Bangladesh dominates the global denim market with its sustained position as top supplier to two major export destinations--the United States and the European Union-on high annualised growth.

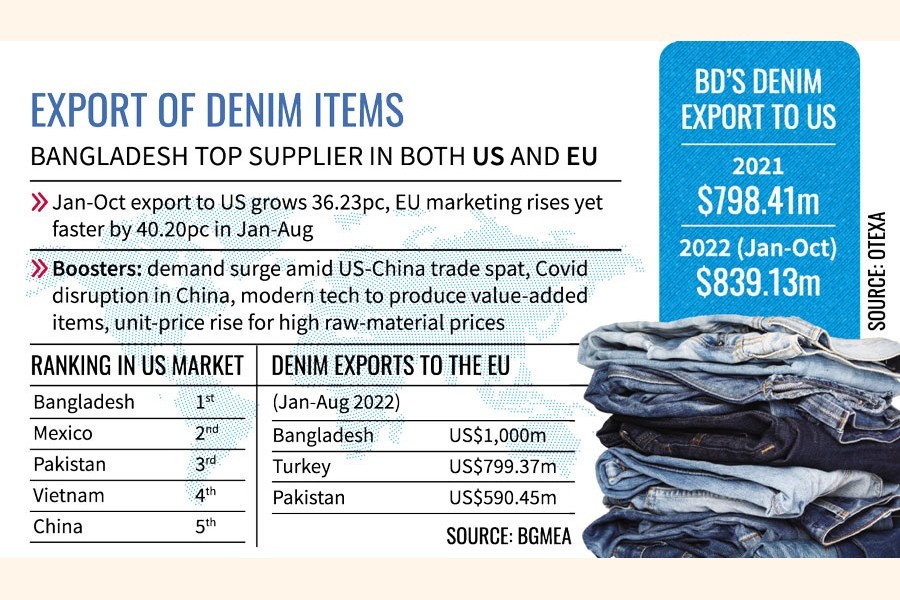

Exporters and analysts see it as a silver lining in the current context of global gloom as export of denim garments to the US market grew by 36.23 per cent to US$ 839.13 million in January-October period of 2022. The amount was $615.95 million in the corresponding period of 2021, according to figures from OTEXA, an affiliate of the US Department of Commerce.

And shipments of this genre of apparel to the European Union-the largest Bangladesh readymade-garment market as a bloc- fetched $1.0 billion from January to August, marking a 40.20-percent growth, according to BGMEA data.

The aforesaid ten months' denim-export earnings from the US also surpassed that of 2021, which was $798.41 million, the data showed.

Exporters list a number of boosters and blessings in disguise for the denim-export buoyancy these days of a global dearth. These are a surge in demand driven by the trade spat between the US and China, Covid-induced supply disruption in China, enhanced capacity of local industry for setting up modern technology to produce quality and value-added items, and rise in unit prices due to high prices of raw materials.

Bangladesh has been the top supplier of denim goods to its single-largest destination - the US - since 2020. The exporters hope the country's position in North America would remain unchanged in 2022 - for a third consecutive year now.

In 2019, Mexico was the top supplier of denim wears with its shipments having fetched $802 million. The figure stood at $654.87 million during the first ten months of 2022.

OTEXA data show that the total US imports of denim apparel from across the world increased by 22.66 per cent to $3.62 billion in the first 10 months of 2022, which was $2.95 billion during the corresponding period of 2021.

Once the biggest denim exporter, China secured the fifth position on the US market with $312.92 million, marking a 3.78-percent negative growth.

Pakistan and Vietnam secured third and fourth position with export of $419.12 million and $383.32 million respectively.

When asked, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) President Faruque Hassan is happy that Bangladesh is doing better on the US market.

"The growth is value-led, as unit prices have increased due to high prices of raw materials. Besides, the buyers held back a number of orders in March and April, which the producers started receiving in recent months," he says.

However, he notes that particularly in denim segment, the local makers have invested a huge amount in setting up modern machinery, especially for washing and dyeing, to produce a wide variety and shades of denim garments ensuring premium quality.

The country's denim export to the US has been on the increase for the last couple of years - due mainly to the 'China-plus one' sourcing strategy of the western buyers, as geopolitical reasons prompted them to diversify their sourcing destinations, a leading denim exporter says.

Besides, factories in China remained closed under the 'Zero Covid' policy, he adds.

Meanwhile, Turkey shipped denim goods worth $799.37 million to the EU during the period, followed by Pakistan $590.45 million.

Bangladesh has been sustaining its top position on the EU market since 2017, according to the data.

Talking to the FE, Sayeed Ahmad Chowdhury, general manager of Square Denim, however, opined that the data did not properly reflect the current situation.

Denim fabrics makers can use up to 70 per cent of their production capacity, while the percentage is 70-80 for denim garment makers.

He said FoB value of garments increased mainly because of surge in prices of raw materials.

"This is not the real growth, as export in terms of quantity has not increased."

The growth in terms of value might decrease in the months ahead with decline in raw-material prices, he added.