Stocks suffered a big jolt in the outgoing week as investor confidence hit rock bottom, triggering panic selling that sent the benchmark index of the prime bourse reeling down in all five sessions of the week.

Market analysts said the government's move to liquidate People's Leasing and Financial Services (PLFS) and the telecom regulator's strict stance on Grameenphone coupled with the gas price hike prompted investors to sell off stocks.

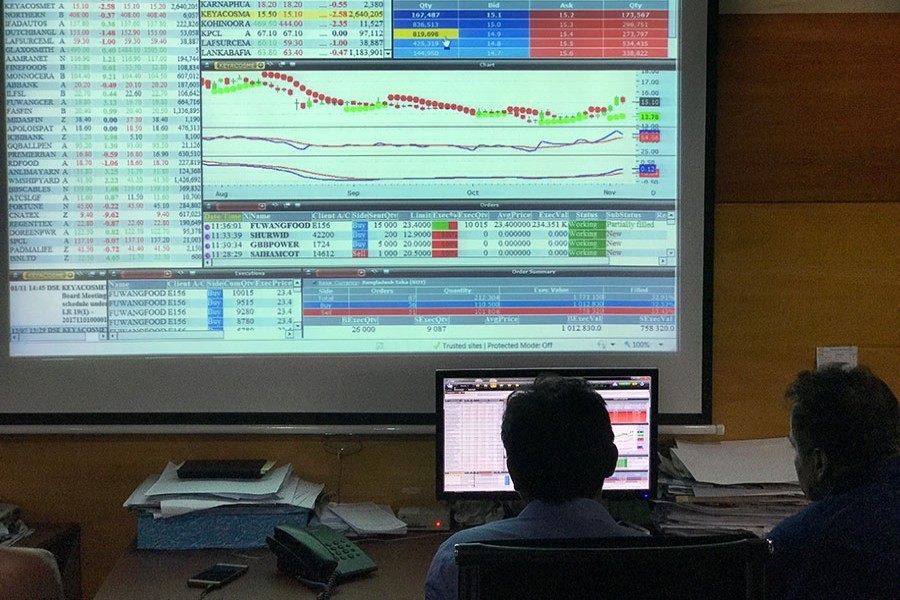

The DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 158.49 points or 2.95 per cent to close the week at 5,222.

Grameenphone (GP), the largest market-cap listed company, plunged 7.84 per cent during the week in a huge blow to the index, said the analysts.

The GP saw its downturn after the Bangladesh Telecommunication Regulatory Commission (BTRC) decided to reduce the bandwidth capacity of the mobile operator as it failed to pay their dues to the government.

Meanwhile, the news of liquidation of People's Leasing has hit the non-bank financial institution sector that lost 4.41 per cent during the week. And the People's Leasing was the week's biggest loser, plummeting 25 per cent.

The government has recently directed the central bank to liquidate the People's Leasing, as its financial health deteriorated over the last several years.

Investors who have already been grappling with several issues such as penalty tax on listed companies, gas price hike and GP woes got panicked by the news of liquidation of People's Leasing, commented EBL Securities in its weekly analysis.

Although the government brought some changes to the budgetary measures for the capital market, they failed to make any positive impact on the market.

The DSEX has lost 200 points and the DSE market-cap shed Tk 132 billion since the national budget for the FY 2019-20 was passed on June 30, 2019.

"Stock investors are not happy with the measures as listed companies are being burdened with more tax," said a leading broker.

The outgoing week featured five trading days as usual and all of them saw the benchmark index drop to a lower level.

Two other indices also ended lower. The DS30 index, comprising blue chips, slumped 52.36 points or 2.74 per cent to finish at 1,857 and the DSE Shariah Index lost 38.79 points or 3.15 per cent to close at 1,194.

The total turnover on the prime bourse stood at Tk 21.12 billion, up from Tk 19.47 billion in the week before.

The daily turnover averaged out at Tk 4.22 billion, registering a decline of 13 per cent over the previous week's average of Tk 4.86 billion.

The general insurance sector dominated the turnover board, capturing 14 per cent of the week's total turnover, followed by textile (13 per cent) and engineering (12.9 per cent).

The market capitalisation of the DSE also fell sharply by 2.75 per cent to Tk 3,866 billion on Thursday from Tk 3975 billion in the week before.

Block trade contributed 3.0 per cent to the total week's total turnover where stocks like Square Pharma, IPDC Finance, BRAC Bank, Islami Bank and Beximco dominated the block trade board.

Almost all the major sectors suffered loss with telecoms witnessed the biggest loss of 7.84 per cent, followed by NBFIs (4.30 per cent), food (2.0 per cent), banking (1.8 per cent), pharma (1.5 per cent), and power (1.2 per cent).

Losers outnumbered the gainers, as out of 354 issues traded, 281 closed lower, 60 ended higher and 13 issues remained unchanged on the DSE floor.

The National Life Insurance Company dominated the week's turnover chart again, with 2.99 million shares worth Tk 786 million changing hands. The company accounted for 3.72 per cent of the week's total turnover.

The other turnover leaders were Runner Automobiles, Asian Tiger Sandhani Life Growth Fund, JMI Syringes and Rupali Insurance.

SEML FBLSL Growth Fund was the week's best performer, posting a gain of 60 per cent while People's Leasing was the worst loser, plunging 25 per cent.

The port city bourse, Chittagong Stock Exchange (CSE), also saw a steep decline, with its CSE All Share Price Index - CASPI - plummeting 497 points to settle at 15,972 points and the Selective Categories Index - CSCX - plunging 286 points to finish the week at 9,698.