Stocks witnessed yet another bearish week that ended on Wednesday, extending the losing streak for the fifth straight week as investors continued their selling binge.

The week saw four trading days instead of five as the market remained closed on Thursday due to Dhaka City Corporation (North) elections. Of them, stocks suffered losses in three sessions while one saw marginal gain.

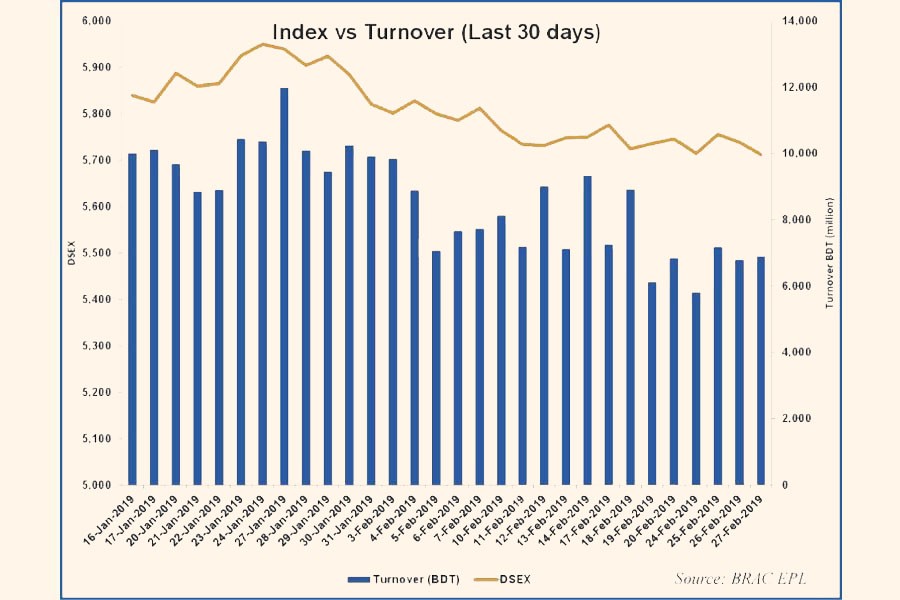

Week-on-week, the DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 34 points or 0.59 per cent to settle at nearly two months low to 5,711.

Market analysts said investors showed their selling spree, particularly on banking and non-bank financial issues, taking the prime index to two months low.

Banking and financial institutions sectors continued to suffer losses amid the news of bulging non-performing loans in the banking sector, said a leading broker.

Despite close monitoring by the central bank, the volume of classified loans in the country's banking system soared more than 26 per cent or Tk 196.08 billion in the last calendar year.

The NPLs rose to Tk 939.11 billion as of December 31, 2018, from Tk 743.03 billion on the same day in 2017, according to the central bank's latest data.

The broker noted that banking and telecom are bellwether sectors for the capital market and fall in banking and telecom stocks obviously have impacted the prime index.

The banking sector lost 0.65 per cent as prices of 21 banks, out of 30, closed lower. The non-bank financial institutions sector also lost 1.49 per cent.

The DS30 index, comprising blue chips, also fell 3.53 points to finish at 1998 points. However, the DSE Shariah Index gained 1.73 points to close at 1,314.

The total turnover stood at Tk 26.67 billion last week against Tk 29.13 billion in the week before.

The daily turnover averaged Tk 6.67 billion, registering a decline of 8.44 per cent over the previous week's average of Tk 7.28 billion.

Block trade contributed 5.80 per cent to the total weekly turnover, where stocks like Square Pharma, Brac Bank, Doreen Power, IPDC Finance and Mutual Trust Bank dominated the block trade board.

According to International Leasing Securities, the shaky investors liquidated their holdings mostly from power, engineering, financial institution, textile and banking sectors stocks, taking the prime index to two months low.

The engineering sector posted the highest loss of 1.99 per cent, followed by power with 1.54 per cent.

On the other hand, telecommunication saw the highest gained of 2.10 per cent, followed by food with 0.88 per cent and pharmaceuticals 0.47 per cent.

The market capitalisation of the DSE also fell 0.15 per cent to Tk 4,150 billion, from Tk 4,256 billion in the week before.

Losers outnumbered the gainers, as out of 348 issues traded, 242 closed lower, 82 ended higher and 24 issues remained unchanged on the DSE floor.

Takaful Islami Insurance was the week's best performer, gaining 20.92 per cent, while Emerald Oil Industries was the worst loser, losing 29.61 per cent as the regulator has decided to 'freeze' the BO (beneficiary owner) accounts of the sponsors, directors and four top officials of the company.

Two listed companies -- GlaxoSmithKline (GSK) Bangladesh and United Finance - recommended dividend last week.

The GSK Bangladesh has recommended 530 per cent cash dividend and United Finance recommended 10 per cent cash dividend for the year ended on December 31, 2018.

The port city bourse, Chittagong Stock Exchange (CSE), also ended lower, with its CSE All Share Price Index -- CASPI - losing 112 points or 0.63 per cent to settle at 17,473 and the Selective Categories Index -- CSCX -shedding 56 points or 0.52 per cent to finish at 10,586.