Stocks rebounded last week that ended Thursday, snapping a two-week losing streak, as investors showed their buying appetite on large-cap stocks amid ongoing quarterly earning declarations.

Brokers said positive earning disclosures of some listed companies and investors' tension over the upcoming monetary policy statement (MPS) eased somewhat. It helped the market return to higher.

The Bangladesh Bank (BB) is scheduled to unveil the monetary policy statement (MPS) for the January-June period of the current fiscal year on January 29.

Meanwhile, some 20 listed companies disclosed their second quarter (Q2) earnings for October-December period of 2017 last week. Of them, earnings of 18 companies increased while two declined in October-December period of 2017 compared to the same period a year ago.

Four sessions, out of five, closed green, with a combined gain of 99.6 points while one saw correction of 6.03 points.

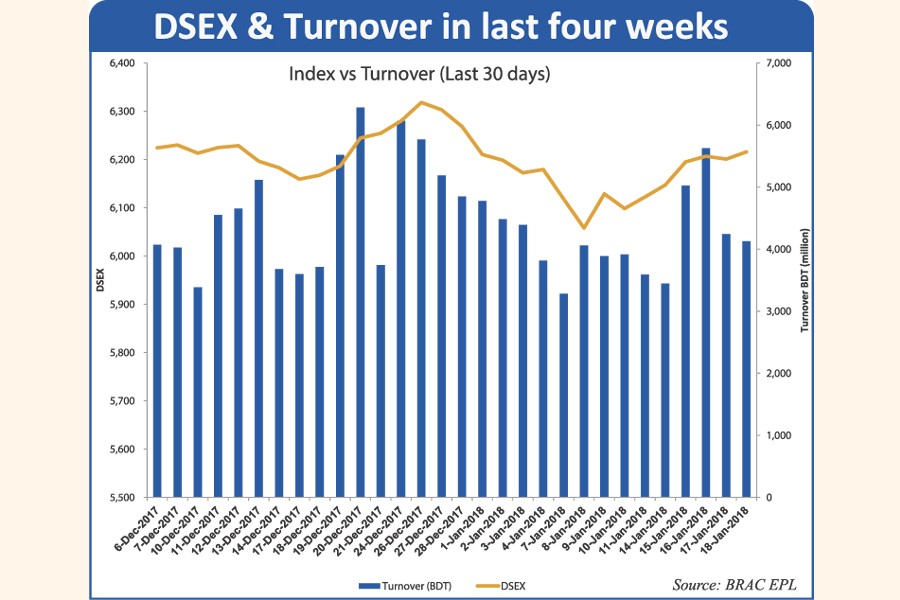

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went up by 93.57 points or 1.53 per cent to settle at 6,216.

"Investors are taking position on fundamentally strong large-cap stocks recently which spurred the DSE index," commented LakaBangla Securities, in its weekly market analysis.

The two other indices also ended higher. The DSE 30 Index comprising blue chips soared 63.57 points or 2.84 per cent to settle at 2,305. The DSE Shariah Index (DSES) also rose 27.52 points or 1.96 per cent to close at 1,431.

Chittagong Stock Exchange (CSE) also backed higher with CSE All Share Price Index -- (CAPSI) - soaring 293 points or 1.55 per cent to finish at 19,161.

The Selective Categories Index of the port city bourse -- CSCX, also soared 180 points or 2.03 per cent to end at 11,571.

"The government's plans to slash tax rate, cooling down of private sector credit growth in the month of December coupled with satisfactory earning disclosures of some listed companies encouraged investors in the market," commented EBL Securities, a stockbroker, in its weekly analysis.

Country's private sector credit growth squeezed in December after a rising trend in last two consecutive months as most banks tried to comply with advance-deposit ratio (ADR) rules properly.

The growth in credit flow to private sector came down to 18.13 per cent in December 2017 on a year-on-year basis from 19.06 per cent a month before, according to the central bank latest statistics.

According to International Leasing Securities, the market saw positive vibe last week as the investors' tension over the upcoming monetary policy statement eased for the time being.

The stockbroker noted that the bargain hunters were active and took position in the lucrative price level on large-cap stocks, especially on telecom, food, financial institution, pharmaceutical, fuel & power and bank sectors which helped the market close higher.

Bullish sentiment was also reflected on the turnover activities as daily turnover averaged Tk 4.49 billion, which was nearly 20 per cent higher than the previous week's average of Tk 3.75 billion.

Pharmaceuticals sector dominated over the turnover chart, grabbing 21 per cent of the week's total turnover, followed by engineering with 18 per cent and banking 12 per cent.

The market capitalisation of the DSE also increased by 1.91 per cent as it was Tk 4,188 billion on opening day of the week while it reached to Tk 4,268 billion on Thursday.

The gainers took a modest lead over the losers as out of 338 issues traded, 160 closed higher, 146 lower and 32 issues remained unchanged on the DSE trading floor.

Square Pharmaceuticals topped the week's turnover chart for the second week in a row with 5.58 million shares worth Tk 1.84 million changing hands, closely followed by Grameenphone with Tk 1.29 million, IFAD Autos Tk 957 million, Beximco Pharma Tk 802 million and Paramount Textile Tk 435 million.

Usmania Glass Sheet Factory was the week's top gainer, posting a gain of 23.37 per cent while Oimex Electrode was the week's worst loser, slumping by 7.94 per cent.