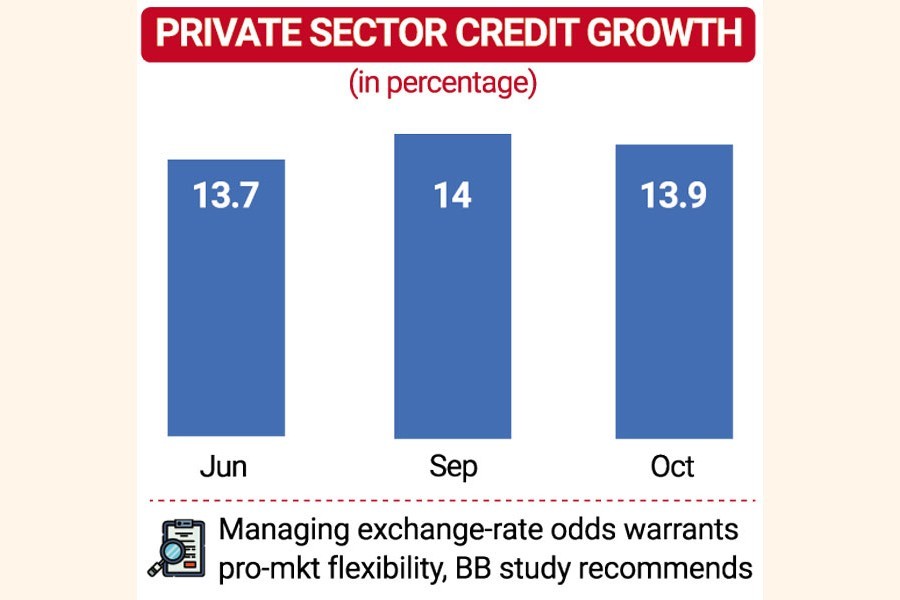

The observed growth rates in the private-sector credits were 13.7, 14.0, and 13.9 per cent in June, September, and October 2022 respectively.

But it can be much lower when exchange rate is adjusted. Then it may stand at 11.9, 10.9, and 10.8 per cent respectively.

"Therefore, the recent high-growth scenario reflects the result of significant exchange-rate depreciation," the central bank points out in its study report.

And the growth in credit to private sector might stand yet lower when both exchange rate and global prices are adjusted. Then the observed growth rates may come to 6.6, 7.3, and 8.8 per cent in June, September, and October respectively.

The paper, however, reads that, overall, adverse commodity-price shocks and exchange-rate volatility can create challenges to the economy through credit channels which ultimately impact the banks' balance sheet.

"A surge in import payments compared to export earnings leads to an increase in bank credits to trade, which may create a potential liquidity mismatch," says the regulator about the downside of the bloated trade lending.

It also says the shocks could unfavorably impact economic activity and agents' (including the Government) ability to meet their debt obligations, thereby potentially deteriorating banks' balance sheets.

And, lastly, a sharp increase in global commodity prices can impact commodity importers' budgetary balance, which may drive the government to adjust its budget to contain any such budgetary imbalance.

In tackling external factors-driven imported inflation, there are not many policy options available other than making appropriate supply-side interventions, while managing the exchange-rate adversities requires market-oriented flexibility.

Economists view the findings as more or less okay and say the credits should have been lowered for grappling with higher inflation.

Dr Zahid Hussian, former lead economist of the World Bank, told the FE that the global price hike and dollar depreciation fueled the inflation.

He feels that the private credit will not expand as long as the inflation remains high.

He suggests easing the interest-rate regime in lending to the private sector.

Dr Masrur Reaz, chairman at the Policy Exchange of Bangladesh, says the BB argument is not justified as the comparison between private-sector-credit growth and dollar rate is not logical.

"We have borrowed in local currency and spent it in local currency, so the dollar comparison is not right...," told the FE.

He also feels that the private credit growth should have been lowered as it helps inflation spike in the economy.