The country's tax collection at import stage marks impressive growth as taxmen have been taking a conservative approach as far as rationalisation of tariff is concerned.

Import duty rate is one of the highest in Bangladesh, 25 per cent, among top five countries, which experts find as a negative factor for a developing country.

As a World Trade Organisation (WTO) member, Bangladesh will have to bring down its average import tariff for the sake of trade liberalisation.

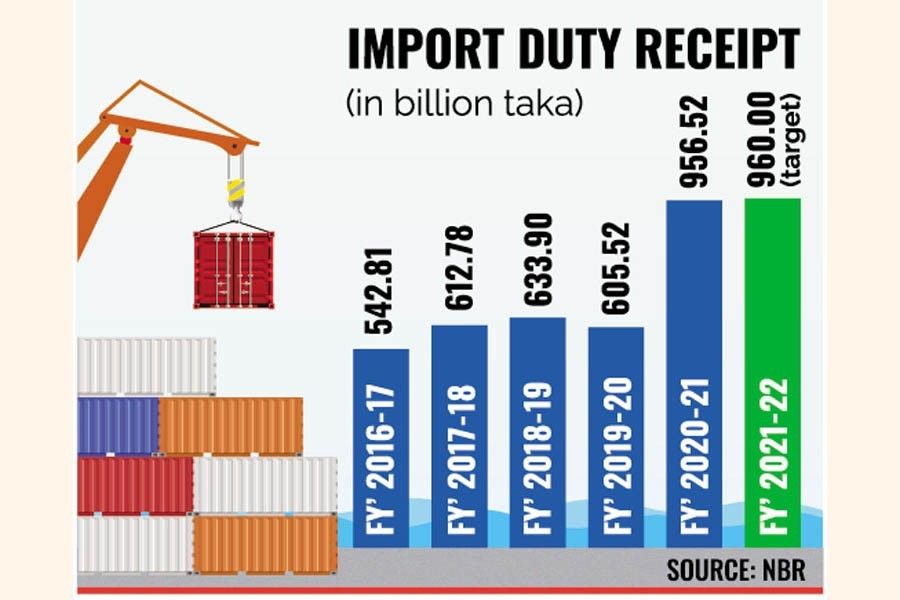

Data available with the National Board of Revenue shows revenue collection at import stage has grown by 76.12 per cent in the past five years (2016-17 to 2020-21).

However, the volume of income tax receipts was higher than customs revenue as almost 60 per cent taxes come at import stage in the form of advance income tax (AIT).

Policy Research Institute chairman Dr Zaidi Sattar says total tax incidence (TTI) at import stage stands at 51 per cent on average in Bangladesh.

It is among one of the top five countries having higher import taxes, he adds.

Dr Sattar says the country has to shift its dependence on trade tax at import stage to domestic revenue mobilisation from VAT and income tax.

The local market is more profitable for non-RMG exports because of higher tariff protection. This is also discouraging them from venturing into export, he adds.

Officials listed the surge in commodity imports, hike in their international prices, increased freight charges, efforts to check trade-based tax evasion and automation as factors that propelled the higher growth of customs revenue.

Import of goods grew by 20 per cent in fiscal year (FY) 2020-21 despite the pandemic.

In the first half (H1) of this fiscal, the revenue collection at import stage grew by 19.50 per cent.

In the first quarter, customs revenue grew by 21 per cent than that of the corresponding period last year.

However, the aggregate revenue collection growth in the past six months has been between 14 and 16 per cent.

Chattogram Customs House (CCH), the main entry point of goods, posted 32.42-per cent growth in revenue receipts year on year in December 2021 while it achieved 26-per cent growth in H1.

CCH commissioner Md Fakhrul Alam said efficiency of customs monitoring team and enforcement of law helped check evasion at import stage.

Importers have to count up to 200-per cent penalty in case of detection of irregularities. Such high penalty has reduced around 80 per cent of irregularities and cases also declined by 50 per cent, he added.

Post-clearance audit, advance ruling, intrusive inspection and e-payment have also started paying off.

Prices of major revenue-earners like fuel oil, bitumen, motor vehicle, electrical and electronic items, lime and cement products, iron and steel, plastic products, sugar, nuclear stove, boiler, machinery, fruits and nuts have gone up globally.

This global price impact and the high cost of imported commodities have contributed to higher customs duties, although the government refrains from upward adjustment of import-stage taxes considering Covid-19.

Petroleum products are one of the major revenue contributing importables that saw a price hike in the international market.

The import cost of petroleum products reached $1.04 billion during the July-August period, up 71 per cent year on year.

A senior customs official says scope for tax evasion has decreased significantly in recent years, thanks to the monitoring of the value-declaration process.

Checking tax evasion at entry point is easier compared to that of detecting direct tax evasion as those are scattered in many placed, he adds.

Former customs member Syed Golam Kibria suggests that Bangladesh cuts tax at import stage as a WTO member.

Still, the country maintains a conservative approach to reducing import-stage taxes, fearing revenue loss.

"A liberalised fiscal policy is required to facilitate local industries get access to the international market," Mr Kibria says.

Local manufacturers are enjoying fiscal protection that is supposed to phase out after a certain time.

Such protection makes the local market more profitable for them compared to that of exporting those to other countries, he concludes.