Stocks extended the gaining streak for a second straight week to Thursday as bargain hunters put fresh bets on selective issues, with an eye on the national budget.

Finance Minister AHM Mustafa Kamal on Thursday unveiled a budget of Tk 6.78 trillion for the Fiscal Year (FY) 2022-2023.

This week saw five trading days as usual, with three sessions ending lower and two others edging up.

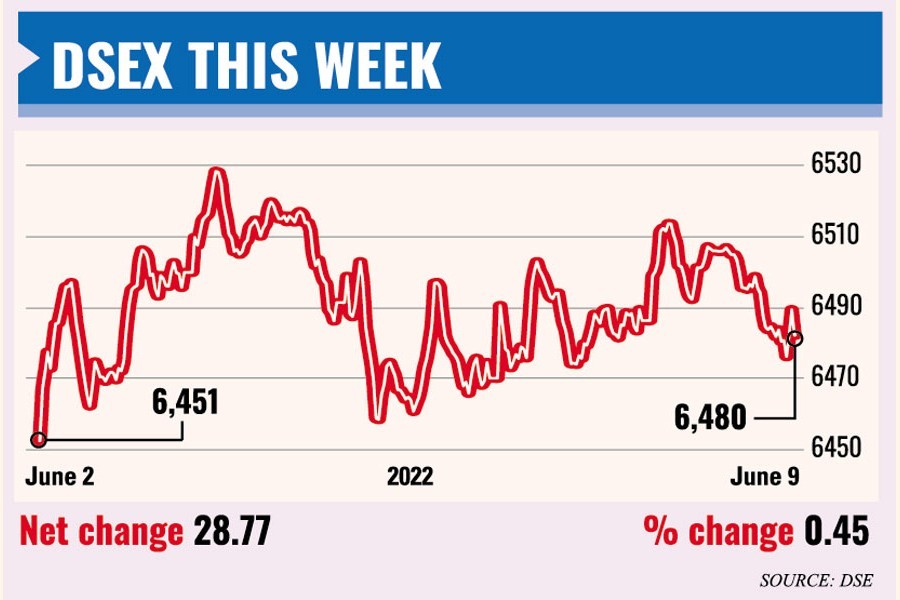

Week on week, DSEX, the key index of Dhaka Stock Exchange (DSE), climbed 28.77 points or 0.45 per cent to settle at 6,480.30. The DSEX soared over 242 points in the past two weeks.

Market analysts said regulatory initiatives as well as positive expectations from the national budget might encourage investors to put fresh bets on lucrative stocks.

"Positive regulatory initiatives and anticipation of capital market-friendly budget declaration kept investors hopeful," said EBL Securities.

However, the overall macroeconomic scenarios continued to be an issue of concern, it added.

The investors showed their buying appetite for general insurance, banks and non-bank financial institutions issues throughout the week, according to International Leasing Securities.

Investors were taking position on the sector-specific issues anticipating a corporate tax cut in the national budget, said the stockbroker.

The finance minister has proposed to cut corporate tax for listed and non-listed companies by 2.5 per cent in the proposed budget for the FY2022-23 on condition that all receipts and income must be transacted through bank transfer.

The finance minister has proposed a tax rate of 20 per cent in place of existing 22.5 per cent for listed companies that issue shares worth more than 10 per cent of its paid-up capital through initial public offering.

However, the tax rate will remain at 22.5 per cent for listed companies that issue shares worth 10 per cent or less than 10 per cent of its paid-up capital.

"The reduction in corporate tax for the listed companies will have a positive impact on the market," said a DSE official.

However, the tax gap would remain unchanged for listed and non-listed companies at 7.50 per cent which analysts think would discourage non-listed firms from going public.

The stock market intermediaries have long been pushing for widening the tax gap between listed and non-listed firms to at least 10 per cent to attract well-performing companies into the market.

This week, the general insurance sector witnessed phenomenal gains of 11.3 riding on expectation that 'bancassurance' would be introduced in the country.

Banking, power, financial institutions and telecom sectors also gained 2.0 per cent, 0.80 per cent, 0.80 per cent and 0.80 per cent respectively.

The week's total turnover also rose to Tk 43.42 billion on the prime bourse as against Tk 39.26 billion in the week before.

The daily turnover averaged out at Tk 8.68 billion, up by 10.59 per cent from the previous week's average of Tk 7.85 billion.

Two other indices also ended higher. The DS30 index, comprising blue chips, advanced 3.30 points to finish at 2,352.38 while the DSE Shariah Index (DSES) gained 1.98 points to close at 1,413.76.

Out of 389 issues traded, 206 advanced, 157 declined and 26 remained unchanged.

Paramount Insurance was the week's top gainer, posting a 26.41 per cent gain, while Trust Bank was the worst loser, shedding 12.34 per cent.

The Chittagong Stock Exchange (CSE) also rose with the CSE All Share Price Index (CASPI) rising 134 points to settle at 19,025 and its Selective Categories Index (CSCX) gaining 81 points to close the week at 11,410.

Of the issues traded, 197 advanced, 132 declined and 25 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 44.51 million shares and mutual fund units with turnover value of Tk 1.30 billion.

Meanwhile, Meghna Insurance made a flying trading debut on Wednesday as its shares closed at Tk 12.10 each on Thursday, soaring 20 per cent in the two consecutive sessions, from its issue price of Tk 10 each.