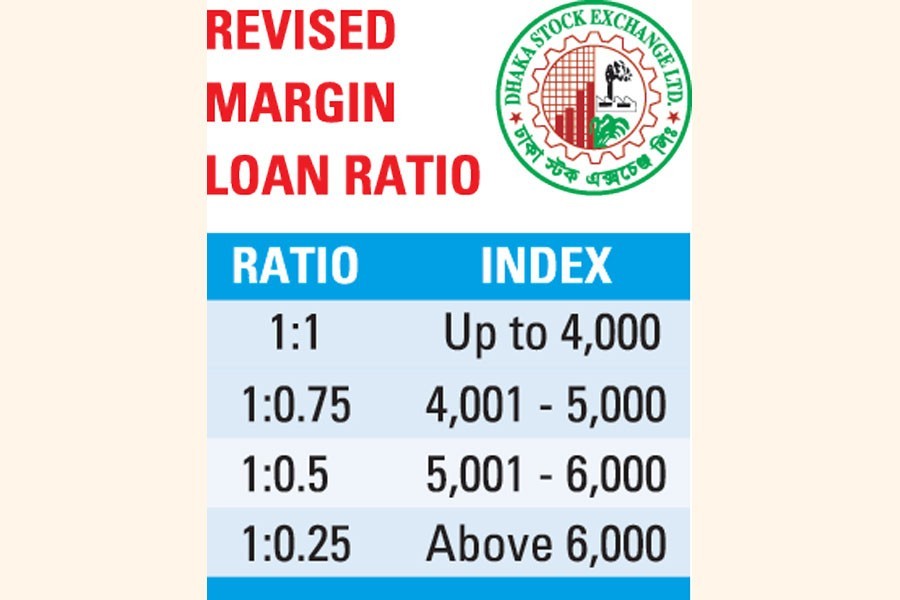

The Bangladesh Securities and Exchange Commission (BSEC) on Monday issued an order revising the margin loan ratio.

As per the revised ratio, margin loan will be distributed at a ratio of 1:1 if the broad index exists up to the 4,000 mark.

The margin loan ratio will be 1:0.75 if the DSE broad index is between 4,001 points and 5,000.

The ratio will be 1:0.50 if the index is between 5,001 points and 6,000 points.

And the ratio will be 1:0.25 if the index goes beyond 6,000 points.

The revised margin loan ratio will come into force from October 1 and the existing ratio is 1:0.5.

"The BSEC has revised the existing margin loan ratio to minimise investment risks as the stock market shown an upward trend," said Mr Karim, who is also spokesperson of the commission.

Stocks witnessed the biggest single-day fall in six months on Monday as risk-averse investors preferred to book quick-profit on major sectors issues.

DSEX, the prime index of the Dhaka Stock Exchange (DSE), settled at 5,012, losing 76.74 points or 1.50 per cent over the previous day.

It was the biggest single-day index fall in more than six months since March 18, when DSEX lost 169 points as investors dumped their holdings fearing impact of Covid-19 outbreak.

With Monday's decline, DSEX lost more than 104 points in the past three consecutive sessions after a big jump in recent weeks.

DSEX surged a cumulative 1,144 points or 29 per cent in the past 13 consecutive weeks. The DSE market-cap also added Tk 752 billion during the period under review.

The news of Walton Hi-tech Industries trading from Wednesday also created some sell pressure in the market as investors freed some fund to take position on the newly listed stock, commented EBL Securities.

The prime bourse witnessed a natural correction, as some investors intended to realise the profit generated from the previous few days, said a merchant banker.

All major sectors faced correction with food sector witnessed the highest loss of 1.70 per cent, closely followed by telecom with 1.60 per cent, banking and financial institutions 1.50 per cent each, engineering 1.40 per cent and power 1.20 per cent.

Meanwhile, investors at a webinar said internet-based transactions must be encouraged on a large scale to expand the country's capital market to keep pace with those of the developed world.

The views came on Monday at a virtual public hearing on 'Prevailing Internet Based Trading: Problems and Prospects,' organised by the Bangladesh Securities and Exchange Commission (BSEC).

The hearing was arranged in association with the Training Academy of Dhaka Stock Exchange (DSE) targeting TREC (trading right entitlement certificate) holders.

BSEC commissioner Mohammad Abdul Halim, who attended the hearing as the chief guest, said it has been organised as part of the regulator's move to ensure good governance in the capital market.

"The problems of IT infrastructure, which is hindering internet-based trading, will be discussed. And the stakeholders' opinions will be taken into account to ensure time-befitting infrastructure of the capital market,"

He said the idea of holding hearing is to sensitise the policy makers about the investors' satisfaction or dissatisfaction over public service.

"The securities regulator exercises rules and regulations for ensuring disciplines in the capital market. We think stakeholders play an important role to help the securities regulator ensure good governance in the capital market," said the BSEC commissioner Mr. Halim.

Mohammad Rezaul Karim, a BSEC executive director, said the securities regulator will continue holding public hearing to get opinions from the stakeholders and investors.

"Today's hearing has been arranged to receive observations regarding the problems and prospects of internet-based trading," Mr. Karim said.

He said investors will have to be encouraged to conduct internet based trading to in line with the stock markets of developed countries.

"Technology will help us ensure accountability and transparency in the capital market and the incumbent commission is working on this," said Mr. Karim, adding that the whole transactions of the capital market should be internet-based.

Presently, around 10 per cent of daily transactions of the premier bourse is executed through DSE mobile app introduced on March 9, 2016.

The number of active BO (beneficiary owner's) accounts stood at 2.34 million on Monday, of which only 52, 000 use the mobile app to conduct trading.

The securities regulator has over and over expressed its dissatisfaction over the number of insignificant mobile app users.

Mr Karim also said internet-based transactions must be encouraged if the brokerage firms want to open trading outlets in different areas of the country.

More than 180 participants, including former vice president of Dhaka Stock Exchange Ahmad Rashid Lali, BSEC executive director Mahbubul Alam, all departmental chiefs of DSE attended the hearing.

The participants told the hearing that they face the problems when they login using the mobile app.

They also said it takes time for executing orders through the mobile app.

Besides, problems crop up while maintaining order sheets, the participants said.