Stocks extended their winning streak for a fourth straight week, with the benchmark equity index hitting a nearly four-month high, as investors renewed their appetite for selective large-cap stocks amid high optimism ahead of the dividend season.

Of the five trading days this week, the first two days saw the market close lower while the last three sessions ended higher, paring the losses incurred in the first two days.

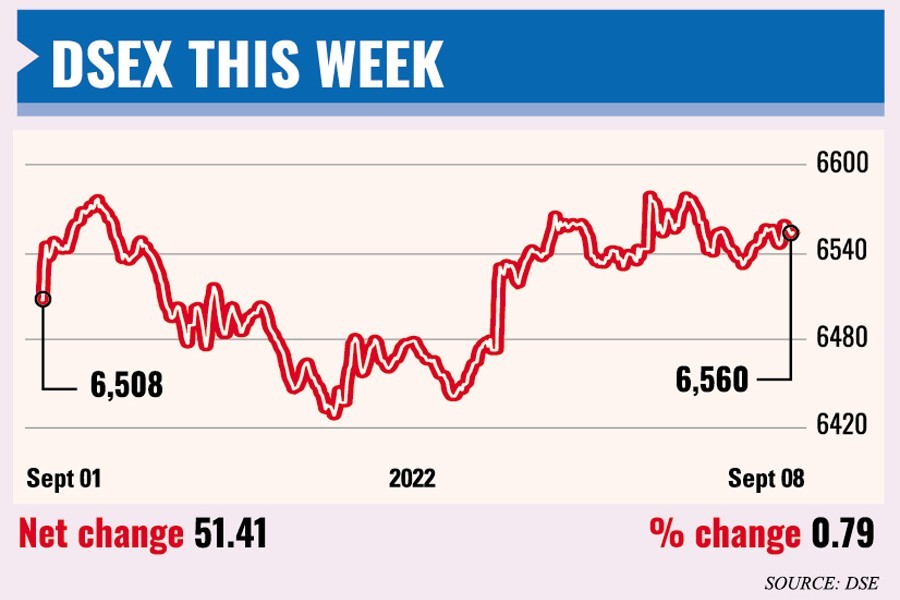

The benchmark DSEX index of the Dhaka Stock Exchange (DSE) settle the week 51.41 points or 0.79 per cent higher at 6,560, the highest level in nearly four months since May 12.

The DSEX gained a total of 411 points in the past four consecutive weeks.

Market analysts said the investors continued their buying binge on sector-wise big-cap stocks ahead of the dividend season as they anticipate strong earnings from the companies for the financial year that ended in June last.

The market remained bullish amidst enthusiastic participation as the investors put fresh bets on major sector shares with confidence backed by regulatory measures, said a merchant banker.

Some recovery signs on the macroeconomic front coupled with 'floor price' restriction instilled confidence into the general investors, he said.

The cautious investors, however, opted for booking some profits from quick-gaining stocks during the week, taking the advantage of the recent price surge, he added.

However, many stocks went through a correction due to the profit-booking tendency of a specific group of investors, said EBL Securities.

The investors' focus mainly concentrated on the selective large-cap stocks throughout the week which helped the market remain afloat, according to International Leasing Securities.

The week's total turnover stood at Tk 90.91 billion on the prime bourse as against Tk 95.14 billion in the previous week.

The daily turnover averaged out at Tk 18.18 billion, down 4.45 per cent over the previous week's average of Tk 19.03 billion.

Two other indices of the DSE also ended higher this week. The DS30 Index, comprising blue-chip companies, rose 70.52 points to close at 2,376 and the DSES Index advanced 32.06 points to finish at 1,441.

The pharma sector dominated the turnover chart, capturing 19 per cent of the week's total turnover, followed by miscellaneous (15 per cent) and engineering (12 per cent).

Most of the major sectors suffered losses. The non-bank financial institutions posted the highest loss of 3.20 per cent, followed by engineering (2.0 per cent), food (0.90 per cent), banking (0.60 per cent), power (0.50 per cent) and telecoms (0.40 per cent).

On the other hand, pharma, miscellaneous, mutual fund and cement posted gains of 6.0 per cent, 4.90 per cent, 4.0 per cent and 2.20 per cent respectively.

Prices of more than 68 per cent of traded issues closed in the red as out of 387 issues traded, 265 ended lower, 68 higher and 54 issues remained unchanged on the DSE floor.

Beximco was the most-traded stock with shares of Tk 6.63 billion changing hands during the week, followed by Orion Pharma, LafargeHolcim, JMI Hospital Requisite Manufacturing and Nahee Aluminum Composite Panel.

Orion Infusion was the top gainer for the third straight week, soaring 35.03 per cent further this week while Phoenix Finance & Investment was the week's worst loser, losing 20.49 per cent following its 'no' dividend declaration.

The Chittagong Stock Exchange (CSE) also extended the winning streak, with the CSE All Share Price Index (CASPI) gaining 120 points to settle at 19,276 and its Selective Categories Index (CSCX) rising 75 points to close the week at 11,555.

Of the issues traded, 236 advanced, 68 declined and 38 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 40.73 million shares and mutual fund units with turnover value of Tk 1.60 billion.