Stocks continued their downtrend, tumbling for the fourth consecutive week to Thursday as growing concerns over an economic slowdown sapped investor sentiment.

Market operators said panic-stricken investors resorted to relentless sell-offs as they apprehend that the market might fall further amid looming uncertainties in the coming months, resulting from the global economic turmoil.

Of the five trading days this week, three sessions suffered huge losses while two other saw a modest rise backed by institutional support.

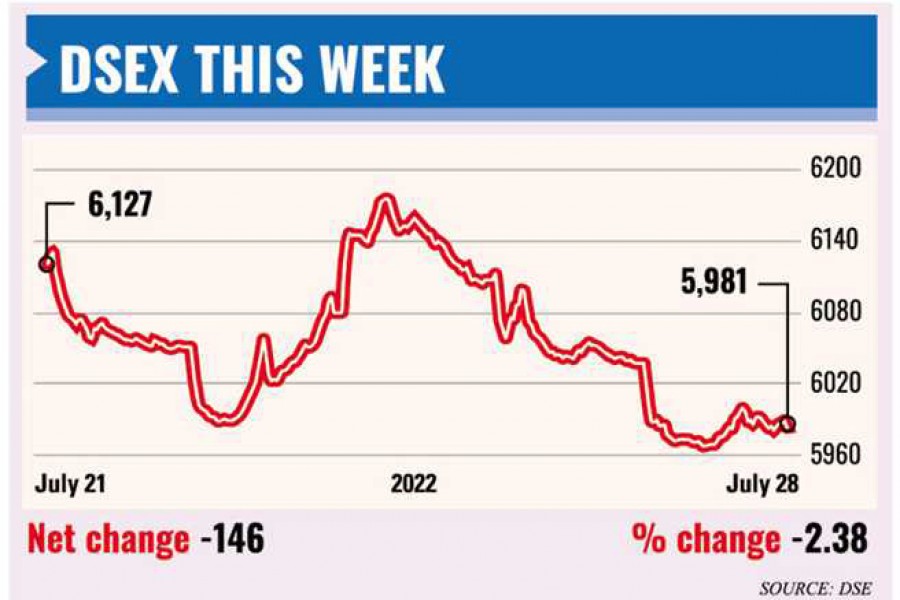

Finally, the benchmark DSEX index of the Dhaka Stock Exchange (DSE) slid 146.01 points or 2.38 per cent to settle at 5,980.51, the lowest in 14 months since June 7, 2021.

DSEX shed more than 396 points in the past four consecutive weeks, and in just 13 trading days after the Eid vacation, the market capitalisation lost Tk 267 billion.

The continuous fall of stock prices brought down the DSE key index below the 'psychological' threshold of 6,000 mark on Thursday, which prompted the securities regulator to impose 'floor price' on all securities to contain the freefall.

Effective from Sunday, the floor price will be considered the lower circuit for a stock, which will be calculated based on the immediate five preceding days' average price of a stock.

The ongoing global economic turmoil has severely impacted the Bangladesh economy, which was reflected on the stock market, said a merchant banker, requesting anonymity.

"The ongoing dollar crisis and rumours of fuel outage also created a negative sentiment among the investors," he said.

He noted that the market may stabilize to some extent in the coming days as the regulator imposed 'floor price' on all securities despite criticism from institutional investors and foreign investors.

The market has been struggling for the past few months since the Russia-Ukraine war began, which was exacerbated by fears of looming economic depression, said a leading stockbroker.

The investors are still worried about a number of macroeconomic issues such as the energy crisis, shrinking foreign currency reserves, depreciating local currency and high inflationary pressure.

"Stocks continued losing streak as the market suffered from dominant selling pressures, which prompted the regulator to bring back the floor price of the listed securities," said EBL Securities.

The stockbroker noted that the current macroeconomic cues, the introduction of floor prices might reduce liquidity in the market as investors might find it difficult to make prompt liquidation of their holdings due to the price limit.

Dismal quarterly earnings of some of the listed companies published during the week also hit investors' sentiment negatively, said the stockbroker.

The International Monetary Fund forecasts gloomy and uncertain world economic outlook due to escalating inflation in the world's major economies, he said.

Two other indices of DSE also ended lower this week. The DS30 Index, comprising blue-chip companies, plunged 55.58 points to close at 2,145.25 and the DSES Index fell 36.89 points to finish at 1,308.20.

The week's total turnover reached Tk 31.69 billion on the prime bourse as against Tk 27.70 billion in the previous week.

The daily turnover averaged out at Tk 6.34 billion, up 14.38 per cent over the previous week's average of Tk 5.54 billion.

The investors' activities were mostly focused on the textile sector, capturing 21.5 per cent of the week's total turnover, followed by banking (13.5 per cent) and miscellaneous sector (10.6 per cent).

All the sectors faced heavy selling pressure, leading to the share price erosion of more than 76 per cent stocks. Out of 389 issues traded, 297 declined, 68 advanced and 24 issues remained unchanged on the DSE.

Among the major sectors, the cement saw the highest loss of 4.40 per cent, followed by power (4.0 per cent), engineering (3.70 per cent), telecom (2.70 per cent) and banking sector (1.90 per cent).

The Chittagong Stock Exchange (CSE) also suffered losses with the CSE All Share Price Index (CASPI) losing 371 points to settle at 17,597 and its Selective Categories Index (CSCX) shedding 222 points to close the week at 10,542.

Of the issues traded, 261 declined, 62 advanced and 18 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 34.96 million shares and mutual fund units with turnover value of Tk 788 million.