Stocks ended lower for the sixth straight weeks that ended Thursday amid dull trading as investors continued their selling binge on sector-wise shares.

Market analysts said majority investors were reluctant to make fresh investment amid liquidity crisis while some were busy in rebalancing portfolio ahead of earnings declaration of financial sectors.

Amid the current bearish market trend, the small investors were not confident enough to inject fresh fund in stocks, said a leading broker.

He noted that liquidity shortage in banks was intensified ahead of adjustment of their advance deposit ratio.

Meanwhile, banks have got another six months to lower their advance-deposit ratio, a move that is expected to tame the current volatility in the money market.

In a circular issued on Thursday, the central bank extended the deadline to September 30 this year to adjust the ratio. This is the third extension since January 2018.

The week saw five trading sessions as usual. Of them, the market suffered losses two sessions while three saw marginal gain.

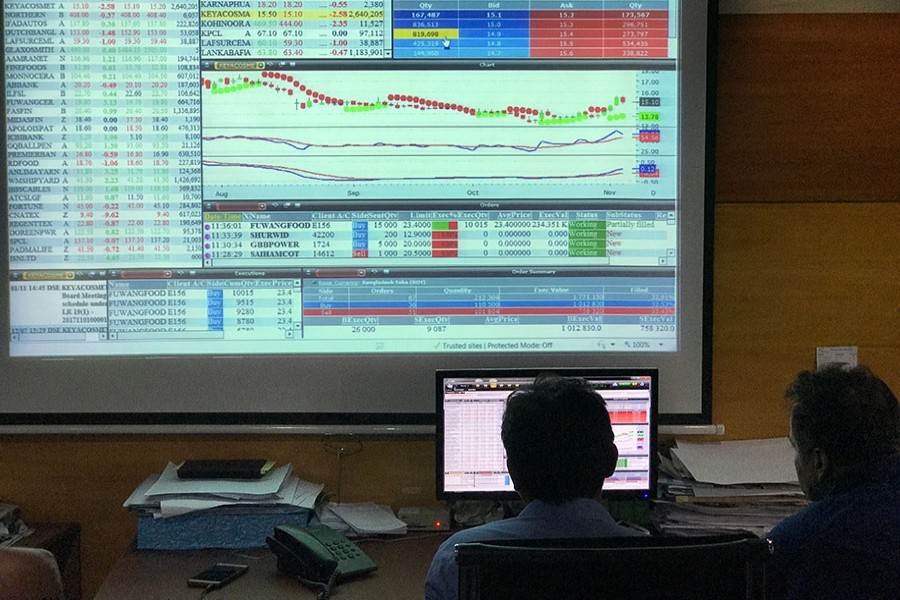

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 25.45 points or 0.45 per cent to settle at 5,686.

DSEX eroded more than 262 points or 4.40 per cent in the past six consecutive weeks.

Two other indices also ended lower. The DS30 index, comprising blue chips, 5.52 points to finish at 1993 and the DSE Shariah Index lost 10.96 points to close at 1,303.

Fears over a liquidity crisis in banks with deposits shortage is a major cause for the fall of the market, said EBL Securities, in its weekly analysis.

The total turnover stood at Tk 29.80 billion last week against Tk 29.13 billion in the week before despite last week saw five trading sessions instead of previous week's four.

The daily turnover averaged Tk 5.95 billion, registering a decline of 11 per cent over the previous week's average of Tk 6.67 billion.

Block trade contributed 3.40 per cent to the week's total turnover, where stocks like United Commercial Bank, Khulna Power, Brac Bank, Monno Jute Stafflers dominated the block trade board.

According to International Leasing Securities, the shaky investors liquidated their holdings mostly from power, telecom, pharmaceuticals and engineering sectors stocks, taking the prime index below 5,700-mark.

The power sector posted the highest loss of 2.39 per cent, followed by telecom with 2.18 per cent, pharma 1.69 per cent and engineering 0.42 per cent.

On the other hand, banking sector saw the highest gained of 2.58 per cent, followed by food with 0.86 per cent and non-bank financial institutions 0.01 per cent.

The market capitalisation of the DSE also fell 0.49 per cent to Tk 4,130 billion, from Tk 4,150 billion in the week before.

Losers outnumbered the gainers, as out of 349 issues traded, 230 closed lower, 93 ended higher and 26 issues remained unchanged on the DSE floor.

Monno Ceramic dominated the turnover chart, with shares worth Tk 2.40 billion changing hands. The company accounted for 8.05 per cent of the week's total turnover.

The other turnover leaders were United Power, Premier Bank, Bangladesh Submarine Cable Company and Singer Bangladesh.

Safko Spinning Mills was the week's best performer, gaining 18.72 per cent, while Paramount Insurance was the worst loser, losing 18.96 per cent following its low dividend deceleration.

The port city bourse, Chittagong Stock Exchange (CSE), also ended lower, with its CSE All Share Price Index -- CASPI - losing 78 points or 0.44 per cent to settle at 17,395 and the Selective Categories Index -- CSCX -shedding 49 points or 0.45 per cent to finish at 10,537.