Stock exchanges and the merchant bankers association urged the National Board of Revenue (NBR) to widen the tax rate gap between listed and non-listed companies to encourage good companies to join the capital market.

Currently, listed firms other than banks, insurers, financial institutions, mobile operators, and tobacco companies, which issued shares equivalent to more than 10 percent of their stakes, pay 20 per cent corporate tax while their non-listed peers pay 27.50 per cent tax.

The rate is 22.5 per cent for the listed firms that floated shares comprising 10 per cent or less of the paid-up capital. The tax rate is 25 per cent instead of 22.5 per cent if companies fail to meet regulatory conditions.

At a pre-budget meeting on Sunday, the market stakeholders also urged the NBR to create scope for investments of undisclosed money in the capital market, with a 5 per cent tax imposed, to boost the liquidity flow.

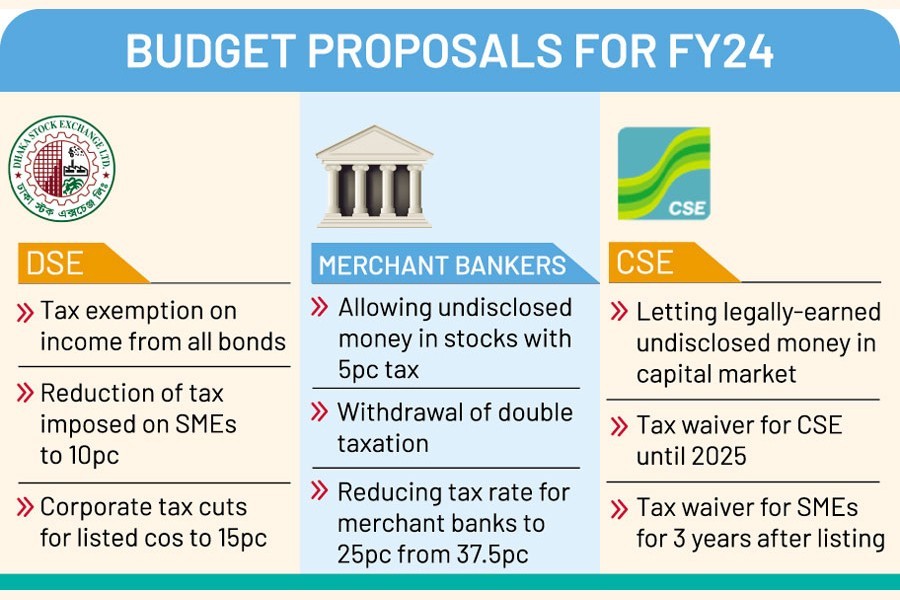

Leaders of the Dhaka Stock Exchange (DSE), Chittagong Stock Exchange (CSE) and Bangladesh Merchant Bankers Association (BMBA) presented their proposals for the fiscal year 2023-24 to NBR Chairman Abu Hena Md. Rahmatul Muneem.

Bangladesh Merchant Bankers Association (BMBA)

The merchant bankers submitted five-point budget proposals, including opening up opportunities to invest undisclosed money in the capital market.

They said investments of undisclosed money would help revive the struggling market.

Another proposal was to widen the tax rate gap at least by 15 per cent between listed and non-listed companies.

"More non-listed companies will be inspired to go public if the amount of corporate tax is reduced. The government revenue will be increased as well," reads the proposal.

According to the association, there are more than 0.2 million companies registered while only 354 are publicly listed. It argues that many good companies are not coming to the capital market due to the existing narrow gap of the tax rates applied to listed and non-listed firms.

"The NBR would be able to bag higher revenue despite the proposed tax cut if more large companies come to the capital market."

The association also sought slashing of tax rate for merchant banks from 37.5 per cent to 25 per cent.

There are 67 merchant banks operating in Bangladesh and most of them could not maintain operating costs due to the slow trend of the stock market, the association said.

Currently, tax on dividends is being deducted at source. Again, taxpayers need to pay income tax for dividends in case annual dividend income crosses Tk 50,000. This is a double taxation and the BMBA urged waiver of the tax on dividends for long-term investments.

Dhaka Stock Exchange

The premier bourse placed a six-point budget proposal, including tax exemption extended to all kinds of bonds including Sukuk and asset-backed securities similar to zero-coupon bonds.

Only 10 corporate bonds are listed on the DSE. A few corporate bonds have been approved and issued under private placement.

"A vibrant bond market may help the economy in different ways. If tax exemption is implemented for all kinds of bonds, it will encourage establishing of a vibrant bond market."

The DSE also proposed reducing the corporate tax rate of listed companies from the existing 20 per cent to 15 per cent. That, it said, would encourage multinational and good companies to be listed on the bourses.

It also proposed a concessional tax rate of 10 per cent for listed SMEs for a period of five years from the date of listing on the SME board.

It also demanded that tax on dividend income of corporate shareholders be brought down to 10 per cent from the existing 20 per cent.

The prime bourse also proposed exemption of income tax from trading of shares by stock dealers considering the present market situation. Currently, 10 per cent tax is applicable on share transactions in the secondary market.

"Stock dealers are integral part of the capital market. Their participation in the market brings stability."

Chittagong Stock Exchange

The CSE made a 14-point proposal including the cancellation of tax at source from dividends paid by listed companies in a bid to avoid double taxation.

The port city bourse also sought an opportunity of investing legally-earned undisclosed money in the capital market to help rejuvenate the capital market.

The CSE also sought tax waiver for SME companies for the first three years after the listing and fixing 15 per cent corporate tax for companies after three years. The CSE said this scope would help strengthen corporate structures of SME companies.

The port city bourse proposed expanding the tax-free limit to Tk 0.1 million dividend income from listed companies from Tk 50,000. It said the tax-free limit on cash dividends of mutual funds should be expanded to Tk 50,000 from Tk 25,000.

The CSE also sought tax waiver for the exchange till June 30, 2025 to facilitate the implementation of commodity exchange and other infrastructure developments.

It also demanded tax waiver on income from corporate bonds and government securities, among others.