Stocks extended the losing streak for a second straight week to Thursday as the risk-averse investors opted to book profit on quick-gaining issues while some were busy rebalancing their portfolios based on the latest quarterly earnings results.

The dismal financial performance of most listed companies prompted investors to continue reshuffling their portfolios while some others took positions in selective issues that posted profit growth in the latest quarter, market operators say.

Investors mostly opted for profit-booking on recently rallied stocks, particularly insurance stocks, as seven out of top ten weekly losers were insurance companies.

Pragati Life Insurance, which saw a sharp rise recently, became this week's top loser, shedding 15.91 per cent to close at Tk 125.8 on Thursday. Its share price dropped 25 per cent over the past two weeks after soaring 152 per cent in the past 12 weeks.

Among other top 10 weekly losers are Pragati Insurance, Popular Life Insurance, Sonali Life Insurance, Pioneer Insurance, Delta Life Insurance and Sandhani Life Insurance.

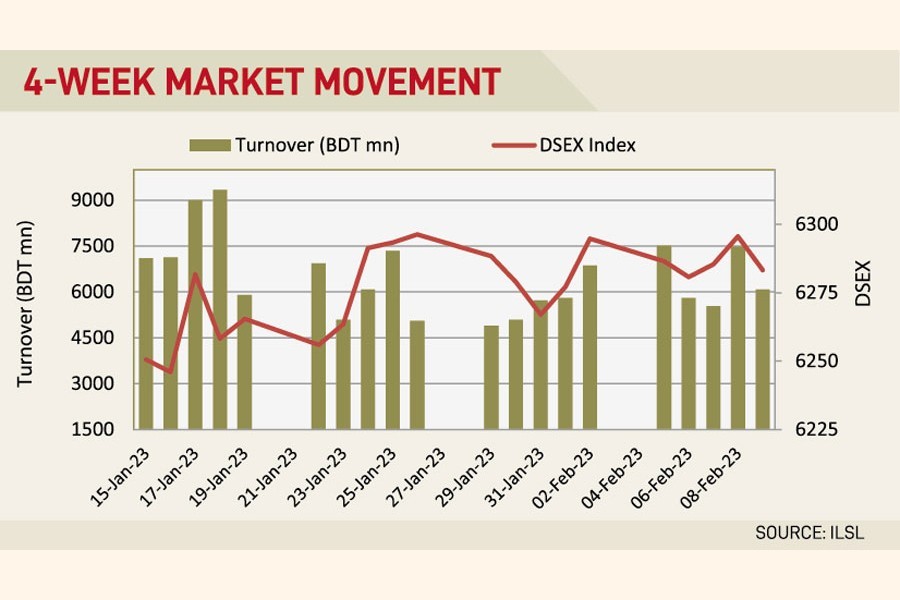

Of the five trading days this week, three sessions suffered losses while the two others posted modest gains but failed to pare those losses.

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), ultimately settled at 6,283, with a fall of 11.43 points. It lost 1.52 points in the previous week.

However, few blue-chip stocks were actively traded as their current market prices proved lucrative to investors. As a result, the DS30 Index, comprising blue-chip companies, went up by 4.62 points to finish at 2,235.

EBL Securities said the market extended its correction mode for the second straight week as investors continued to rebalance their portfolios in response to the earnings disclosures of the listed companies for the most recent quarter.

"Investors have chosen to stay on the sidelines until the market experiences a major trigger to regain a consistent positive momentum, as their investment appetite has been weakened due to the dismal financial performance of most of the listed firms," said the stockbroker.

The market has been concentrated on selective stocks that have been able to post a favourable bottom-line growth, defying recent macroeconomic adversities, said the stockbroker.

For example, Apex Footwear Ltd was the week's top gainer; posting a 16.84 per cent gain, after the leading footwear maker reported a 42 per cent growth in both revenue and profit in the first half of FY23.

Olympic Industries, Gemini Sea Food, Orion Infusion, Bangladesh Shipping Corporation also featured in the weekly turnover list as they posted hefty growth in profit in the first half of FY23 despite the macroeconomic challenges.

The IT sector kept its dominance in the weekly turnover list, capturing 17.9 per cent of the weekly turnover, followed by pharmaceuticals (14 per cent) and miscellaneous (9.5 per cent).

According to International Leasing Securities, most of the investors remained pessimistic and reluctant to make fresh investments in the stocks as they failed to find any clear direction about the future market movement.

Also, they are concerned about the macroeconomic indicators like inflation, interest rate and dollar crisis in 2023. Though the indicators are approaching stability, the investors are still suffering from the confidence crisis, said the stockbroker.

Investors' participation in the market, however, rose 14 per cent to Tk 32.44 billion in total. As a result, the average daily turnover stood at Tk 6.49 billion as against Tk 5.68 billion in the week before.

Buyers had been concentrated on selective stocks while the majority of stocks remained stuck at the 'floor price' level. Of 380 issues traded, 200 remained unchanged, 138 declined while 42 advanced on the DSE floor.

Genex Infosys became the week's turnover leader with shares worth Tk 3.27 billion changing hands, followed by Bangladesh Shipping Corporation, Shinepukur Ceramic, Orion Pharma and Olympic Industries.

Most of the major sectors suffered losses with general insurance incurring the highest loss of 4.4 per cent as the price of 53 insurers, out of 56, dropped during the week, followed by life insurance, non-bank financial insurance, power and pharma.

The Chittagong Stock Exchange (CSE) also ended lower, with the CSE All Share Price Index (CASPI) shedding 48 points to settle at 18,535 and its Selective Categories Index (CSCX) losing 28 points to close the week at 11,112.