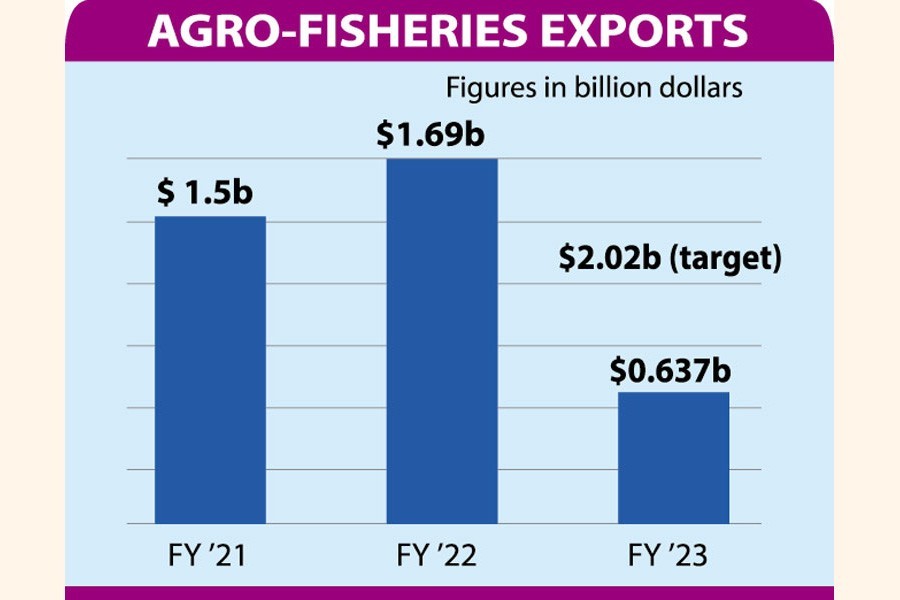

Agro-fisheries exports witnessed a massive fall so far this financial year after fetching record US$1.69 billion last fiscal year (FY).

Despite having lucrative 10- to 20- percent incentives for businesses against their shipment, exports declined by 25 per cent in the first five months (July-November) of the current financial year to $637 million.

It was $843 million in the same period of FY '22, show Export Promotion Bureau (EPB) data.

Businesses and experts said if the trend continues for the next few months, the target to post $2.08 billion in export earnings might remain a dream.

Falling demand, rocketing freight charges as well as shortage of suitable farm produce are key reasons for the gloomy condition, said insiders.

Bangladesh exports fisheries products, including shrimp, other frozen fish, live fish, crab and eel, and fresh agricultural products like fruits, vegetable, tobacco, tea and spice, and processed farm products to more than 60 countries.

"EU, UK, Middle East, Malaysia, Indonesia, Singapore and India are the key importers of Bangladeshi fresh and processed products," said SM Zahangir, president of Bangladesh Fruits Vegetable and Allied Products Exporters Association.

He said the export of fresh products usually remains low in summer but rises in winter.

This year the summer export was comparatively low compared to previous years amid a higher freight charge, low cargo space, and a lack of suitable vegetables caused by a flood in June-August period, he said.

He said local vegetable prices were too high to make any profits resulting in a low export.

"But the conditions have started changing since the first week of December as winter vegetable prices have become rational for the traders," he said.

He said potato exports would also add a good amount to the shipment, he said.

But the overall export target from agricultural and fisheries products for FY '23 could hardly be achieved if the current trend continues, he added.

Shariful Alam, an exporter, told the FE that air freight charge is more than $2.5 a kg, which is below $2.0 a kg for competitors India and Thailand.

He said the higher domestic price and freight charge discourage many medium-scale traders from getting involved in exports.

Ahmed and Co proprietor Md Iqtadul Hoque told the FE that the demand is lesser in EU, UK and ME amid a recession.

Raw materials have become pricey but buyers are not ready to raise prices while production has also declined amid the energy crisis, he said.

"Our company exports puffed rice, potato and a few other products to the Middle East, UK, Malaysia, Singapore and EU countries," said Mr Hoque, also general secretary of Bangladesh Agro Processors Association (BAPA).

Bangladesh is losing the puffed rice market gradually to India amid higher prices of rice in Bangladesh as well as rocketing freight charge, he pointed out.

The good sign is that potato and processed agro products export has been rising since the second week of December, he added.

According to the EPB, the country fetched $429 million from fresh farm and processed products in July-November '23 period against $557 million in the same period of FY '22.

Processed food exports declined to $282 million during the period from $448 million in the same period of FY '22.

The company Pran alone comprises 50 per cent of the processed food and beverage shipment.

Director of Pran Kamruzzaman Kamal said despite all odds his company has been able to maintain a 20 per cent export growth thanks to its diversified products and markets which hardly could affect its overall shipment.

"We export above 100 of products to 145 countries. Exports of many products declined in few destinations amid a fall in demand there for recession while many countries also raised their orders for some specific products which make balance."

He recognised that most of the industries are facing a great challenge for the demand fall and a notable appreciation of US Dollar that fuelled up raw material costs.

Meanwhile, the shipment from shrimp and other frozen and live fish fell by 27 per cent to $208 during the July-November period from $287 million in the corresponding period of FY '22.

Bangladesh Frozen Foods Exporters Association (BFFEA) president Amin Ullah also echoed a decline in demand in Europe amid higher inflation followed by the Russia-Ukraine war as one of the key reasons behind the fall in shrimp and other frozen fish exports.

He said higher production costs of local shrimp and its declining output are other reasons for the fall.

Export earnings from agro-fisheries combined was $1.5 billion in FY '21 which surged to all-time high $1.69 billion in FY '22.

The target has been set at $2.02 billion for the current financial year which is unlikely to achieve, said insiders.