Bangladesh's import expenses crossed US$22 billion in the first five months of the current fiscal year (FY), 2018-19, following a 59.59 per cent increase in fuel oil import, officials said.

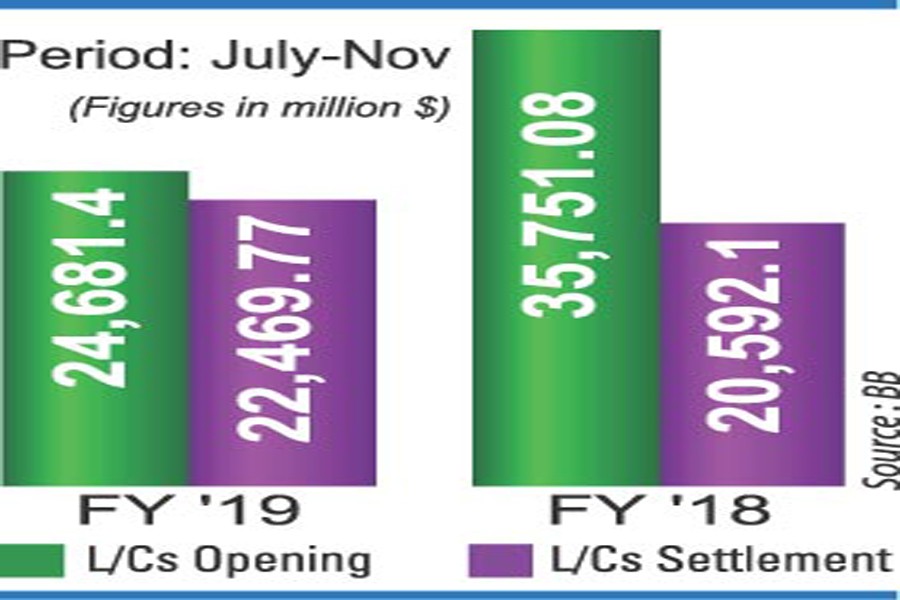

The actual import in terms of settlement of letters of credit (LCs) grew by 9.12 per cent to $ 22.47 billion during the July-November period of FY '19 from $20.59 billion in the same period of the previous fiscal, according to the central bank's latest statistics.

But opening of LCs, generally known as import orders, dropped by nearly 31 per cent to $24.68 billion during the period under review from $35.75 billion in the same period of FY '18.

"The import orders fell significantly in the five months of this fiscal mainly due to the national polls," a senior official of the Bangladesh Bank (BB) told the FE.

He said most of the businessmen had maintained a 'go-slow' policy for setting up fresh LCs ahead of the polls to avoid possible risks.

Earlier, LCs for some mega projects including Rooppur Nuclear Power Plant (NPP) were opened that has also contributed to fall in the import orders, the central banker explained.

The country's overall import orders recorded an all-time high of $16.10 billion in November 2017 while LC of a large amount was opened for setting up Rooppur NPP.

Bangladesh Atomic Energy Commission (BAEC) opened the LC worth $ 11.38 billion through the state-owned Sonali Bank Limited to import different items, including capital machinery, to build the plant.

"The settlement of LCs will be increased more than that of opening in the coming months," the central banker predicted.

Talking to the FE, Syed Mahbubur Rahman, chairman of Association of Bankers, Bangladesh (ABB), said fresh LCs opening would not increase significantly before March this calendar year.

He also expected that expenses for fuel oil imports may ease after one-and-half month following downward trend of petroleum products prices in the global market.

The overall import payments increased during the period under review mainly due to higher import of petroleum products, according to another BB official.

Import of petroleum products rose to $1.79 billion in the first five months of FY '19 from $1.12 billion in the same period of the FY '18.

The central banker also said the upward trend in term of quantity in fuel oil imports may continue in the coming months following diversified use of the gasoline products, particularly for power generation.

Currently, around 70 power plants out of the total 127 across the country are running with fuel oil.

On the other hand, import of capital machinery or industrial equipment used for production, dropped by 5.18 per cent to $2.01 billion from $2.12 billion, the BB data showed.

However, import of intermediate goods, like coal, hard coke, clinker and scrap vessels etc, increased by 53.51 per cent to $2.43 billion in the July-November period of FY '19 from $1.58 billion in the same period of the previous fiscal.

Industrial raw materials import also rose by nearly 10 per cent to $7.98 billion during the period under review from $7.26 billion in the same period of FY '18.

Meanwhile, import of food grains, particularly rice and wheat, dropped by 53.65 per cent to $572.53 million from $1.23 billion.

Import of consumer goods also decreased by 30.58 per cent to $2.24 billion during the period under review from $3.23 billion, the BB data showed.