Owners of Banglalink, the third-largest telecoms operator in Bangladesh, are considering offloading bulk of their stakes in the multinational to improve its liquidity situation, insiders say.

Apart from going public, speculations are rife that the company is also mulling over stakes selloff to private sector.

The authorities of the multinational company were recently in discussion with two major corporate houses of the country. "But, till now, nothing is mature," an official of the company told the FE Tuesday, on condition of anonymity.

One of these houses is in tobacco business and another one is owned by a politically influential business leader, sources said.

Though the official spokesperson for Banglalink declined to comment, saying that they do not comment on 'rumours or speculations', insiders said recently a top official of VEON met one of the potential buyers.

"In fact, in our industry, preparations for offloading stake or ownership transfer are being done quietly and is not made public unless there is a deal," said one industry-insider.

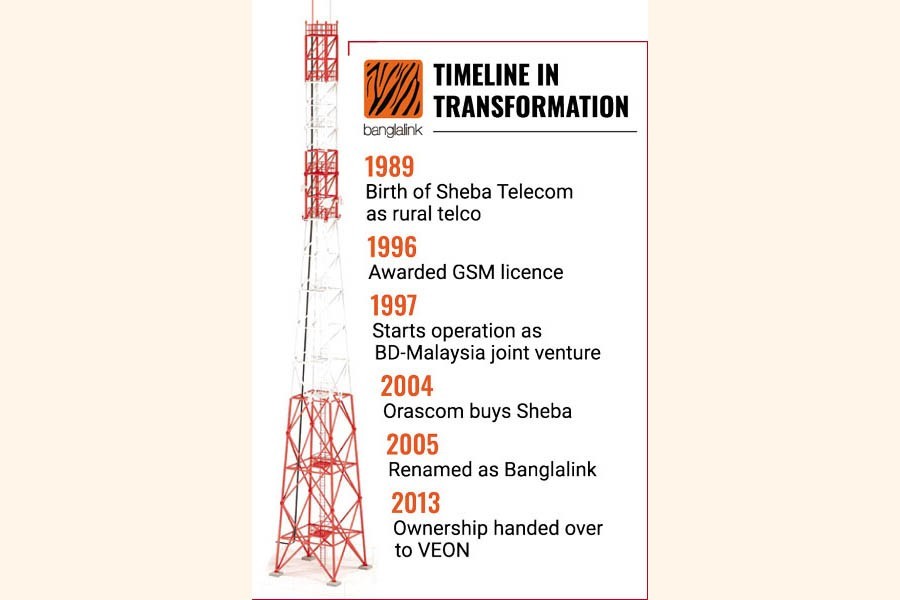

Previously, total secrecy was maintained when the ownership of Sheba telecom was transferred to Egyptian telecoms giant Orascom in a USD60- million deal in 2004.

Sheba got its telecom licence in 1989 to operate in rural areas and was granted GSM licence in1996.

It started off mobile telecoms operation as a Bangladesh-Malaysia joint venture in 1997.

After the takeover of the full ownership of Sheba by Orascom, the company was renamed and rebranded as Banglalink in 2005.

In 2013, Orascom sold its total stakes to the present owner, VEON, a Dutch company partially owned by Russian business tycoons.

It is learnt that the company wants to sell its stake to expand its network operation and quality as it made a move to set up 3000 new base transceiver stations (BTS) within this year.

The operator presently has over 10,200 BTS towers against the 18,023 of Grameenphone and 13,812 of Robi.

In 2021, the revenue of the company was nearly Tk 48 billion with a revenue growth of 5.1 per cent, officials said.

Its another plan is to offload 10 per cent of its shares on the stock market to have a better liquidity and recently the Banglalink authorities met the top brass of the Bangladesh Securities and Exchange Commission (BSEC) on Monday to discuss the listing of the company.

Their main competitor Robi Axiata went public following the largest-ever Tk 52.38 billion initial public offerings (IPO) in Bangladesh in 2020.

Grameenphone, the telecoms market leader, floated its Tk 48.60 billion worth of IPOs in 2009.

According to company officials it is serving over 11.40 million 4G users which is 33 per cent of its total customer base.

At the end of last year, Banglalink had a 37.2 million subscriber base out of the country's 178.6 million total active mobile SIM users.

Their market share is 21 per cent whereas the top operator Grameenphone has 46 per cent and Robi, the second-largest operator, has 30-percent market share.

However, there are speculations in industry circles that Banglalink may sell off its entire stakes as its owning company VEON is not in good shape due to the sanctions imposed on Russia over the Ukraine war.

Russian business-tycoon Mikhail Fridman and Peter Aven had their assets frozen last week, which include their stakes in LetterOne, which holds 48-percent stake in VEON, says an analyst.

Fridman and Aven subsequently stood down from the LetterOne board, while Fridman gave up his position as VEON director.

The 1.25-billion-dollar revolving credit facility, processed for VEON by a syndicate of global lenders, becomes uncertain due to the sanctions, say reports.

According to reports, Citigroup coordinated the $1.25 billion RCF, said the FT, with Barclays, Crédit Agricole, ING, JPMorgan, Raiffeisen and Société Générale among the lenders.

At the end of last month VEON withdrew $430 million of the facility to pay off a bond that matured. It leaves $820 million undrawn under the RCF credit line.

But VEON in a statement said that it should not be subjected to any sanctions since Fridman and Aven hold minority stakes in LetterOne, and that LetterOne is a minority stakeholder in VEON.