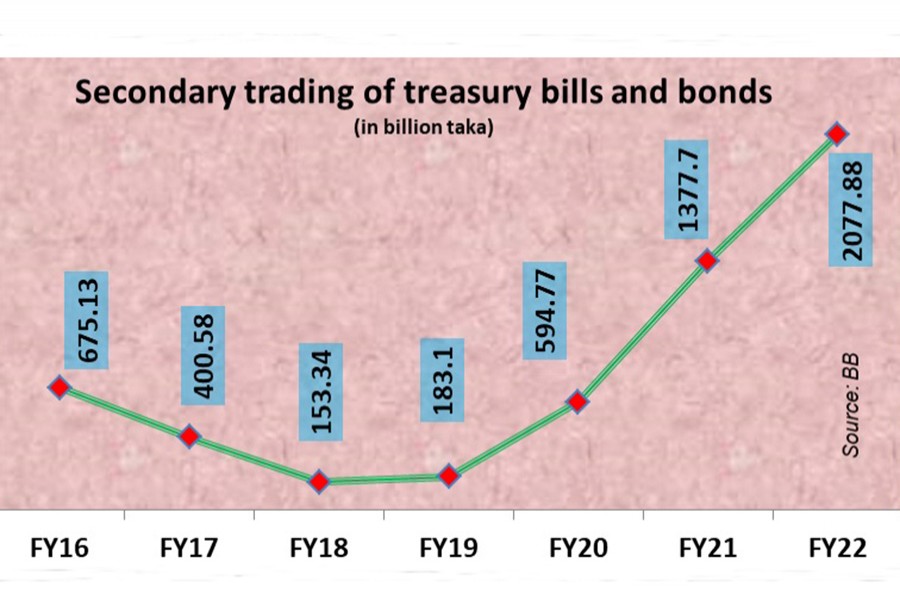

Annual transactions of the government’s fixed-income tradable securities in the secondary market crossed Tk 2.0 trillion in the past fiscal year (FY22).

Statistics available with Bangladesh Bank showed that the combined value of annual secondary transactions of short and long-term government securities stood at Tk 2077.88 billion (or Tk 2.07 trillion) in FY22 which was 1377.70 billion (or Tk 1.37 trillion) in FY21.

Thus, the secondary trading of treasury bills and treasury bonds jumped by around 50.82 per cent in the last fiscal year over the previous fiscal year (FY21).

Treasury bills are short-term debt instruments of the government while treasury bonds are long-term in nature.

Earlier in FY20, the annual transaction of the government’s tradable debt securities in the secondary market was recorded at Tk 594.77 billion against Tk 183.10 billion in FY19.

Bangladesh Bank, on behalf of the government, issues the treasury bills to manage day-to-day liquidity. It also issues treasury bonds for mobilising long-term debt for the government to finance the budget deficit.

Selected banks are now authorised primary dealers to purchase the bills directly through the auction conducted by Bangladesh Bank.

Other banks and financial institutions are allowed to purchase and sell the bills and bonds among themselves in the secondary market as a secure investment. Individuals can also invest in these fixed-income securities.

Savings certificates with various maturities are other fixed-income government securities. These are, however, not tradable in the secondary market.

Bangladesh government issues and sells all these securities to borrow from the market to finance the budget deficit.