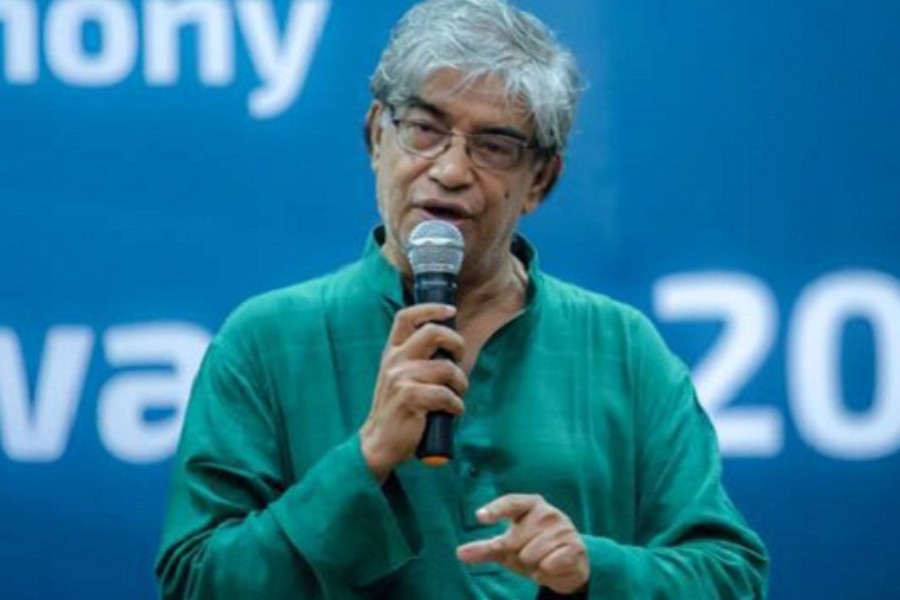

Post and Telecommunication Minister Mustafa Jabbar, on Thursday, said the country's banks are unable to reach people in the remotest areas with banking services due to their inadequate infrastructure.

He further said if the mobile financial services (MFS) are bestowed with the responsibilities of providing banking services at the doorstep of common people, they are capable of doing it.

"The banks' expansion of services stalls until agent banking; they can't move ahead further. I see the banks' lack of infrastructure to do so," he said while replying to a question at an event in a city hotel.

He was speaking to telecom sector reporters in the programme, organised by Nagad, an MFS provider, to announce its crossing of Tk 2.0-billion daily transactions mark.

Nagad is a public-private partnership-initiated digital financial service in Bangladesh, operating under the authority of the Bangladesh Post Office.

Speaking through digital platform, the minister said, "We would have been happier, if we could reach people with banking services besides the mobile financial services of Nagad."

"But you know the entire issue depends on the Bangladesh Bank (BB), and the central bank wants to facilitate these services through banks."

"We hope that we will be able to make the BB understand that MFS can provide banking services also," he further said.

He opined that bKash, the country's largest MFS provider and market competitor of Nagad, will no more remain number one MFS provider, if it does not bring down charges and fees as low as Nagad soon.

"People now know bKash as synonymous to MFS, but I think it will not be anymore."

Mr Jabbar said Nagad's key motive is not to make profit, but to serve common people.

The government earlier set a target for Nagad to reach the Tk 2.0-billion daily transactions mark by January next year.

The country's fastest-growing digital financial carrier has achieved the target much ahead of the deadline, said its managing director Tanvir A Mishuk in the programme.

In this January, Nagad crossed the milestone of Tk 1.0-billion daily transactions.

Mr Mishuk attributed the rapid advancement of Nagad to introduction of state-of-the-art technological innovations and customer-friendly services.

"We are working towards the goal of making all conventional services available on Nagad under the slogan - 'Everything will be through Nagad'. For that, we are working every day in the hope of achieving the impossible."

There was a time when a lot had to be done to open an account, but in just one and a half years of inception, Nagad has reached the milestone of Tk 2.0-billion transactions, he added.