Faster transmission of resurgent coronavirus and increased fuel prices dampen businesses' confidence in Bangladesh's economic recovery in the opening quarter of 2022, after an upbeat rebound, according to a survey.

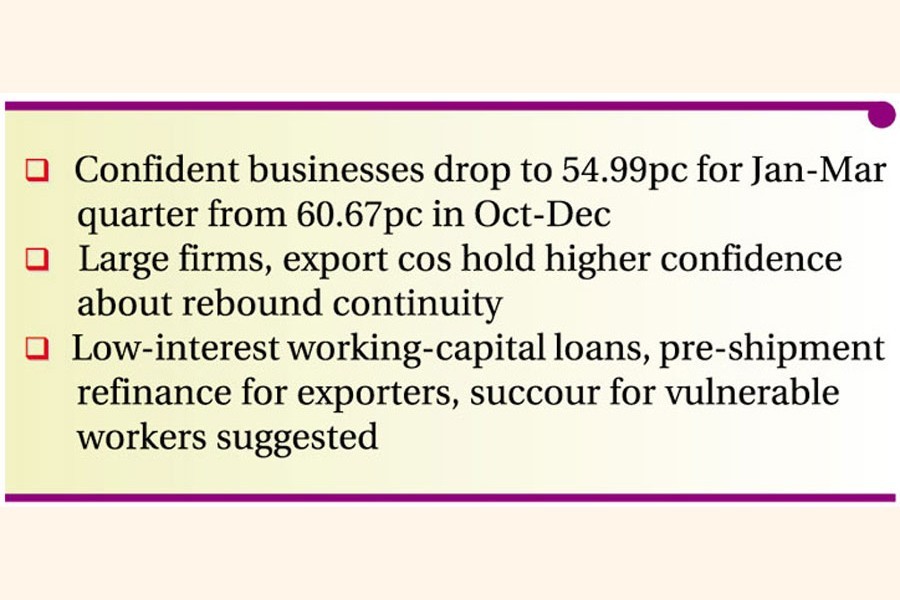

As per the Business Confidence Index (BCI), developed in the survey, the proportion of confident businesses dropped to 54.99 per cent for the January-March quarter from 60.67 per cent in the previous quarter (October-December).

The observations of the survey, titled 'New Wave of COVID-19: State of Business Confidence in Bangladesh' and conducted by South Asian Network on Economic Modelling (SANEM), were disseminated at a webinar Monday.

Executive Director of SANEM Prof Dr Selim Raihan presented the findings of the seventh round of the survey that fell in the midst of the two odds: the highly contagious omicron variant of the coronavirus and the hike in fuel tariffs.

In the presentation he said overall business confidence in January-March 2022 declined principally due to the growing concerns about the spread of new coronavirus variant, omicron.

The survey shows that large firms (57 per cent) and export-oriented companies (56 per cent) have higher degrees of business confidence compared to micro, small and medium enterprises (54-55 per cent) and non-exporter firms (54 per cent).

About 58.42 per cent of the survey respondents were positive about profitability during the first quarter of the current year-down from 65.45 per cent in the last quarter.

"Besides, confidence about sale and export also dropped to 58.02 per cent from previous 68.05 per cent as a result of global tensions regarding the fresh wave of the pandemic," it is stated in the survey report.

In relation to omicron adversities, 71 per cent of the firms have reported a decrease in export orders and sales followed by 79 per cent reporting additional health measures and increased associated costs and 82 per cent reporting increase in input costs.

In terms of business recovery, nearly 17 per cent of respondents observed that Bangladesh is on a path of strong recovery, while it was 21 per cent in the earlier round.

Similarly, their views on moderate recovery have fallen to 44 per cent in this round from 52 per cent in the previous round.

For resuscitating business recovery, SANEM suggests stimulus like providing low-interest working-capital loans, introducing pre-shipment refinance facilities for exporters and social safety-net programmes for vulnerable workers.

In the meantime, Dr Raihan says, the impact of fuel-price hike has been significant as 97 per cent of firms reported an increase in transportation cost and 79 per cent reported an increase in energy cost.

It has also increased the risk of hike in transportation cost as reported by 94-per cent firms and the risk of increase in energy cost, as reported by 81 per cent, he adds.

The group also suggests relaxed taxation on oil imports and strategic, dynamic and forward-looking fuel-price policy.

Meanwhile, referring to a falling flow of remittance, the study recommends assessment of remittance flow and increasing cash incentives from 2.5 per cent to 3.0 per cent.

From each round of survey, SANEM calculates three indices (1) an index derived from present-quarter data called -- Present Business Status Index (PBSI) (2) an index on the anticipation of business conditions in the next quarter - the Business Confidence Index (BCI) and (3) an index on the overall business environment -- called Enabling Business-Environment Index (EBI).

A total of 502 firms were surveyed from January 3 to 24, representing micro, small, medium and large enterprises -- manufacturing sector including RMG, textile, leather and tannery; pharmaceutical and chemicals, food processing, electronics and light engineering; retail, wholesale, hotels and restaurants, financial sector, ICT, transport and real estate.

The survey results show that PBSI (year) is approaching the mark of 60 in the October-December 2021 quarter from 56.79 in the earlier quarter, indicating a continuation of improvement.

Considerable improvement has been observed in the profitability and sales or export order sub-indicators.

Similar to PBSI (year), the PBSI (quarter) points to an improvement in business activities in October-December 2021 quarter in comparison to July-September 2021 quarter.

Compared year on year, RMG, textile, restaurant, food processing, and pharmaceutical sectors have registered a comparatively faster recovery.