Stocks extended the loss for fourth straight week as worried investors continued heavy sell-offs amid lack of confidence.

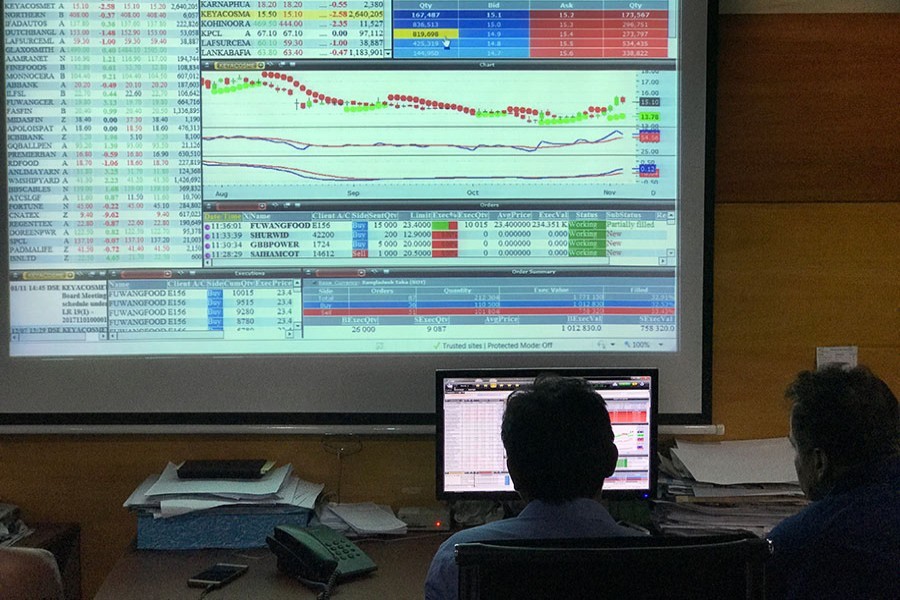

Core index of the Dhaka bourse hit one-year low, much to the chagrin of general investors.

Market operators said investors were mostly on selling binge fearing further fall of stock prices as ongoing pessimism coupled with companies' disappointing earning results, particularly banks, dented the investors' confidence.

"The investors' confidence remains low as prevailing bearish market trend coupled with disappointing earnings results, taking toll on the market," said an analyst at a leading brokerage firm.

He noted that mounting selling pressure in large-cap stocks, especially telecom and bank, triggered the week's steep fall of index.

Since beginning of the year, indices have been on the downward direction, with some periodic upward movement, which failed to sustain. During the fall in 12 consecutive sessions, the longest ever bearish spell, core index lost more than 370 points or 6.36 per cent.

Dhaka bourse signed the much-talked-about share purchase agreement with the Chinese consortium on Monday for strategic partner. But, the news failed to make any positive impact on trading yet.

The week featured five trading sessions as usual and all five sessions closed lower.

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 255 points or 4.48 per cent to settle the week at one year lowest level to 5,443 points.

"The week passed a bearish mood triggered the index falling below 5,500-mark following the dissatisfactory earnings declarations," commented EBL Securities, in its weekly market analysis.

"The downward trend led by telecommunication and banking sectors as expectation regarding upcoming earnings has been marred by some recent disclosures," said the stockbroker.

Two other indices also ended lower with the DS30 index, comprising blue chips, fell sharply by 103 points to finish at 2,025 and the DSES (Shariah) index shed 41 points to settle at 1,277.

Chittagong Stock Exchange (CSE) also saw sharp decline with the CSE All Share Price Index - CASPI - losing 457 points to settle at 16,804 and the Selective Categories Index - CSCX - plunging by 270 points to close at 10,159.

Total turnover on the DSE fell to Tk 19.52 billion last week, against Tk 26.18 billion in the week before.

The daily turnover averaged Tk 3.91 billion, which was 25 per cent lower than the previous week's average of Tk 5.23 billion.

The engineering sector dominated the turnover chart, grabbing 20 per cent of the week's total turnover, followed by textile with 13 per cent and power 12 per cent.

According to International Leasing Securities, stocks witnessed price correction for the fourth consecutive weeks and lost 400 points in its prime index amid concerned trading behavior of the investors.

"The ongoing bearish trend and disappointing quarterly earnings declaration of most of the companies eroded the investors' confidence," said the stockbroker.

The market capitalisation of the DSE also fell 2.73 per cent as it was Tk 3,983 billion on opening day of the week while it came down to Tk 3,874 billion on Thursday.

Among the major sectors, telecommunication witnessed the highest correction of 4.18 per cent, followed by banking 3.45 per cent, non-bank financial institutions 2.21 per cent, engineering 1.90 per cent and pharmaceuticals 1.60 per cent.

Prices of 78 per cent traded issues fell last week as out of 342 issues traded, 268 closed lower, 61 advanced and 13 issues remained unchanged on the DSE floor.

Western Marine Shipyard dominated the turnover chart with 32.20 million shares worth Tk 1.15 billion changing hands, followed by United Power with Tk 906 million, Bangladesh Steel Re-rolling Mills Tk 754 million, Beximco Tk 738 million and BRAC Bank Tk 452 million.

Monno Jute Stafflers was the week's best performer, posting a gain of 20.51 per cent while the ONE Bank was the week's worst loser, losing 24.54 per cent.

Intraco Refueling Station, which made its share trading debut in the last session of the week, soaring 336 per cent, from its issue price of Tk 10 each, to close at Tk 43.60.