US apparel imports from its top five destinations including China, Cambodia and Vietnam recorded a rise while that from Bangladesh and India declinedduring the first four months of the year 2021.

During January to April period in 2021, the US apparel imports from China witnessed 19.86 per cent growth to US$ 4.66 billion which was $3.89 billion during the corresponding period of last calendar year, according to data available with the Office of Textiles and Apparel (OTEXA), an affiliate of the US Department of Commerce.

Exports from Cambodia and Vietnam to the US also witnessed a growth of 8.91 per cent and 8.56 per cent respectively year on year during the period.

Vietnam exported US$4.55 billion worth of apparel items to the USA from January to April of 2021, showing a speedy recovery. Cambodia exported US$ 1.02 billion during the period, according to OTEXA data.

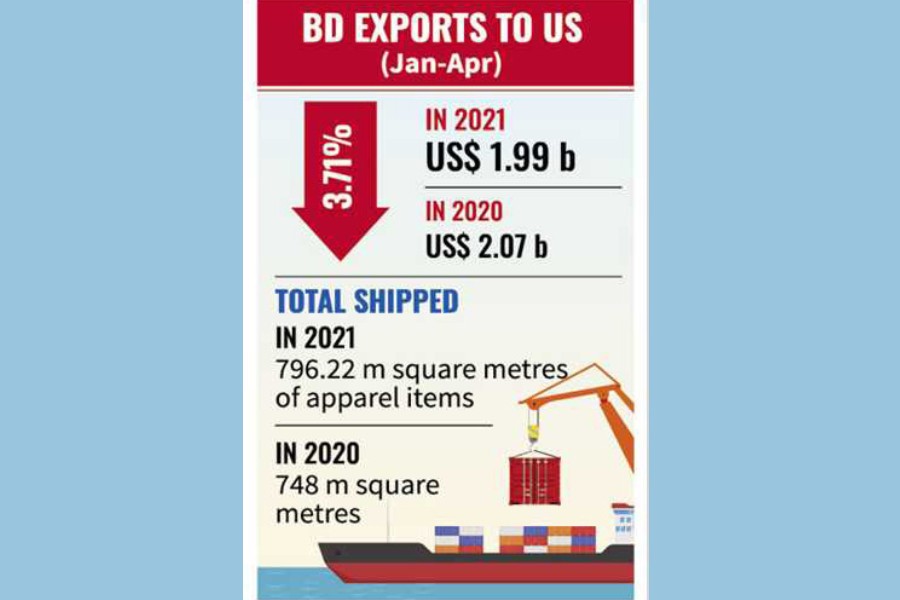

On the other hand, Bangladesh fetched US$ 1.99 billion during the period under review through apparel exports to the US, down by 3.71 per cent from $2.07 billion during the same period of 2020.

During the first four months of this year, Bangladesh shipped 796.22 million square metres of apparel items, up from 748 million square metres in the corresponding period last year.

The country fetched $5.22 billion in 2020, against $5.92 billion in 2019 through apparel exports to the USA.

The US apparel imports from India fell by 1.10 per cent to $1.34 billion in the first four months of 2021, according to the data.

Apparel exporters, however, listed the Covid-19 pandemic, among others, as a reason that had further eroded the competitiveness of local RMG exports.

US overall apparel imports from the world also increased by 8.53 per cent to US$ 23.07 billion from $21.26 billion during the same period in 2020, data showed.

Asked, Faruque Hassan, president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said the OTEXA data reflected that unit price of locally made apparel items had declined despite the higher volume of exports to the US.

Local exporters are taking the work orders below their production costs mainly to keep the factories operational and sustain the employment, he claimed.

Talking to the FE on Sunday, Fazlee Shamim Ehsan, a director of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said Bangladesh is losing its competitiveness to its main rivals, especially China and Vietnam.

China is more competitive in terms of man-made or artificial fibre while buyers shifted to Vietnam as it could offer competitive prices of apparel items, he explained.

During the pandemic that has eaten up the global demands for apparel, buyers are placing orders or sourcing from the destinations that are able to offer competitive or lower prices, he noted, adding that Vietnam was also ahead of Bangladesh in this area.

In this connection, Bangladesh failed to retain the work orders followed by price hike by spinners, he alleged.

Industry people opine that China and Vietnam export a more diverse range of products, whereas apparel exports from Bangladesh concentrate on basic fashion items only.

The BGMEA president, however, was optimistic about growth in the next quarter saying that an increase in value might be observed followed by the rise in raw materials.