The market rebounded this week to Wednesday, paring some losses from the previous week, as investors put fresh funds on stocks amid optimism following the central bank's move to stabilise the foreign exchange rates.

All three trading days of the week posted gains, as the market remained closed on Monday and Thursday due to public holiday.

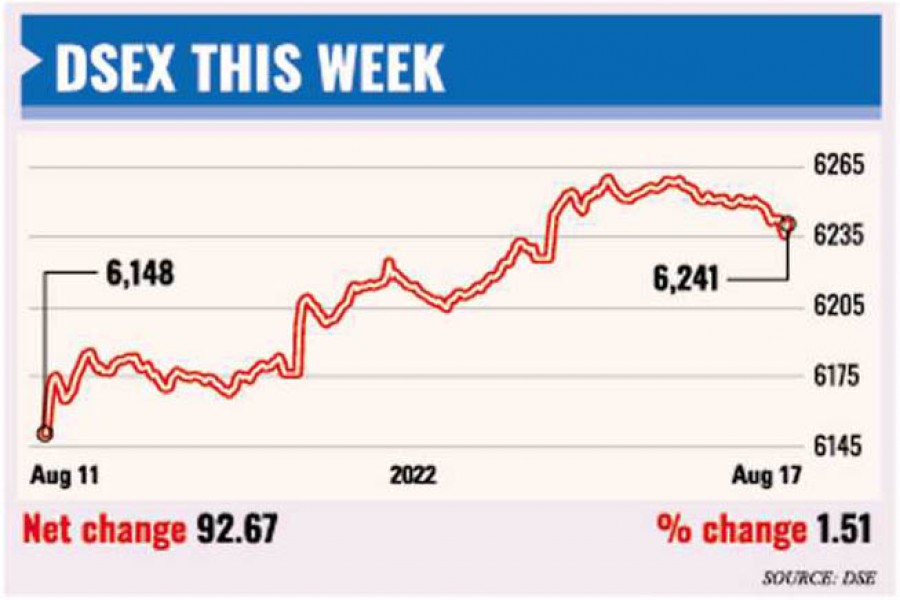

DSEX, the key index of the Dhaka Stock Exchange (DSE), climbed 92.67 points or 1.51 per cent to settle the week at 6,241.44, after losing over 163 points the previous week.

Market operators said the central bank tightened the spread between the buying and selling rates of the US dollar to contain the currency volatility, which helped improve the investor sentiment to some extent.

Bangladesh Bank this week set the spread between buying and selling rates of the greenback at Tk 1.0 for banks while the spread for money exchanges is Tk 1.50.

The general investors increased their participation hoping that the market will not fall further due to regulatory assurance to keep the 'floor price' in place until further order, said a merchant banker.

He noted that the investors gained some confidence amid continuous declining trend of fuel price on the global market as well as slight stability in the foreign exchange market.

Some positive economic indicators such as rise in remittance inflow, declining imports, falling inflation and positive export growth also prompted investors to put fresh funds on stocks, he said.

The market participants reacted positively to the recent initiatives from the central bank in tightening the dollar spread to manage the ongoing foreign exchange volatility along with the continuous decline in oil prices in the global markets, EBL Securities said.

"Announcement of adjusting the fuel price in the local market according to the global market price also played a role in changing investors' sentiment," said the stockbroker.

International Leasing Securities said the assurance of the securities regulator regarding keeping the 'floor price' in place until further order boosted the investor confidence in the market.

The week's total turnover stood at Tk 28.38 billion on the prime bourse as against Tk 35.84 billion in the previous week as this week saw only three trading days and the previous week four days.

The daily turnover averaged out at Tk 9.46 billion, up 5.61 per cent over the previous week's average of Tk 8.96 billion.

Investors were mostly focused in the textile sector, capturing 20 per cent of the week's total turnover, followed by miscellaneous sector (14.2 per cent) and pharmaceutical sector (9.5 per cent).

Two other indices of the DSE also ended higher this week. The DS30 Index, comprising blue-chip companies, rose 25.66 points to close at 2,220.05 and the DSES Index advanced 20.67 points to finish at 1,366.38.

Almost all sectors posted gains this week with cement sector witnessing the highest gain of 6.10 per cent, followed by textile with 3.50 per cent, general insurance 2.10 per cent, financial institutions 1.70 per cent, pharma 1.60 per cent and engineering 1.50 per cent.

Gainers took a strong lead over the losers, as out of 388 issues traded, 257 closed higher, 42 lower and 89 issues remained unchanged on the DSE trading floor.

Beximco became the most-traded stock with shares worth Tk 2.10 billion changing hands, followed by Malek Spinning Mills, IPDC Finance, Fortune Shoes and LafargeHolcim.

Kay & Que was the week's top gainer, advancing 21.31 per cent while 1st Janata Bank Mutual Fund was the day's worst loser, plunging 3.13 per cent.

The Chittagong Stock Exchange (CSE) also rebounded with the CSE All Share Price Index (CASPI) gaining 243 points to settle at 18,370 and its Selective Categories Index (CSCX) rising 146 points to close the week at 11,006.

Of the issues traded, 184 advanced, 54 declined and 87 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 21.45 million shares and mutual fund units with turnover value of Tk 586 million.