Bangladesh's land property-transfer market rebounds strongly even amid corona curbs with several financial factors, including a pause in capital flight, pushing up sales, officials say.

They find a spurt in sales volume of land and apartments across the country after the coronavirus-induced lockdowns were over.

Such a rise in land and apartment transfers comes as a boon for government exchequer, too, as a major portion of its non-NBR tax-revenue target of Tk 160 billion for the financial year 2021-2022 will come from this area.

The way the collection is mounting the revenue target set for the land registration in the ongoing fiscal is likely to be met ahead of the deadline.

Usually, the government earns revenue amounting to around Tk 100 billion on average in a fiscal from 13 areas related to the property trade.

The areas are registration of transfer deeds, including fees, certified copies of documents, stamp fees, tax at source, renewal fees, land-handover fees and some other fees.

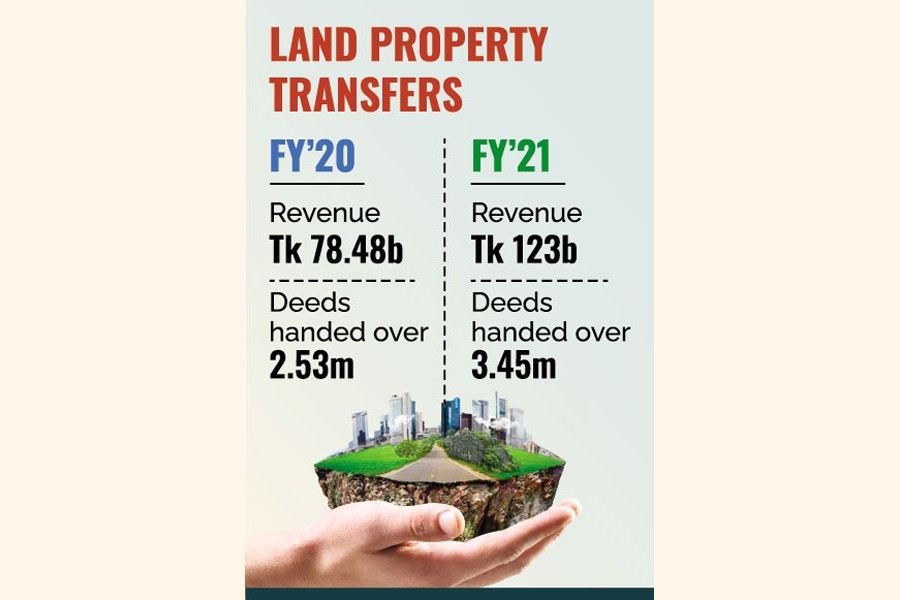

But in the financial year (FY) 2020-2021, estimated revenue of around Tk 123 billion was earned from land-property transfers, according to the statistics with the state-run Directorate of Registration.

They earned revenue through handing over 3.47 million deeds that accounted for 82 per cent of government's previous fiscal's non-NBR tax-revenue target at Tk 150 billion.

Of the revenue, Tk 93.39 billion came from registration purposes while the remaining Tk 29.53 billion came in the form of local-government tax.

In the previous fiscal year, 2019-2020, the revenue figure was Tk 78.48 billion earned through handover of 2.55 million deeds across the country.

Normally, the country sees sales of around 3.0 million deeds per annum, but the pandemic that appeared here in March 2020 badly affected trade in land property like other sectors, according to the officials engaged in the sales and transfers.

When contacted, Inspector-General of Registration (IGR) Shahidul Alam Jhinuk admitted the leap in sales of land, saying that revenue earnings from the sales have increased significantly in recent times.

Behind the sector's turnaround he sees several factors, like economic recovery from covid shocks, increased flow of remittance, and lower registration costs.

He says a significant number of expatriate Bangladeshis, who contribute a good share to annual land transfers, returned home with money because of the pandemic.

As there were not very many vibrant areas to invest in during the covid time, this community chose land property for their investment. And this cast a positive impact on the sector, he adds.

Talking to the FE, former president of Bangladesh Registration Service Association (BRSA) Dipak Kumar Sarker cited two reasons that made a contribution to the rise in revenue.

Government offices were shut for days due to the government-enforced restrictions soon after the pandemic had hit the region. Once the offices resume operations, people in large numbers started flocking to the offices to avail the services.

"Another reason is strong economic recovery-and some sectors enjoy huge growth even in the covid time, which also positively impacted the sale," says Mr Sarker, also district registrar of Khulna.

Seeking anonymity, a sub-registrar says the pandemic is not only hitting country's economic activities but also deterring the scope of capital flight.

In the covid time, he adds, people having good amounts of undisclosed money chose the area of land-property transfer to whiten their 'black money'.

"These buyers do not show the actual price of land beyond the minimum land value during registration to avert additional cost. So, by doing so, he/she can whiten huge volume of undisclosed money," he says about the why behind the push to property market.

A post-lockdown surge in property or real-estate market in developed countries, including the United States, is also reported.

"There has been created a huge demand for house over there. We want to change our old house but don't find an affordable new one-huge price rises have taken place," says one Bangladeshi expatriate to Pennsylvania, who is back on vacation.