Stocks extended the losing streak in the outgoing week, as nervous investors continued selloffs in major sector issues amid persistent market volatility.

The week featured four trading days as trading remained suspended on Thursday on the occasion of Bangla New Year. Of them, two sessions fell sharply while two others ended marginally higher.

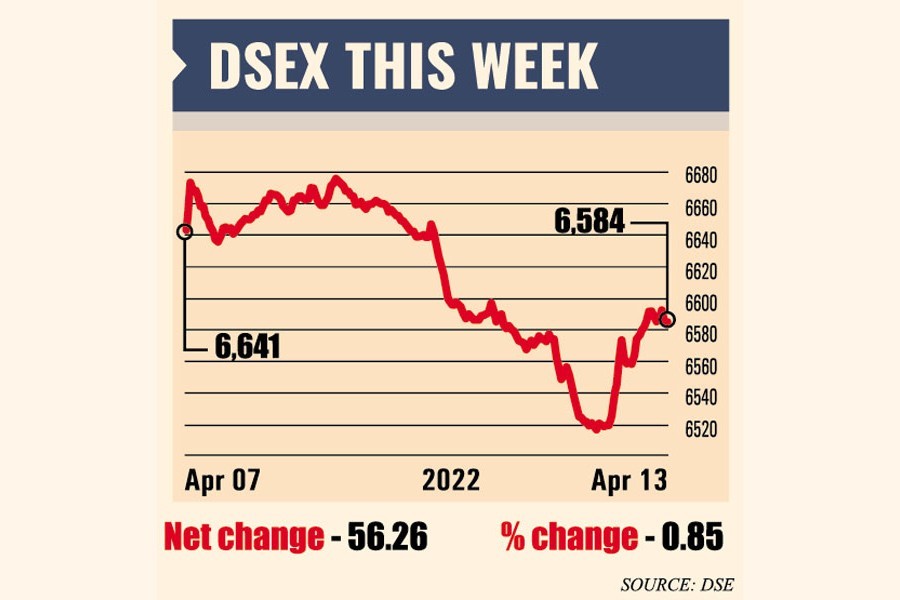

Week on week, the prime DSEX index of Dhaka Stock Exchange (DSE), slid 56.26 points or 0.85 per cent to settle at 6,584. The benchmark index shed 173 points in the past two consecutive weeks.

This week's total turnover tumbled further to Tk 22.63 billion on the prime bourse as against Tk 30.39 billion in the week before.

The daily turnover averaged out at Tk 5.65 billion, down 7.0 per cent from the previous week's average of Tk 6.70 billion.

Market analysts said the sentiment of investors remained fragile and fearful and they were losing risk appetite.

"The looming uncertainty over the global economy and the commodity market instability continued to dampen the investor sentiment," said a merchant banker.

He said the investor fears that the listed companies may perform badly in the days to come because of a gradual rise in raw material prices in the international market.

The South Asian economy is now falling into trouble, as the global prices of raw materials are rising at a time when freight charge has already increased, he said.

"So the investors prefer to keep money in hand instead of making fresh investments as they think the rising prices would hurt the listed companies' profitability also," he said.

Shorter trading periods in the Holy Ramadan and the liquidity need for the upcoming Eid-ul-Fitr have also exacerbated the market situation, he added.

The investor sentiment remained pessimistic as liquidity crunch in the money market, rising inflation and interest rate, and expanding current account deficit further complicated the macroeconomic outlook of Bangladesh, according to EBL Securities.

"The investors' remained cautious due to concerns over the macroeconomic scenarios led by global price instabilities," said the stockbroker.

The investors' fears loomed amid the global economic turmoil owing to commodity market volatility and price increases for essentials, resulting in a liquidity shortage in the capital market as most investors are hesitant to participate in the market, said the stockbroker.

"The recent regulatory intervention failed to recover investor sentiment as the Russia-Ukraine war escalates inflationary pressure on the economy further," said a leading broker.

He said historically stock trading goes slow during Ramadan when most individual investors step back from the market.

According to the International Leasing Securities, the risk-averse investors continued their selling spree on sector-specific issues to avoid further losses that pushed the stock prices down further.

Some of the investors stayed on the sidelines to grab the opportunity of further price erosion of some stocks, said the stockbroker.

Two other DSE indices also closed lower. The DS30 index, comprising blue chips, lost 11.14 points to finish at 2,440 and the DSE Shariah Index (DSES) fell 5.82 points to close at 1,447.

Market capitalisation of the DSE also fell by 0.66 per cent to Tk 5,290 billion on Wednesday, down from Tk 5,325 billion in the week before.

Of the 386 issued traded, 280 declined, 76 advanced and 28 remained unchanged on the DSE trading floor.

IPDC Finance was the most traded stock with shares worth Tk 1.72 billion changing hands, followed by Beximco, Sonali Papers & Board Mills, Genex Infosys and LafargeHolcim.

The newly listed JMI Hospital Requisite Manufacturing was the week's top gainer, posting a 45.61 per cent gain, while Mercantile Bank was the worst loser, shedding 7.50 per cent, following its price adjustment after record date during the week.

The Chittagong Stock Exchange (CSE) also ended lower, with the CSE All Share Price Index (CASPI) shedding 135 points to settle at 19,366 and its Selective Categories Index (CSCX) losing 81 points to close the week at 11,619.

Of the issues traded, 234 declined, 74 advanced, and 25 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 23.64 million shares and mutual fund units with turnover value of Tk 730 million.