A mini briefing recently published by global energy think tank Ember finds that spot market LNG imports could cost Bangladesh about $11 billion between 2022 and 2024. Solar could reduce these imports by 25 per cent and save the country $2.7 billion.

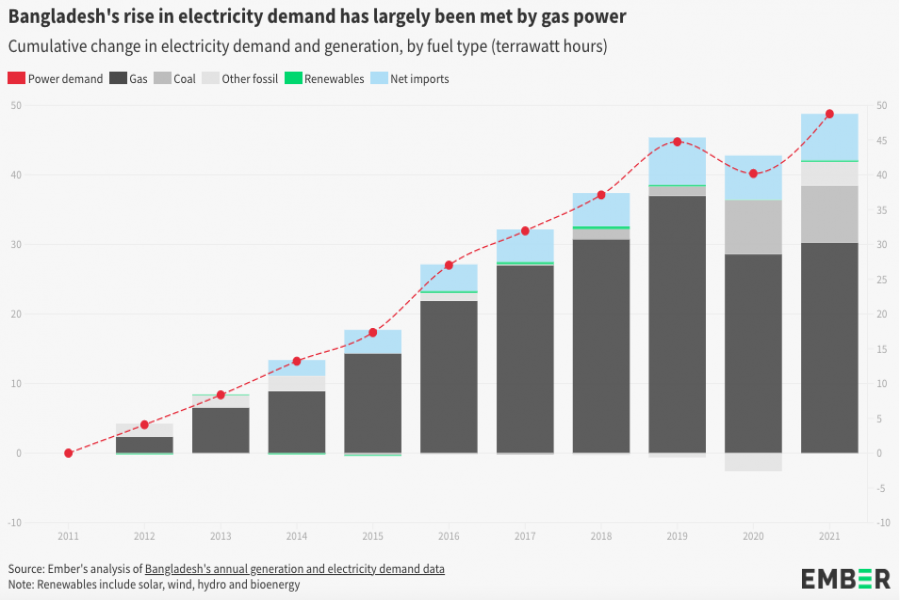

The briefing shows that heavy reliance on gas for power generation is a key factor in the current LNG import crisis in Bangladesh. Ember’s Data Explorer shows that Bangladesh’s electricity demand grew on average at 8 per cent annually in the last decade; about 62 per cent of which was met with gas power. To keep up with the demand, the country started importing LNG from 2018-2019 and eventually started purchasing LNG from the spot market from 2020. By contrast, renewable energy generation saw only marginal growth and accounted for just 1 per cent of Bangladesh's total power generation in 2021.

Ember’s analysis finds that under current plans, Bangladesh could spend $11 billion between 2022 and 2024 just on spot market LNG imports to keep up with its growing electricity demand, weakening the country’s energy security. This number could be even higher if Bangladesh’s spot LNG imports continue to increase as per the trend in the recent year.

The Mujib Climate Prosperity Plan published in 2021 laid out ambitious solar targets. Had this plan been fully implemented, additional solar generation could have reduced these imports by 25 per cent between 2022 and 2024, saving about $2.7 billion.

Ember’s senior electricity policy analyst, Aditya Lolla, said: “Bangladesh can turn the current power crisis caused by the spiralling gas prices into an opportunity. Redirecting its efforts to ramp up renewable energy capacity and grid augmentation investments now can solve so many problems. It will reduce the country’s reliance on expensive LNG imports, offer protection from global fossil energy price fluctuations, reduce the fiscal burden on the government, improve overall energy security and place Bangladesh in a stronger position in climate negotiations.”

What is clear from the current crisis is that Bangladesh needs to diversify its energy mix in a more sustainable way. Pivoting to renewable energy will decrease energy costs and boost energy security.

Ember’s electricity analyst, Dr Achmed Edianto, said: “Renewable energy, especially solar, represents a low-risk diversification option when compared to other fossil energy sources. Once installed, domestic renewables offer Bangladesh control over its energy and protection from global market volatility.”

A practical breakthrough is required to allow the renewable market to grow. For this, the government needs to address various supply-side issues such as insufficient grid infrastructure, lack of flexible capacity to accommodate rising outputs from variable renewable energy, and oversupply in the domestic electricity market.

In its updated NDC, Bangladesh committed to 4.1 GW RE by 2030 contingent on international support, up from the current level of 0.5 GW. While this is a step in the right direction, it will not be enough.

For Bangladesh to shake off its fossil fuel reliance and build a sustainable, reliable and affordable electricity supply, international financing in building renewable capacity and flexibility is absolutely critical. Investing in solar makes sense for the financiers too as the investments are likely to be paid off quickly.

India is currently building solar power plants at an average cost of $560 million/GW. Even if such projects cost 50 per cent more in Bangladesh and if we assume flexibility and grid augmentation costs double the overall project cost, about 6.5 GW of solar could still be installed with the same $11 billion, which Bangladesh might have to spend on spot market LNG purchases in just 3 years.