State run Bangladesh Petroleum Corporation (BPC) has started incurring loss again in oil trading since November this year, after making substantial profits for last three consecutive years since late 2014.

The oil price in the international market suddenly escalated due to global political turmoil, causing a loss of Tk 5-6 per litre of furnace oil and Tk 1.0 per litre of diesel or kerosene, a senior BPC official said.

He expressed the fear that the loss might go up further if the oil price in international market climbs up further.

The price of brent crude, the benchmark in international oil price, climbed up to $ 64 per barrel in November, 2017 from $47 in June, 2017 and below $30 in early 2016.

The Organisation of the Petroleum Exporting Countries (OPEC) and non-OPEC producers, led by Russia, have agreed last week to extend the oil output cuts until the end of 2018, prompting the steady rise in the fuel oil price.

A senior BPC official said the state trading agency was facing losses in oil trades as the cost -- import cost with 31 per cent tax and freight charges plus margins for the company and dealers -- is higher than the retail prices.

The appreciation of US dollars against the local currency also caused losses to the BPC, he added.

If one litre of diesel in the international market is Tk 100, the BPC's overall costs to supply the fuel at retail level stands around Tk 135 per litre, after paying all taxes and margins, the official added.

The BPC imported diesel at $ 59 per barrel in June 2017, which soared to $ 76 in November 2017, said the official.

Its import price of furnace oil soared to around $380 per tonne in November 2017 from $ 280-300 in June, 2017, he added, distinguishing the price hike of the fuel oil in international market over the past several months.

The state-owned enterprise was making profits through trading the petroleum products - furnace oil, diesel and kerosene - since September 2014 until October, 2017 thanks to a slump in international oil prices.

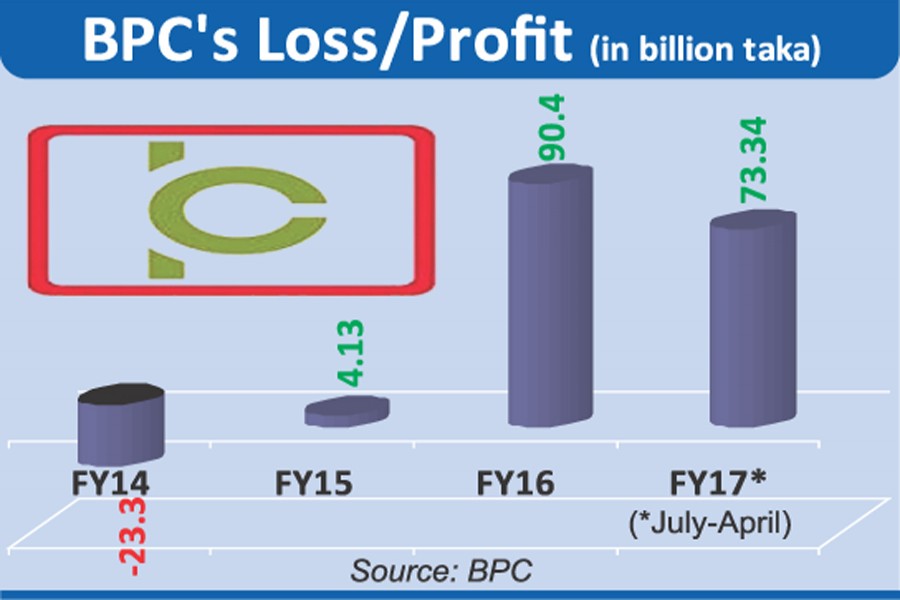

It registered a profit of Tk 73.34 billion in the first 10 months of the last fiscal year until April 2017, following a profit of Tk 90.4 billion in FY2015-16 and Tk 4.13 billion in FY2014-15.

Before then, it had incurred a loss of Tk 23.32 billion in FY2013-14 and Tk 48.32 billion in FY2012-13. In FY2011-12, the loss was Tk 113.71 billion, which was Tk 88.40 billion in FY2010-11. The BPC incurred losses every year since FY2001- 02 to FY2013-14.

When contacted, energy adviser of the Consumers' Association of Bangladesh (CAB) professor M Shamsul Alam was critical over the accounting system of the BPC and said there was no logic for incurring loss right now.

He stressed the need for an independent and technical auditing of the accounts by a reputed professional firm to check 'corruption' and lack of transparency.

Professor Ijaz Hossain of Bangladesh University of Engineering and Technology (BUET) said the latest hike in oil price in the international market would be a big blow to the country's growing economy. He predicted that the price hike might continue throughout the next year due to global volatile geo-political tensions and production-cut decisions by oil producers -- both OPEC and non-OPEC.