Stocks suffered a notable correction Wednesday as cautious investors continued their selling spree following the news of slashing the limit of banks’ advance-deposit ratio (ADR).

The Bangladesh Bank (BB) slashed the limit of advance-deposit ratio (ADR) on Tuesday to help check any possible liquidity pressure on the market due to the banks’ ‘aggressive’ lending.

The ADR is re-fixed at 83.50 per cent for all the conventional banks and at 89 per cent for the Shariah-based Islamic banks. The existing ratios are 85 per cent and 90 per cent respectively. The banks must adjust it gradually by June 30.

“Political uncertainty coupled with lower-than-expected earnings declaration of some listed companies also dented investors’ confidence to put fresh fund into the market,” said an analyst at a leading brokerage firm, seeking anonymity.

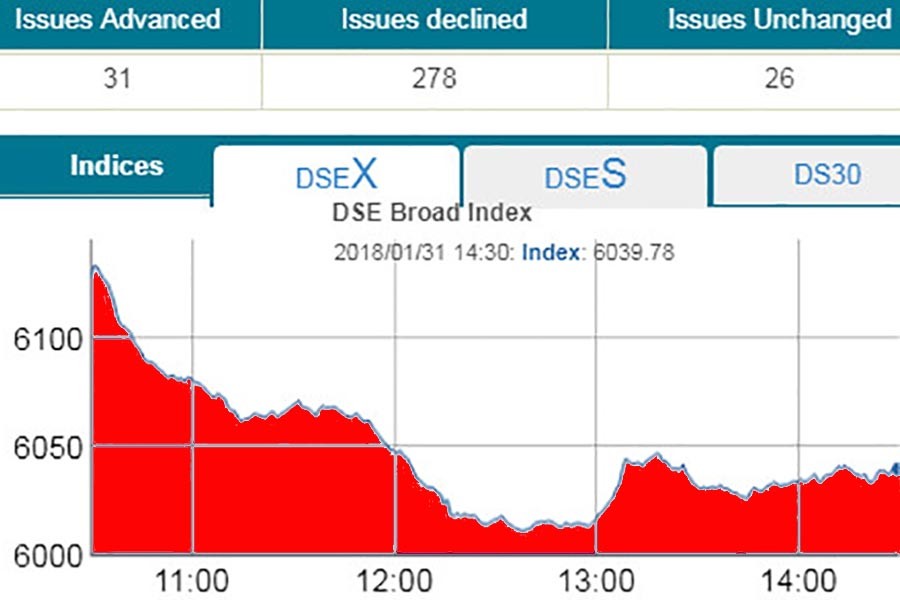

The market started on downward trend and the negative trend continued till end of the session with no sign of reversal, finally ended more than 88 points lower.

DSEX, prime index of Dhaka Stock Exchange (DSE), settled at 6,039, slumping by more than 88 points or 1.44 per cent over the previous session.

Two other indices of the premier bourse also saw sharp declined. The DS30 index, comprising blue chips, plunged 28 points or 1.23 per cent to finish at 2,239 and DSES (Shariah) dropped by 16 points or 1.13 per cent to close at 1,398.

However, trading activities increased to Tk 4.72 billion, which was 18 per cent higher than the previous day’s Tk 3.99 billion.

The losers took a strong lead over the gainers as out of 335 issues traded, 278 closed lower, 31 higher and 26 remained unchanged on the DSE trading floor.

Olympic Industries topped the turnover chart with shares worth Tk 284 million changing hands, followed by Square Pharmaceuticals, LankaBangla Finance, Grameenphone and IFAD Autos.

Port city bourse CSE also closed lower with CSE All Share Price Index – CAPSI- shedding 264 points to settle at 18,691 and Selective Categories Index - CSCX – falling 157 points to finish at 11,292.

Here too, the losers beat the gainers as 200 issues closed lower, 16 ended higher and 16 remained unchanged on the CSE.

The port city bourse traded 17.54 million shares and mutual fund units worth nearly Tk 434 million in turnover.