Stocks posted a moderate rise in the outgoing week, after a single-week break, with investors maintaining a cautious stance amid high volatility.

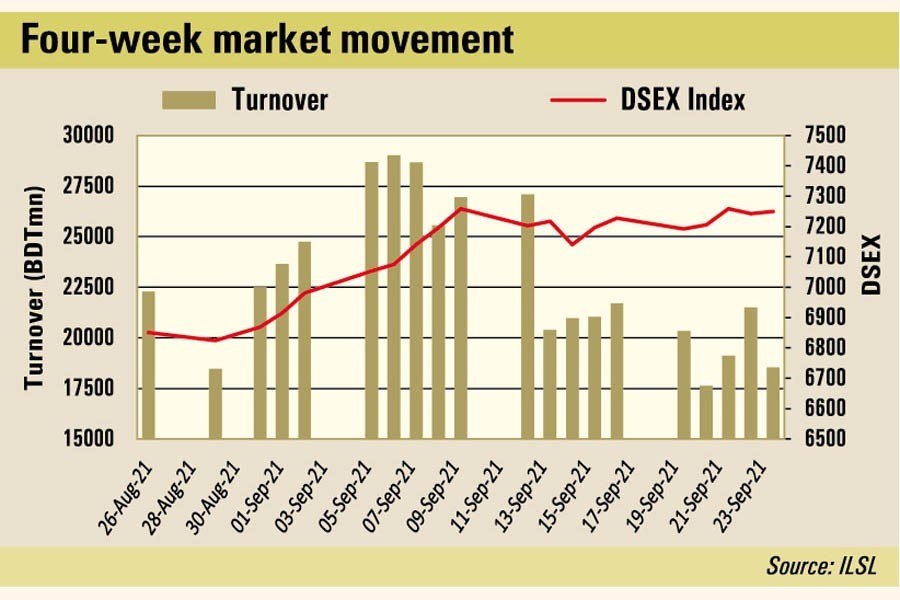

Week on week, the benchmark DSEX index of Dhaka Stock Exchange (DSE) edged up 22.29 points or 0.31 per cent to settle at 7,250, after shedding 30.43 points in the previous week.

The DSE Shariah Index (DSES) also inched up 3.95 points to close at 1,581. On the other hand, the blue-chip DS30 index saw a fractional loss of 0.99 point to finish at 2,673.

The weekly turnover stood at Tk 97.09 billion on the prime bourse, down from Tk 111.22 billion in the week before. And the daily average turnover clocked in at Tk 19.42 billion, 13 per cent down from the previous week's average of Tk 22.24 billion.

Market analysts observed that investors mostly took a cautious approach throughout the week, with the key index hovering around the highest level as many stock prices rose significantly in recent weeks.

Most investors trimmed their positions in the recent outperformers while some were closely observing the market movement, said a merchant banker.

He noted that the investors' participation also dropped as they retreated to the sidelines witnessing the high volatility of the benchmark index during the week.

"Some investors opted to book profit while bargain hunters took positions on lucrative stocks, sending the market into volatile territory."

The index witnessed mixed performances as most investors took a cautious approach while some others pulled out their investments for profit-booking, according to the EBL Securities.

Investors were also rebalancing their portfolios ahead of corporate declarations of many listed companies, said a stockbroker.

Even the government decision to cut yield rates on new savings certificates failed to attract investors, he added.

Major sectors showed mixed performances this week. The textiles sector generated the highest return of 4.20 per cent, followed by general insurance (1.60 per cent), pharmaceuticals (0.90 per cent) and engineering (0.60 per cent).

On the other hand, food, banking, telecoms, financial institutions and power sectors lost 1.70 per cent, 0.90 per cent, 0.70 per cent, 0.68 per cent and 0.60 per cent respectively.

Losers, however, took a modest lead over the gainers, as out of 378 issues traded, 198 closed lower, 162 higher and 18 issues remained unchanged on the DSE trading floor during the week.

Beximco -- the flagship company of Beximco Group -- continued to top the turnover chart with shares worth Tk 5.96 billion changing hands, followed by Beximco Pharma (Tk 3.15 billion), Orion Pharma (Tk 2.46 billion), LankaBangla Finance (Tk 2.31 billion) and LafargeHolcim (Tk 2.28 billion).

Low-cap companies dominated the week's gainer list, with Pacific Denims making its way to the top of the gainers chart, posting a 24.66-per cent rise, followed by Eastern Insurance (20.80 per cent), Alif Manufacturing Company (19.44 per cent), Bangladesh National Insurance (17.87 per cent) and KDS Accessories (17.25 per cent).

Bangladesh Monospool Paper Manufacturing Company was the worst loser, shedding 18.39 per cent, after soaring 312 per cent since it came back to the main market on June 13 this year.

The Chittagong Stock Exchange (CSE) also inched higher with the CSE All Share Price Index (CASPI) advancing 5.0 points to settle at 21,1146 and the Selective Categories Index (CSCX) gaining 0.50 points to close at 12,687.

Of the issues traded, 179 declined, 149 advanced and 14 remained unchanged on the CSE trading floor.

The port city's bourse traded 110.30 million shares and mutual fund units with turnover value of Tk 3.25 billion.