Stocks extended the losing streak for the second straight week that ended Thursday as investors were selling shares amid political tension.

Analysts said the investors went for selling shares, keeping a wary eye on the latest political developments centering the key opposition leader, Khaleda Zia's imprisonment.

"The ongoing liquidity shortage coupled with fear of political insecurity centering Zia Orphanage Trust graft case verdict kept investors mostly inactive almost throughout the week, taking the market into the red zone further" said an analyst at a leading brokerage firm.

Merchant bankers and stockbrokers, however, alleged that a 'political rumour' spread by a vested quarter among the stock investors, prompting them to go for a sell pressure.

During the week, a major development on capital market that the premier bourse agreed in principle to sell shares to Shanghai-Shenzhen consortium for strategic partnership.

A consortium of two Chinese stock exchanges, - Shanghai Stock Exchange and Shenzhen Stock Exchange-- leads the race to buy 25 per cent stake worth about Tk 9.92 billion to become the strategic partner of the country's premier bourse.

"DSE will be able to attract foreign and local investors when the Shanghai and Shenzhen exchanges will be in a strategic tie-up with the Dhaka bourse," said a director of the premier bourse.

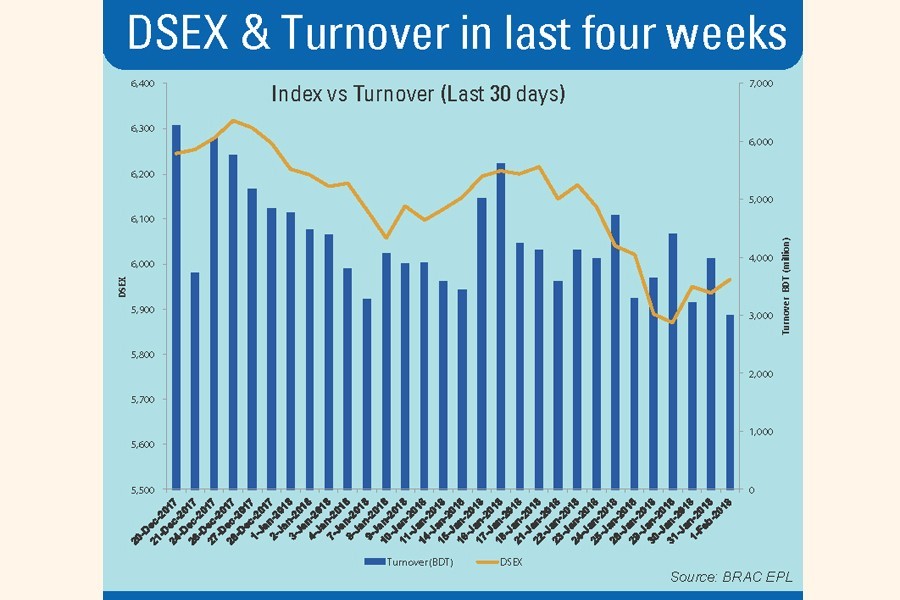

The market witnessed five trading sessions as usual. Of them, index lost 165 points in three sessions while recovered 109 points in the other two sessions.

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 56 points or 0.93 per cent to settle at 5,965, after witnessing a precipitous single-week fall in the previous week.

Two other indices of the premier bourse ended almost flat. The DS30 index, comprising blue chips, shed 2.44 points or 0.11 per cent to finish at 2,225 and DSES (Shariah) lost 7.49 points or 0.54 per cent to close at 1,389.

Chittagong Stock Exchange (CSE) also ended lower with the CSE All Share Price Index -- (CAPSI) -losing 196 points or 1.04 per cent to finish at 18,624.

The Selective Categories Index of the port city bourse -- CSCX, also plunged 121 points or 1.07 per cent to settle at 11,128.

Total turnover on the DSE came down to Tk 18.26 billion against Tk 19.73 billion in the week before.

The daily turnover averaged Tk 3.65 billion, which was more than 7.42 per cent lower than the previous week's average of Tk 3.95 billion.

"As stakeholders are wary of deteriorating political issues, market participation has been very slow," commented LankaBangla Securities, in an analysis.

International Leasing Securities, "The market witnessed correction for the second week on the trot amid political jitters".

"Apart from political tension, the central bank's move to cut banks' lending sparked the fall," said the stockbroker.

The stockbroker noted that the investors mostly liquidated their position from engineering, textile, food and financial institution sectors fearing further fall.

While, some opportunistic investors took position on the lucrative price level in travel, general insurance, life insurance and pharmaceutical sector stocks amid optimism.

The banking sector kept dominance over the turnover chart, grabbing 20 per cent of the week's total turnover, closely followed by pharmaceuticals with 17 per cent and engineering 12 per cent.

The market capitalisation of the DSE also fell 0.69 per cent as it was Tk 4,176 billion on opening day of the week while it came down to Tk 4,147 billion on Thursday.

Losers outnumbered gainers by 269 to 62, with seven issues remaining unchanged on the DSE floor.

LankaBangla Finance topped the week's turnover chart with 22.54 million shares worth nearly Tk 900 million changing hands, followed by Beximco Pharmaceuticals with Tk 752 million, Square Pharma Tk 652 million, Grameenphone Tk 511 million and Monno Ceramic Industries Tk 453 million.

Monno Ceramic was the week's best performer, posting a gain of 23.66 per cent while Oimex Electrode was the week's worst loser, slumping by 18.39 per cent.