Speakers in a seminar on development of women entrepreneurs stressed the need for changing the mindset of banks and other financial institutions (FIs) to provide loans to fresh entrepreneurs for creating more employment opportunities and ensuring economic growth through inclusive development.

They said the banking channel must change its traditional credit risk assessment system in providing loans to women entrepreneurs; and the agencies concerned must provide necessary lands to them, including in the special zones.

Most women entrepreneurs were deprived of loans, even from the government-declared stimulus packages due to the (traditional) credit risk assessment system by the banks and FIs, although they had been badly hit by the coronavirus pandemic, the speakers observed.

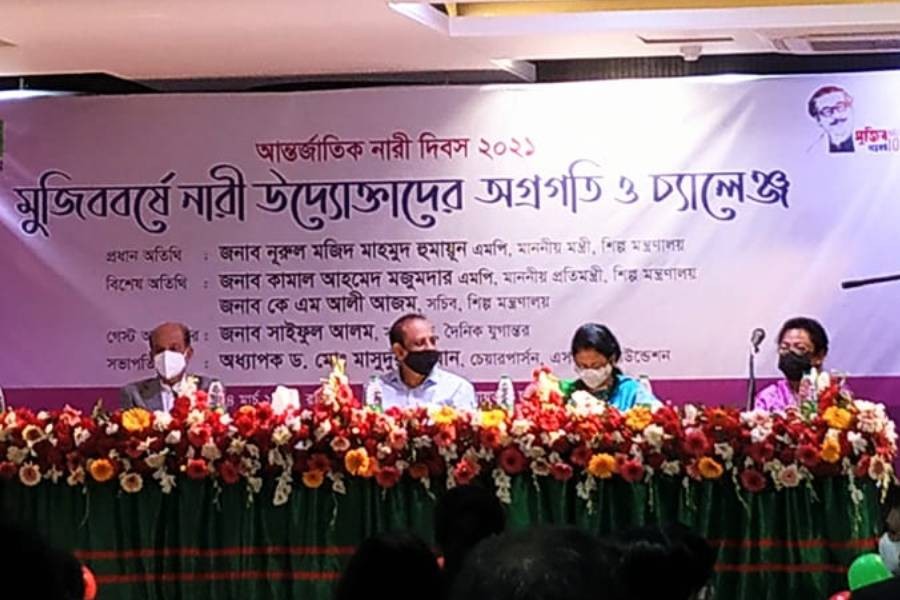

The SME Foundation (SMEF) organised the seminar - 'Progress and challenges of women entrepreneurs in Mujib 100 years' - on the occasion of International Women's Day at Agargaon in the capital on Sunday.

Chaired by SMEF Chairperson Professor Mohammad Masudur Rahman, the seminar was attended by Industries Minister Nurul Majid Mahmud Humayun as the chief guest as well as State Minister Kamal Ahmed Majumder and Secretary K M Ali Azam as the special guests.

Senior Research Fellow of Bangladesh Institute of Development Studies (BIDS) Nazneen Begum presented the keynote paper. President of Chittagong Women Chamber of Commerce and Industry (CWCCI) Monowara Hakim Ali and Managing Director of Joyita Foundation Afroza Khan discussed on it.

SMEF General Manager Farzana Khan moderated the seminar, attended by women entrepreneurs from different sectors and associations.

Dr Nazneen said challenges of women entrepreneurs were much higher than others; but their success stories helped the country achieve development, including women empowerment at various stages.

"Journey of women entrepreneurs has been hard; but it has helped them achieve development for the country through creating employment and examples of empowerment."

She highlighted that some 58 per cent of women entrepreneurs had become entrepreneurs with their own initiatives, including by managing fund by themselves.

Banking channel as well as other agencies must give women entrepreneurs due importance in their business expansion, including capacity building on digital platform, she opined.

The researcher also said women were facing six kinds of barriers, in taking their businesses forward, which intensified during the time of Covid-19 pandemic due to not getting loans for complexities in submission of various documents.